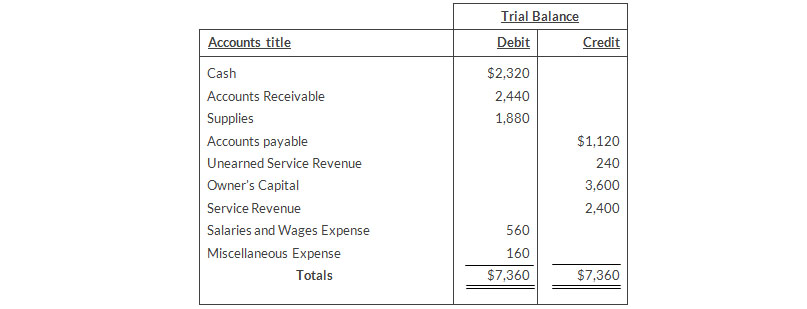

Worksheet

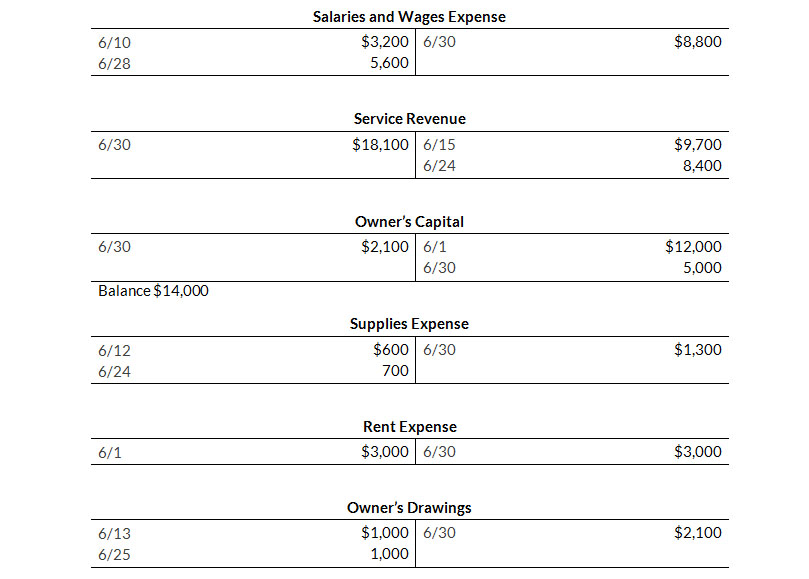

For the Month Ended June 30, 2019

- A physical count reveals only $500 of supplies on hand

- $100 of the unearned revenue is still unearned at month-end

- Accrued salaries are $210.

Instructions

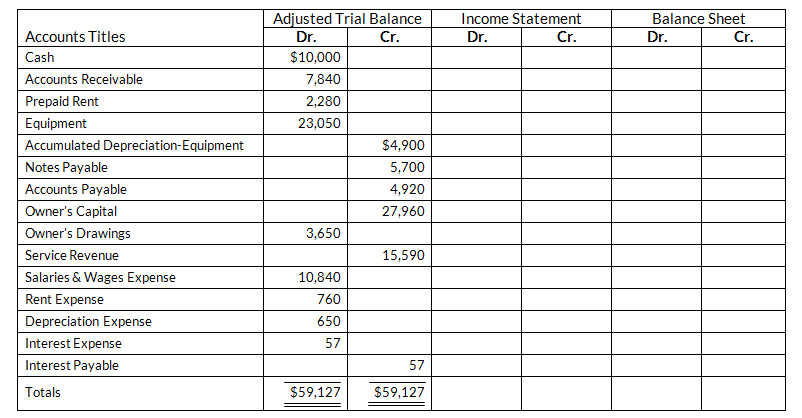

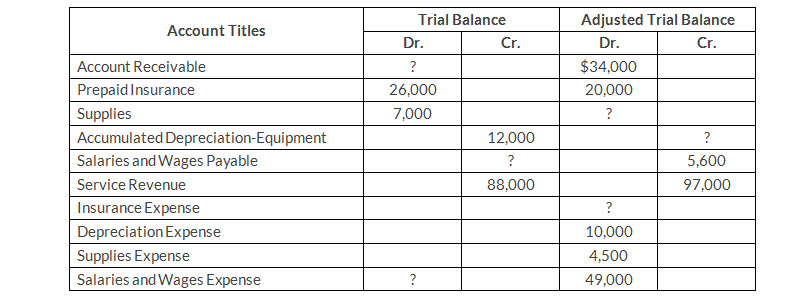

Worksheet (partial)

