| Debit | Credit | ||

| Buildings | $128,800 | Owner's Capital | $115,000 |

| Accounts Receivable | 14,520 | Accumulated Depreciation-Buildings | 42,600 |

| Prepaid insurance | 4,680 | Accounts Payable | 12,300 |

| Cash | 18,040 | Notes Payable | 97,780 |

| Equipment | 62,400 | Accumulated Depreciation-Equipment | 18,720 |

| Land | 67,000 | Interest Payable | 3,800 |

| Insurance Expense | 780 | Service Revenue | 17,180 |

| Depreciation Expense | 7,360 | ||

| Interest Expense | 3,800 | ||

| $307,380 | $307,380 |

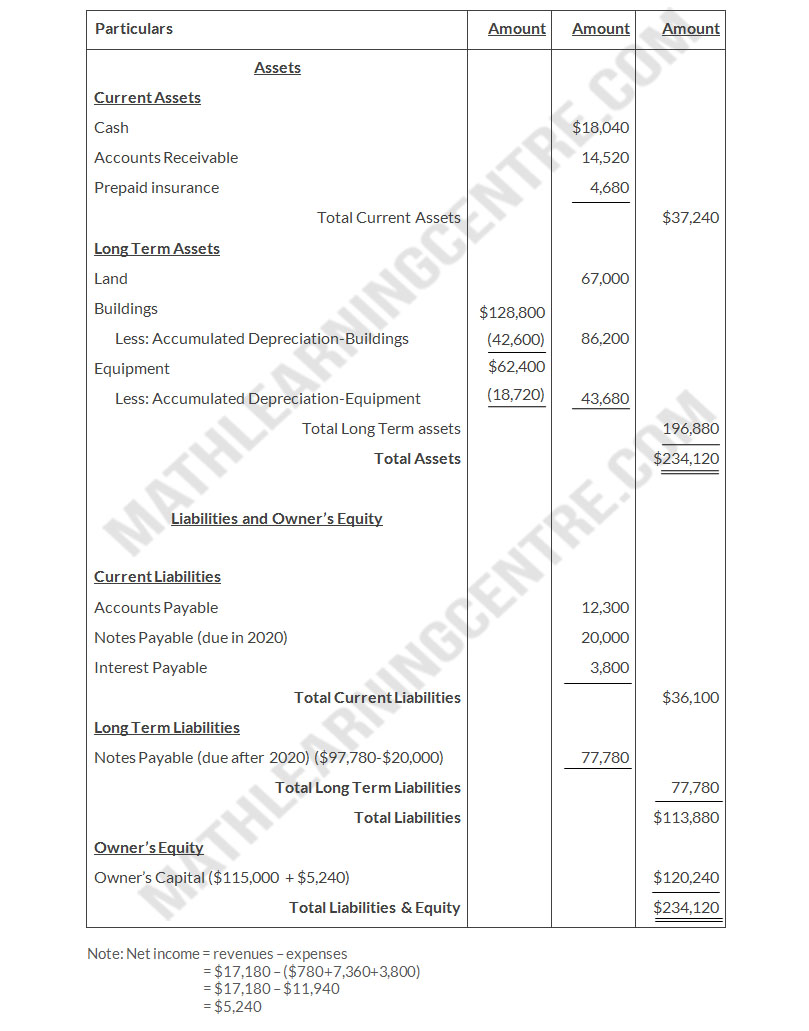

Instructions

- Prepare a classified balance sheet; assume that $20,000 of the note payable will be paid in 2020.

- Comment on the liquidity of the company.

Solution

Classified balance sheet

December 31, 2019