At Sekon Company prepayments are debited to expense when paid, and unearned revenues are credited to revenue when cash is received. During January of the current year, the following transactions occurred.

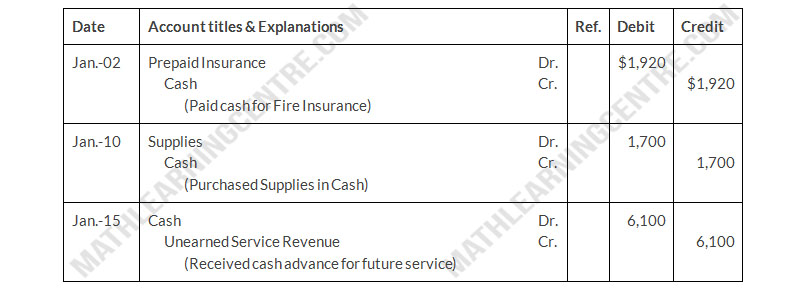

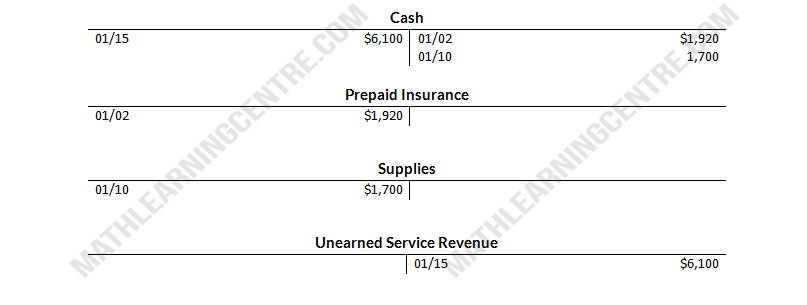

| Jan. 02 | Paid $1,920 for fire protection for the year. |

| 10 | Paid $1,700 for supplies. |

| 15 | Received $6,100 for services to be performed in the future. |

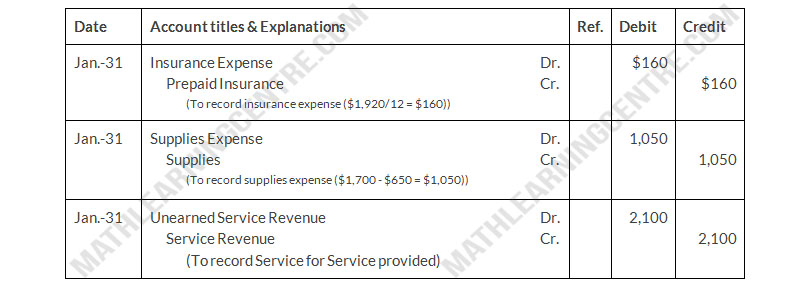

On January 31, it is determined that $2,100 of the services were performed and that there are $650 of supplies on hand.

Instructions

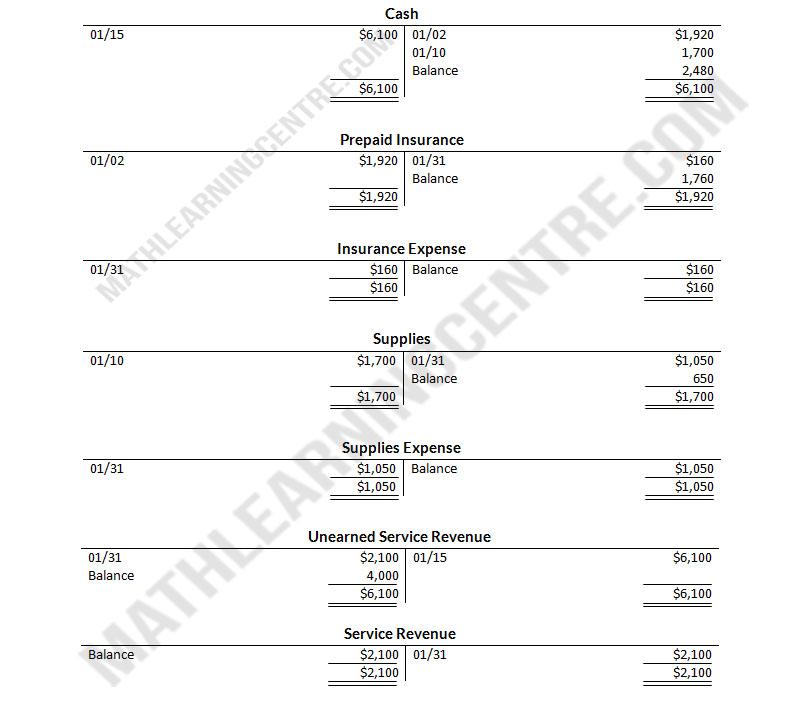

- Journalize and post the January transactions. (Use T-accounts.)

- Journalize and post the adjusting entries at January 31.

- Determine the ending balance in each of the accounts.

Answer

a.

Sekon Company

Journal Entries

Journal Entries

Sekon Company

Ledger Account

Ledger Account

b.

Sekon Company

Adjusting Journal Entries

Adjusting Journal Entries

Sekon Company

Ledger Account

Ledger Account

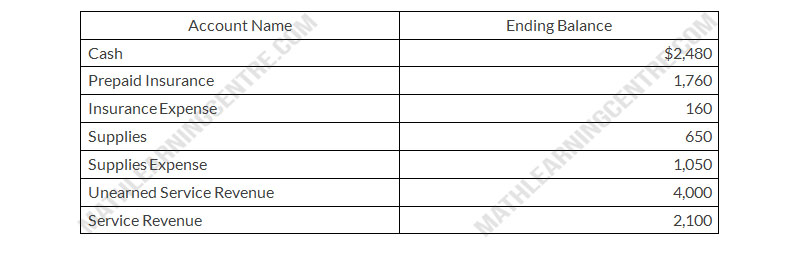

c.

Sekon Company

Ending Balances of Accounts

Ending Balances of Accounts