For the Month Ended April 30, 2020

Instruction

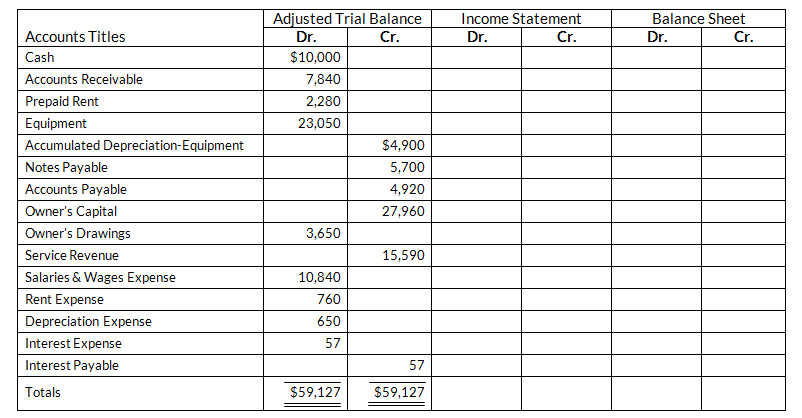

Worksheet (partial)

For the Month Ended April 30, 2020

Instruction

Instructions

- Prepare the adjusting entries

- Assuming the adjusted trial balance amount for each account is normal. Indicate the financial statement column to which each balance should be extended.

Instructions

- Fill the missing amounts

- Prepare the adjusting entries that were made

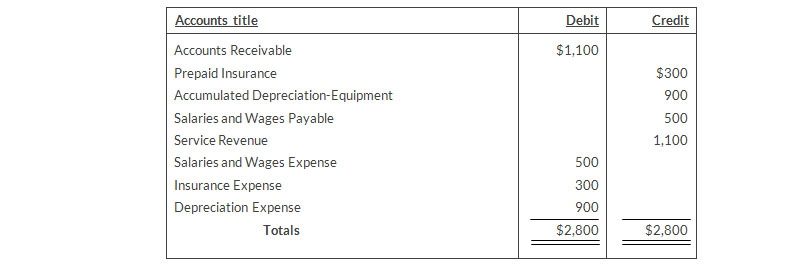

Adjusted Trial Blance

July 31, 2020

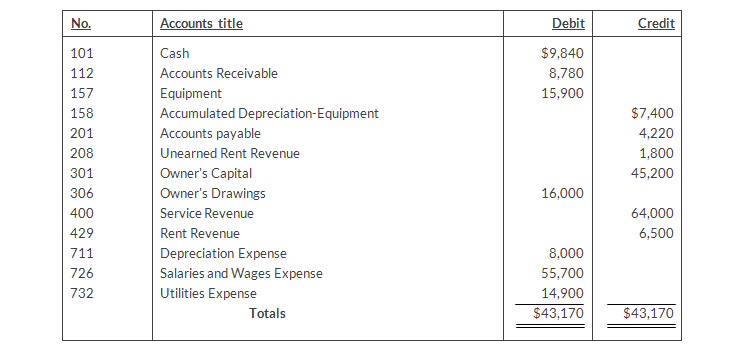

Instruction

- journalize the closing entries using page J15.

- Post to Owner's Capital and No. 350 Income Summary accounts. (Use the three-column form.)

- Prepare a post-closing trial balance at July 31.

Instruction

- Prepare the closing entries that were made.

- Post the closing entries to Income Summary.

- A payment of Salaries and Wages Expense of $700 was debited to Equipment and credited to Cash, both for $700.

- A collection of $1,000 from a client on account was debited to Cash $100 and credited to Service Revenue $100.

- The purchase of equipment on account for $760 was debited to Equipment $670 and credited to Accounts Payable $670.

Instructions

- Correct the errors by reversing the incorrect entry and preparing the correct entry.

- Correct the errors without reversing the incorrect entry.

- A payment on account of $750 to a creditor was debited to Accounts Payable $570 and credited to Cash $570.

- The purchase of supplies on account for $560 was debited to Equipment $56 and credited to Accounts Payable $56.

- A $500 withdrawal of cash for N. Patel's personal use was debited to Salaries and Wages Expense $500 and credited to Cash $500.

Instructions

| Debit | Credit | ||

| Buildings | $128,800 | Owner's Capital | $115,000 |

| Accounts Receivable | 14,520 | Accumulated Depreciation-Buildings | 42,600 |

| Prepaid insurance | 4,680 | Accounts Payable | 12,300 |

| Cash | 18,040 | Notes Payable | 97,780 |

| Equipment | 62,400 | Accumulated Depreciation-Equipment | 18,720 |

| Land | 67,000 | Interest Payable | 3,800 |

| Insurance Expense | 780 | Service Revenue | 17,180 |

| Depreciation Expense | 7,360 | ||

| Interest Expense | 3,800 | ||

| $307,380 | $307,380 |

Instructions

- Prepare a classified balance sheet; assume that $20,000 of the note payable will be paid in 2020.

- Comment on the liquidity of the company.