Selected transactions for A. Mane, an interior decorator, in her first month of business, are as follows:

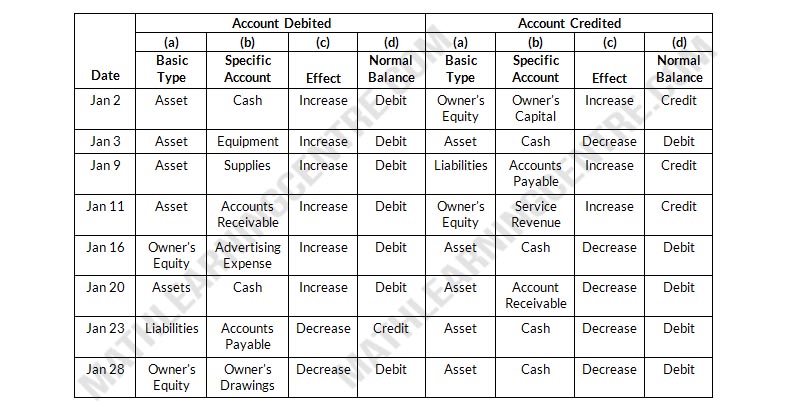

| Jan. 2 |

Invested $10,000 cash in the business |

| 3 |

Purchased used car for $3,000 cash for use in business. |

| 9 |

Purchased supplies on account for $500. |

| 11 |

Billed customers $2,400 for services performed. |

| 16 |

Paid $350 cash for advertising. |

| 20 |

Received $700 cash from customers billed on January 11 |

| 23 |

Paid creditor $300 cash on balance owed. |

| 28 |

Withdrew $1,000 cash for personal use by owner. |

Instructions

For each transaction, indicate the following:

- The basic type of account debited and credited (asset, liability, owner's equity).

- The specific account debited and credited ( Cash, Rent Expense, Service Revenue, etc.)

- Whether the specific account is increased or decreased

- The normal balance of the specific account.

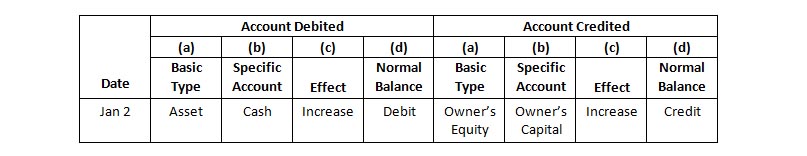

Use the following format, in which the January 2 transaction is given as an example.

Solution