Instructions

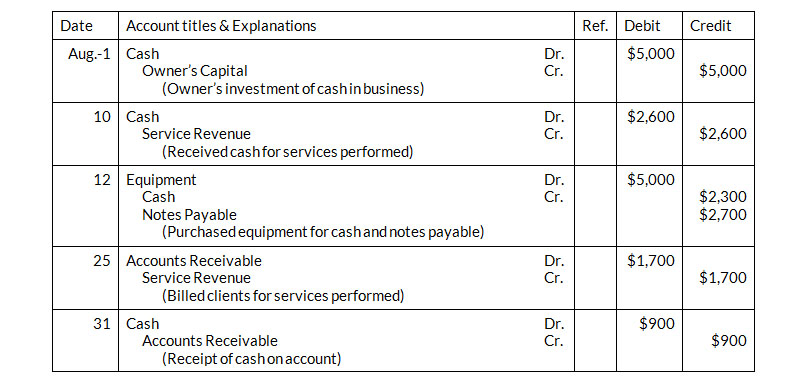

- Post the transactions to T-accounts.

- Prepare a trial balance at August 31, 2020.

Instructions

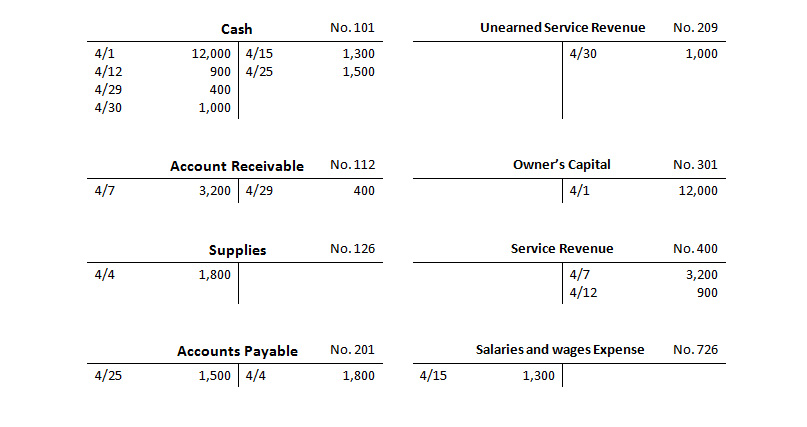

- Prepare the complete general journal (including explanations) from which postings to Cash were made.

- Prepare a trial balance at April 30, 2018.

Instructions

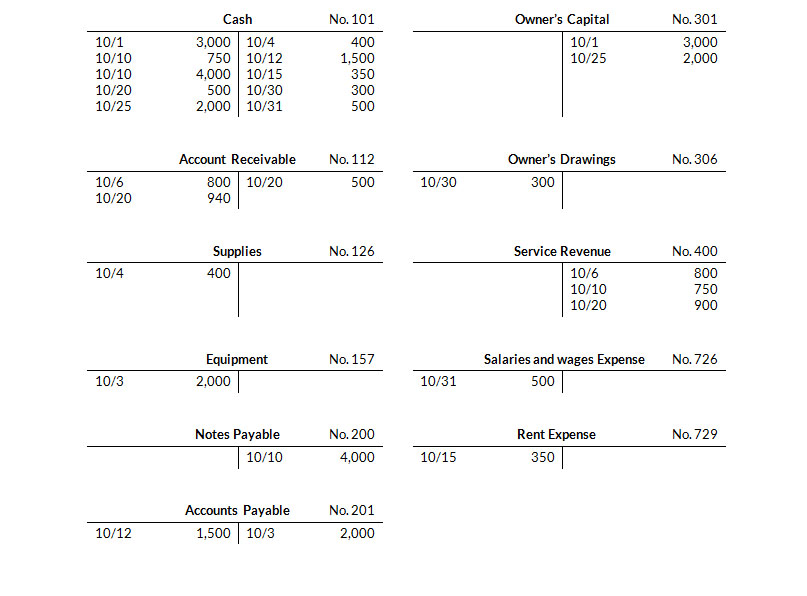

- Reproduce the journal entries for the transactions that occurred on October 1, 10, and 20, and provide explanations for each.

- Determine the October 31 balance for each of the accounts above, and prepare a trial balance at October 31, 2020.

| Sept. 1 | Invested $10,000 cash in the business. |

| 5 | Purchased equipment for $12,000 paying $4,000 in cash and the balance on account. |

| 25 | Paid $3,000 cash on balance owed for equipment. |

| 30 | Withdrew $700 cash for personal use. |

Burke's chart of accounts shows: No. 101 Cash, No. 157 Equipment, No. 201 Accounts Payable, No. 301 Owner's Capital, and No. 306 Owner's Drawings.

Instructions

- Journalize the transactions on page J1 of the Journal. (Omit explanations.).

- Post the transactions using the standard account form.

- A credit posting of $525 to Accounts Receivable was omitted

- A debit posting of $750 for Prepaid Insurance was debited to Insurance Expense

- A collection from a customer of $100 in payment of its account owed was journalizing and posted as a debit to Cash $100 and a credit to Service Revenue $100.

- A credit posting of $415 to Property Taxes Payable was made twice.

- A cash purchase of supplies for $250 was journalized and posted as a debit to Supplies $25 and a cr3edit to Cash $25.

- A debit of $625 to Advertising Expense was posted as $652.

Instructions

- Indicate whether the trial balance will balance.

- If the trial balance will not balance, indicate the amount of the difference.

- Indicate the trial balance column that will have the larger total.

Consider each error separately. Use the following form, in which error (1) is given as an example.

| (a) | (b) | (c) | |

| Error (1) |

In Balance No |

Difference $525 |

Larger Column debit |

| Accounts Receivable | $7,642 | Prepaid Insurance | $1,968 |

| Accounts Payable | 8,396 | Maintenance and Repairs Expense | 961 |

| Cash | ? | Service Revenue | 10,610 |

| Equipment | 49,360 | Owner's Drawings | 700 |

| Gasoline Expense | 758 | Owner's Capital | 42,000 |

| Utilities Expense | 523 | Salaries and Wages Expense | 4,428 |

| Notes Payable | 17,000 | Salaries and Wages Payable | 815 |

Instructions

| Jan. 2 | Invested $10,000 cash in the business |

| 3 | Purchased used car for $3,000 cash for use in business. |

| 9 | Purchased supplies on account for $500. |

| 11 | Billed customers $2,400 for services performed. |

| 16 | Paid $350 cash for advertising. |

| 20 | Received $700 cash from customers billed on January 11 |

| 23 | Paid creditor $300 cash on balance owed. |

| 28 | Withdrew $1,000 cash for personal use by owner. |

Instructions

| Oct. 1 | Alan Sanculi begins business as a real estate agent with a cash investment of $15,000 |

| 2 | Hires an administrative assistant. |

| 3 | Purchases office furniture for $1,900, on account. |

| 6 | Sells a house and lot for R. Craig; bills R. Craig $3,800 for realty services performed. |

| 27 | Pays $1,100 on the balance related to the transaction of October 3. |

| 30 | Pays the administrative assistant $2,500 in salary for October. |