Three Point Sports Inc. manufactures basketballs for the Women's National Basketball Association (WNBA). For the first 6 months of 2020, the company reported the following operating results while operating at 80% of plant capacity and producing 120,000 units.

| Amount | |

| Sales | $4,800,000 |

| Cost of goods sold | 3,800,000 |

| Selling and administrative expenses | 405,000 |

| Net Income | $ 795,000 |

Fixed costs for the period were cost of goods sold $960,000, and selling and administrative expenses $225,000.

In July, normally a slack manufacturing month. ThreePoint Sports receives a special order for 10,000 basketballs at $28 each from the Greek Basketball Association (GBA). Acceptance of the order would increase variable selling and administrative expenses $0.75 per unit because of shipping costs but would not increase fixed costs and expenses.

Instructions

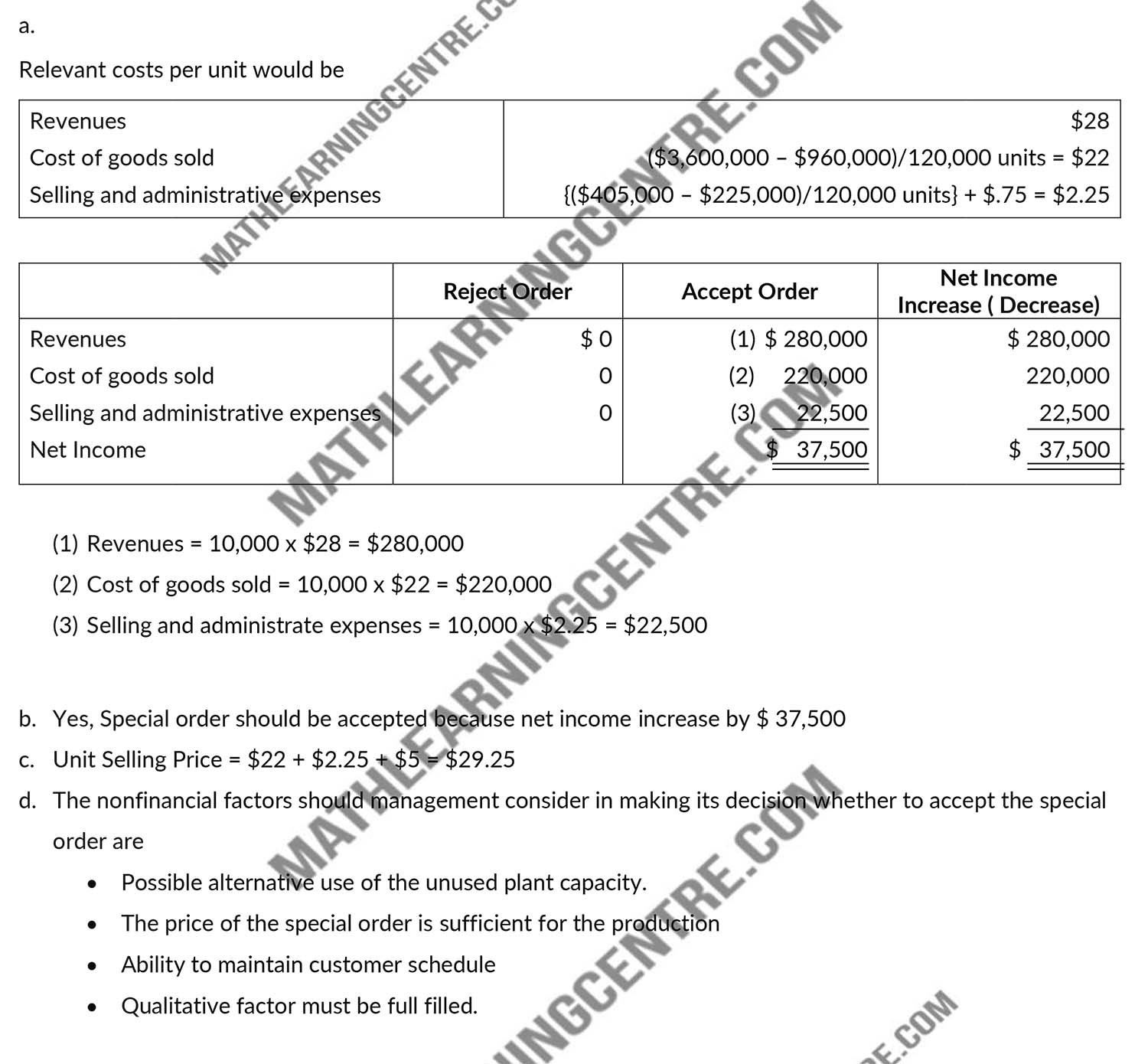

- Prepare an incremental analysis for the special order.

- Should ThreePoint Sports inc. accept the special order? Explain your answer

- What is the minimum selling price on the special order to produce net income of $5.00 per ball?

- What nonfinancial factors should management consider in making its decision?

Solution