| Long-term debt | $1,000 | Accumulated depreciation-equipment | $5,655 |

| Prepaid insurance | 880 | Accounts payable | 1,444 |

| Equipment | 11,500 | Notes Payable (due after 2020) | 400 |

| Stock investments (long-term) | 264 | Owner's capital | 12,955 |

| Debt investments (short-term) | 3,690 | Accounts receivable | 1,696 |

| Notes Payable (due in 2020) | 500 | Inventory | 1,256 |

| Cash | 2,668 |

Instructions

| Salaries and Wages Payable | $2,080 | Notes Payable (long-term) | $1,800 |

| Salaries and Wages Expense | 48,700 | Cash | 14,200 |

| Utilities Expense | 22,600 | Accounts Receivable | 9,780 |

| Equipment | 34,400 | Accumulated depreciation-equipment | 6,000 |

| Accounts Payable | 4,100 | Owner's Drawings | 3,000 |

| Service Revenue | 63,000 | Depreciation Expense | 4,000 |

| Rent Revenue | 8,500 | Owner's capital (beginning of the year) | 51,200 |

Instructions

- Prepare an income statement and an owner's equity statement for the year. The owner did not make any new investments during the year.

- Prepare a classified balance sheet at July 31, 2019.

Instructions

- Assume the company does not use reversing entries. Prepare the December 31 adjusting entry and the entry on Monday, January 6, when Lovrek pays the payroll.

- Assume the company does use reversing entries. Prepare the December 31 adjusting entry, the January 1 reversing entry,a and the entry on Monday January 6, when Lovrek pays the payroll.

| Accounts Receivable | $24,500 | Service Revenue | $92,500 |

| Interest Expense | 7,700 | Interest Payable | 2,200 |

Analysis shows that adjusting entries were made to (1) accrue $5,000 of service revenue and (2) accrue $2,200 interest expense.

Instructions

- Prepare the closing entries for the temporary accounts shows above at December 31.

- Prepare the reversing entries on January 1.

- Post the entries in (a) and (b). Underline and balance the accounts. (Use T-Accounts)

- Prepare the entries to record (1) the collection of the accrued revenue on January 10 and (2) the payment of all interest due ($3,000) on January 15.

- Post the entries in (d) to the temporary accounts.

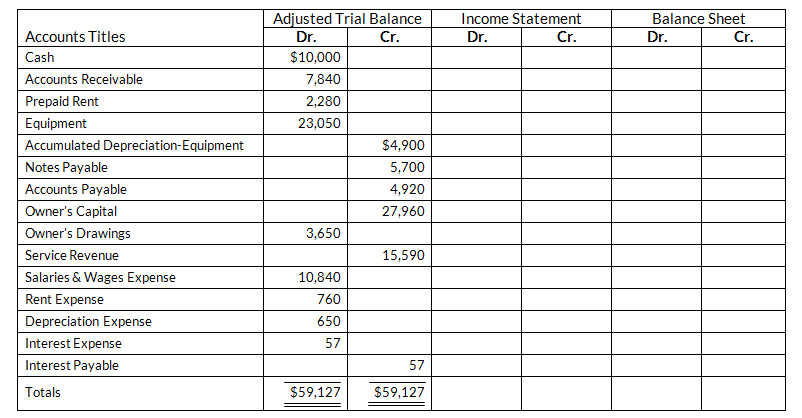

Worksheet (partial)

For the Month Ended April 30, 2020

Instruction

- journalize the closing entries at Atril 30.

- Post the closing entries to become Summary and Owner's Capital. Use T-accounts.

- Prepare a post-closing trial balance at April 30.

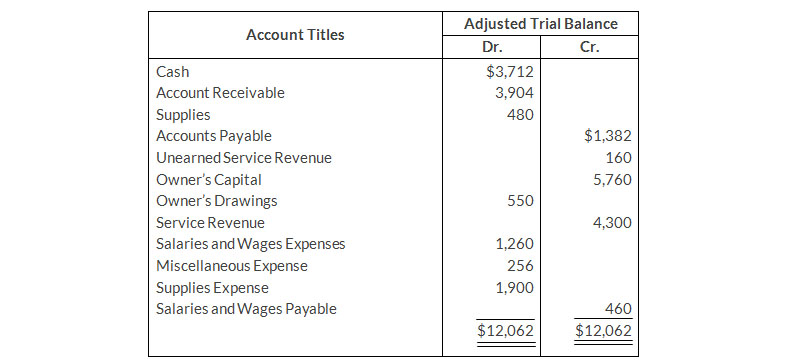

Adjusted Trial Balance

For the Month Ended June 30, 2019

Instructions

- Prepare closing entries at June 30, 2019.

- Prepare a post-closing trial balance

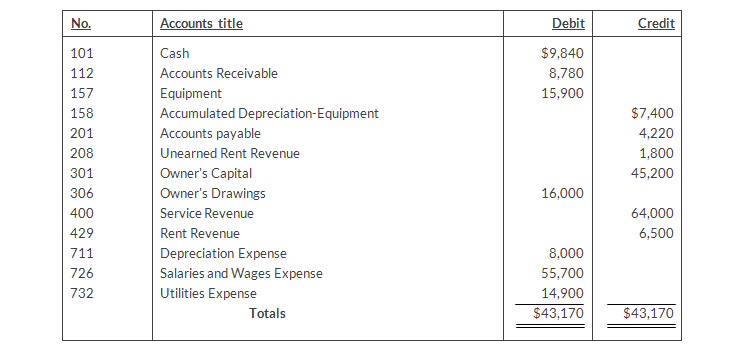

Adjusted Trial Blance

July 31, 2020

Instructions

- Prepare an income statement and an owner's equity statement for the year. Okabe did not make any new investments during the year.

- Prepare a classified balance sheet at July 31, 2019.