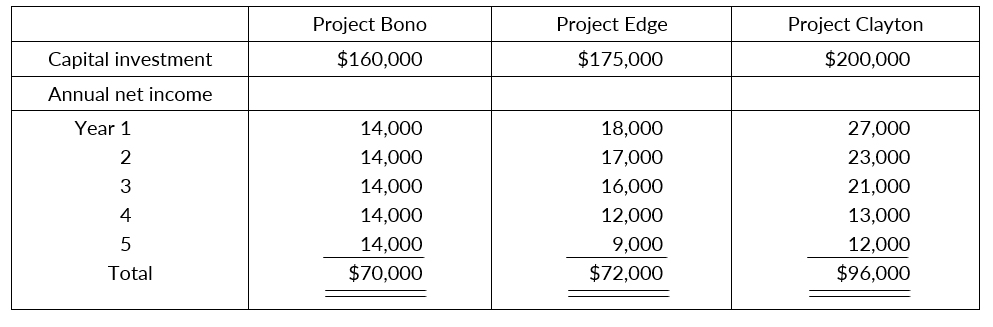

Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.)

Instructions

- Compute the cash payback period for each project. (Round to two decimals.)

- Compute the net present value for each project. (Round to nearest dollar.)

- Compute the annual rate of return for each project. (Round to two decimals.)

- Rank the projects on each of the foregoing bases. Which project do yourecommend?

Solution

(a) Project Bono $160,000 / ($14,000 + $32,000) = 3.48 years

|

|

Project Edge |

|||||||

|

|

|

|

|

|||||

|

|

Year |

|

Cash Flow |

|

Cumulative Cash Flow |

|||

|

|

1 2 3 4 5 |

|

$53,000 ($18,000 + $35,000) $52,000 ($17,000 + $35,000) $51,000 ($16,000 + $35,000) $47,000 ($12,000 + $35,000) $44,000 ($ 9,000 + $35,000) |

|

$ 53,000 $105,000 $156,000 $203,000 $247,000 |

|||

Cash payback period 3.40 years

$175,000 - $156,000 = $19,000

$19,000 / $47,000 = .40

|

|

Project Clayton |

||||

|

|

|

|

|

|

|

|

|

Year |

|

Cash Flow |

|

Cumulative Cash Flow |

|

|

1 2 3 4 5 |

|

$67,000 ($27,000 + $40,000) $63,000 ($23,000 + $40,000) $61,000 ($21,000 + $40,000) $53,000 ($13,000 + $40,000) $52,000 ($12,000 + $40,000) |

|

$ 67,000 $130,000 $191,000 $244,000 $296,000 |

Cash payback period 3.17 years

$200,000 - $191,000 = $9,000

$9,000 / $53,000 = .17

(b) Project Bono

|

|

Item |

|

Amount |

|

Years |

|

PV Factor |

|

Present Value |

|

|

Net annual cash flows Less: Capital investment Negative net present value |

|

$46,000 |

|

1-5 |

|

3.35216 |

|

$154,199 160,000 $ (5,801) |

|

Project Edge |

Project Clayton |

|||||||||

|

Year |

Discount Factor |

Cash Flow |

PV |

Cash Flow |

PV |

|||||

|

1 2 3 4 5 Total |

.86957 .75614 .65752 .57175 .49718 |

|

$ 53,000 52,000 51,000 47,000 44,000 $247,000 |

$ 46,087 39,319 33,534 26,872 21,876 167,688 175,000

$ (7,312) |

$ 67,000 63,000 61,000 53,000 52,000 $296,000 |

$ 58,261 47,637 40,109 30,303 25,853 202,163 200,000

$ 2,163 |

||||

|

Less: Capital |

||||||||||

|

Positive (negative) net present value |

|

|||||||||

(c) Project Bono = $14,000 / [($160,000 + $0) / 2] = 17.5%.

Project Edge = $14,400 / [($175,000 + $0) / 2] = 16.5%.

Project Clayton = $19,200 / [($200,000 + $0) / 2] = 19.2%.

|

(d) |

Project |

|

Cash Payback |

|

Net Present Value |

|

Annual Rate of Return |

|

|

Bono Edge Clayton |

|

3 2 1 |

|

2 3 1 |

|

2 3 1 |

The best project is Clayton.