Instructions

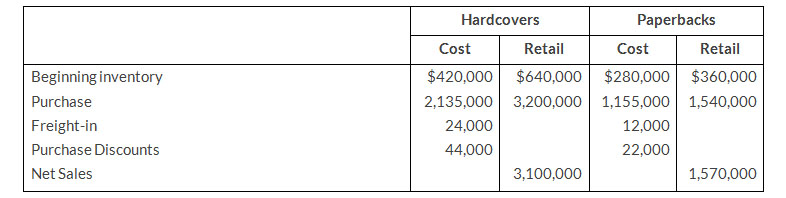

- Determine the estimated cost of the ending inventory for each department at October 31, 2019, using the retail inventory method.

- Compute the ending inventory at cost for each department at December 31, assuming the cost-to-retail ratios for the year are 75% for Hardcovers and 75% for Paperbacks.

- Wilfred sold goods costing $38,000 to Lilja Company, FOB shipping point, on December 28. The goods are not expected to arrive at Lilja until January 12. The goods were not included in the physical inventory because they were not in the warehouse.

- The physical count of the inventory did not include goods costing $95,000 that were shipped to Wilfred FOB destination on December 27 and were still in transit at year-end

- Wilfred received goods costing $22,000 on January 2. The goods were shipped FOB shipping point on December 26 by Brent Co. The goods were not included in the physical count.

- Wilfred sold goods costing $35,000 to Jesse Co., FOB destination, on December 30. The goods were received at Jesse on January 8. They were not included in Wilfred's physical inventory.

- Wilfred received goods costing $44,000 on January 2 that were shipped FOB destination on December 29. The shipment was a rush order that was supposed to arrived December 31. This purchase was included in the ending inventory of $297,000.

Instructions

Determine the correct inventory amount on December 31.- Included in the company's count were goods with a cost of $250,000 that the company is holding on consignment. The goods belong to Kroeger Corporation.

- The physical count did not include goods purchased by Depue with a cost of $40,000 that were shipped FOB destination on December 28 and did not arrive at Depue warehouse until January 3.

- Included in the inventory account was $14,000 of office supplies that were stored in the warehouse and were to be used by the company's supervisors and managers during the coming year.

- The company received an order on December 29 that was boxed and sitting on the loading dock awaiting pick-up on December 31. The shipper picked up the goods on January 1 and delivered them on January 6. The shipping terms were FOB shipping not included in the count because they were sitting on the dock.

- On December 29, Depue shipped goods with a selling price of $80,000 and a cost of $60,000 to Macchia Sales Corporation FOB shipping point. The goods arrived on January 3. Macchia had only ordered goods with a selling price of $10,000 and a cost of $8,000. However, a sales manager at Depue had authorized the shipment and said that if Machia wanted to ship the goods back next week, it could.

- Included in the count was $40,000 of goods that were parts for a machine that the company no longer made. Given the high-tech nature of Depue's products, it was unlikely that these obsolete parts had any other use. However, management would prefer to keep them on the books at cost, "since that is what we paid for them, after all."

Instructions

Instructions

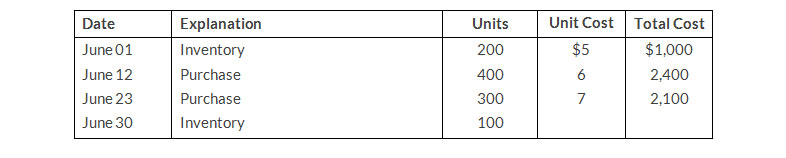

- Calculate the cost of goods sold using the FIFO periodic inventory method assuming that two of the three players were sold by the end of December, Kiyak Electronics year-end.

- If Kiyak Electronics used the specific identification method instead of the FIFO method, how might it alter its earnings by "selectively choosing" which particular players to sell to ethe two customers? What would Kiyak's cost of goods sold be if the company wished to minimize earnings? Maximize earnings?

- Which of the two inventory methods do you recommend that Kiyak use? Explain why.

Instructions

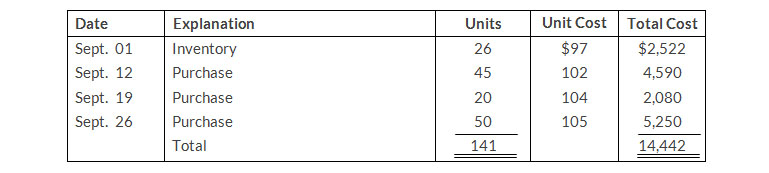

- Compute the ending inventory at September 30 and cost of goods sold using the FIFO and LIFO methods. Prove the amount allocated to cost of goods sold under each method.

- For both FIFO and LIFO, calculate the sum of ending inventory and cost of goods sold. What do you notice about the answers you found for each method?

Instructions

Instructions

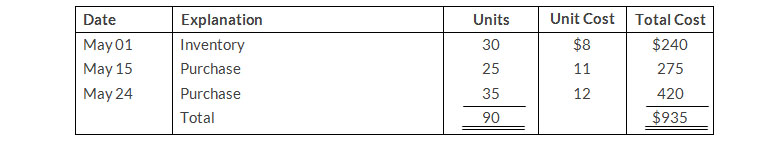

- Compute the cost of ending inventory and the cost of goods sold under (1) FIFO and (2) LIFO.

- Which costing method gives the higher ending inventory?. Why?

- Which method results in the higher cost of goods sold?. Why?

Instructions

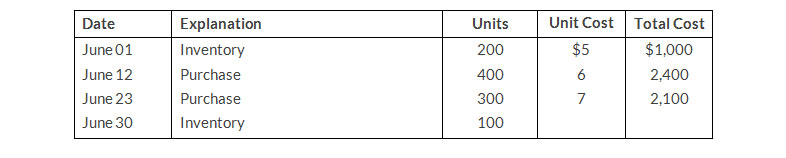

- Compute the cost of ending inventory and the cost of goods sold under (1) FIFO, (2) LIFO and (3) average-cost.

- Which costing method gives the higher ending inventory?. Why?

- Which method results in the higher cost of goods sold?. Why?

Instructions

- Compute the cost of ending inventory and the cost of goods sold using average-cost method.

- Will the results in (a) be higher or lower than the results under (1) FIFO and (2) LIFO.

- Why the average unit cost not $6?

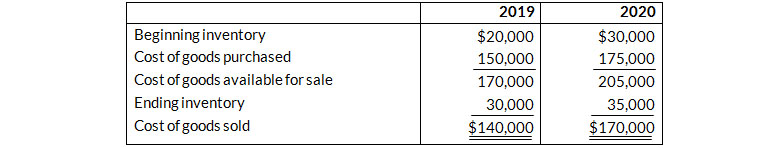

Elliott's made two errors: (1) 2019 ending inventory was overstated $3,000, and (2) 2020 ending inventory was understated $5,000.