On January 1, 2019, Klosterman Company issued $500,000, 10%, 10-year bonds at face value. Interest is payable annually on January 1.

Instructions

Prepare the journal entries to record the following events.

- The issuance of the bonds.

- The accrual of Interest on December 31, 2019.

- The payment of Interest on January 1, 2020.

On January 1, 2019, Forrester Company issued $400,000, 8%, 5-year bonds at face value. Interest is payable annually on January 1.

Instructions

Prepare the journal entries to record the following events.

- The issuance of the bonds.

- The accrual of Interest on December 31, 2019.

- The payment of Interest on January 1, 2020.

Laudie Company issued $400,000 of 9%, 10-year bonds on January 1, 2019, at face value. Interest is payable annually on January 1, 2020.

Instructions

Prepare the journal entries to record the following events.

- The issuance of the bonds.

- The accrual of Interest on December 31, 2019.

- The payment of Interest on January 1, 2020.

- The redemption of bonds at maturity, assuming interest for the last interest period has been paid and recorded.

Swisher Company issued $2,000,000 of bonds on January 1, 2019.

Instructions

- Prepare the journal entry to record to record the issuance of the bonds if they are issued as (1) 100, (2) 98, and (3) 103.

- Prepare the journal entry to record the redemption of the bonds at maturity, assuming the bonds were issued at 100.

- Prepare the journal entry to record the redemption of the bonds before maturity at 98. Assume the balance in Premium on Bonds Payable is $9,000.

- Prepare the journal entry to record the conversion of the bonds into 60,000 shares at $10 par value common stock. Assume the bonds were issued at par.

Whitmore Company issued $500,000 of 5-year, 8% bonds at 97 on January 1, 2021. the bonds pay interest annually.

Instructions

- Prepare the journal entry to record the issuance of the bonds

- Compute the total cost of borrowing for these bonds.

- Repeat the requirements from part (a), assuming the bonds were issued at 105.

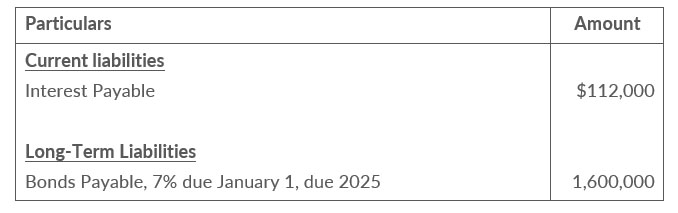

The following section is taken from Ohlman Corp's balance sheet at December 31, 2020

Bond interest is payable annually on January 1. The bonds are callable on any interest date.

Instructions

- Journalize the payment of the bond interest on January 1, 2021.

- Assume that on January 1, 2021, after paying interest, Ohlman calls bonds having a face value of $600,000. the call price is 103, Record the redemption of the bonds.

- Prepare the entry to record the accrual of interest on December 31, 2021.

Presented below are three independent situations.

- Longbine Corporation redeemed $130,000 face value, 12% bonds on June 30, 2021, at 102. The carrying value of the bonds at the redemption date was $117,500. The bonds pay annual interest and the interest payment due on June 30, 2021, has been made and recorded.

- Tastove Inc. redeemed $150,000 face value, 12.5% bonds on June 30, 2020, at 98. The carrying value of the bonds at the redemption date was $151,000. The bonds pay annual interest, and the interest payment due on June 30, 2020, has been made and recorded

- Precision Company has $80,000, 8%, 12-year convertible bonds outstanding. These bonds were sold at face value and pay annual interest on December 31 of each year. The bonds are convertible into 30 shares of precision $5 par value common stock for each $1,000 worth of bonds on December 31, 2020, after the bond interest has been paid. $20,00 face value bonds were converted. The market price of Precision common stock was $44 per share on December 31, 2020

Instructions

For each independent situation above, prepare the appropriate journal entry for the redemption or conversion of the bonds

Jernigan Co. receives $300,000 when it issues a $3000,000, 10%, mortgage ote payable to finance the construction of a building at December 31, 2019. The terms provide for annual installment payments of $50,000 on December 31.

Instructions

Prepare the journal entries to record the mortgage loan and thefirst two payments

Dreiling Company borrowed $300,000 on January 1, 2019, by issuing a $300,000, 8% mortgage note payable. The terms call for annual installment payments of $40,000 on December 31.

Instructions

- Prepare the journal entries to record the mortgage loan and the first two installment payments.

- Indicate the amount of mortgage note payable to be reported as a current liability and as a long-term liability at December 31, 2019.

The adjusted trial balance for Karr Farm Corporation at the end of the current year contained the following accounts.

| Interest Payable | $9,000 |

| Lease Liability | 89,500 |

| Bonds Payable, due 2027 | 180,000 |

| Premium on Bonds Payable | 32,000 |

Instructions

Prepare the long-term liabilities section of the balance sheet