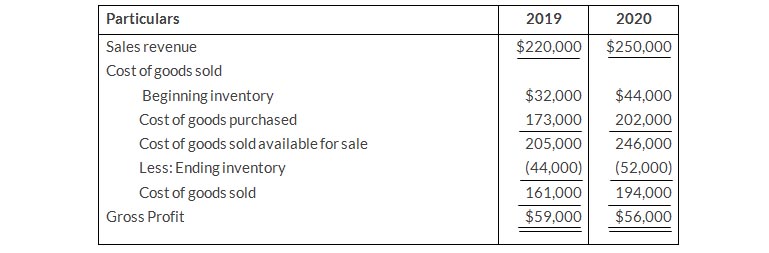

Smat uses a periodic inventory system. The inventories at January 1, 2019, and December 31, 2020, are correct. However, the ending inventory at December 31, 2019, was overstated $6,000.

Instructions

- Prepare correct income statement data for the 2 years.

- What is the cumulative effect of the inventory error on total gross profit for the 2 years?

Instructions

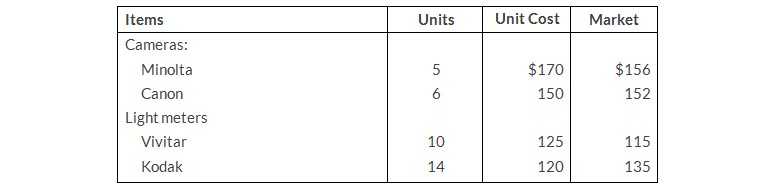

Determine the amount of the ending inventory by applying the lower-of-cost-or-market basis

| Cameras | 100 units at a cost per unit of $65 |

| Blu-ray players | 150 units at a cost per unit of $75 |

| iPods | 125 units at a cost per unit of $80 |

The cost of purchasing units at year-end was cameras $71, Blu-ray players $67, and iPods $78.

Instructions

Determine the amount of the ending inventory at lower-of-cost-or-market

Instructions

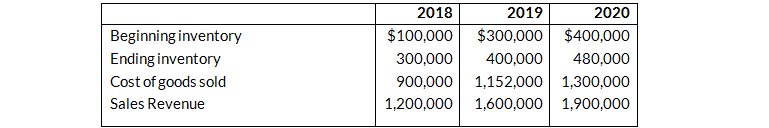

Calculate inventory turnover, days in inventory, and gross profit rate for Abdullah's Photo corporation for 2018, 2019, and 2020. Comment on any trends.

Instructions

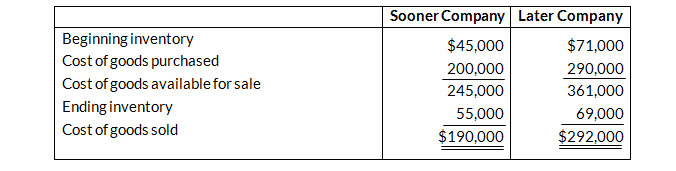

- Compute inventory turnover and days in inventory for each company.

- Which company moves its inventory more quickly?

Instructions

Instructions

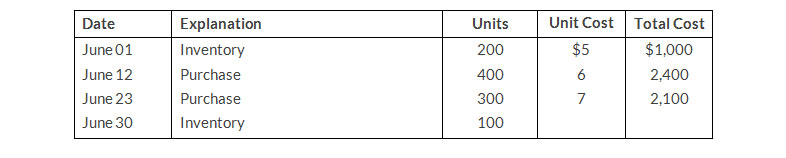

- Calculate the cost of the ending inventory and the cost of goods sold for each cost flow assumption, using a perpetual inventory system. Assume a sale of 440 unts occurred on June 5 for a selling price of $8 and a sale of 360 units on June 27 for $9.

- How do the results differ under (1) FIFO and (2) LIFO.

- Why the average unit cost not $6 [($5+$6+$7)/3]?

Instructions

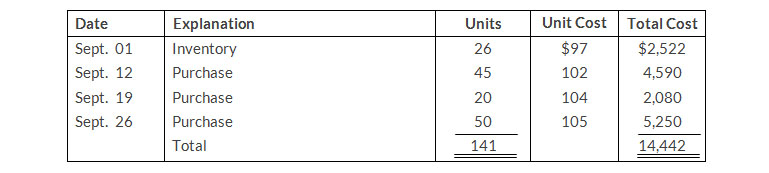

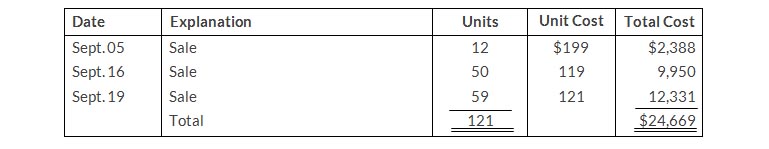

- Compute ending inventory at September 30 using FIFO, LIFO and moving-average cost.

- Compare ending inventory using a perpetual inventory system to ending inventory using a periodic inventory system.

- Which inventory cost flow method (FIFO, LIFO) gives the same ending inventory value under both periodic and perpetual? Which method give different ending inventory values?

| November | December | |

| Cost of goods purchased | $536,000 | $610,000 |

| Inventory, beginning of month | 130,000 | 120,000 |

| Inventory, end of month | 120,000 | ? |

| Sales revenue | 840,000 | 1,000,000 |

Instructions

- Compute the gross profit rate for November.

- Using the gross profit rate for November, determine the estimated cost of inventory lost in the fire

Instructions

- A beginning inventory of $20,000 and a gross profit rate of 30% on net sales.

- A beginning inventory of $30,000 and a gross profit rate of 40% on net sales.