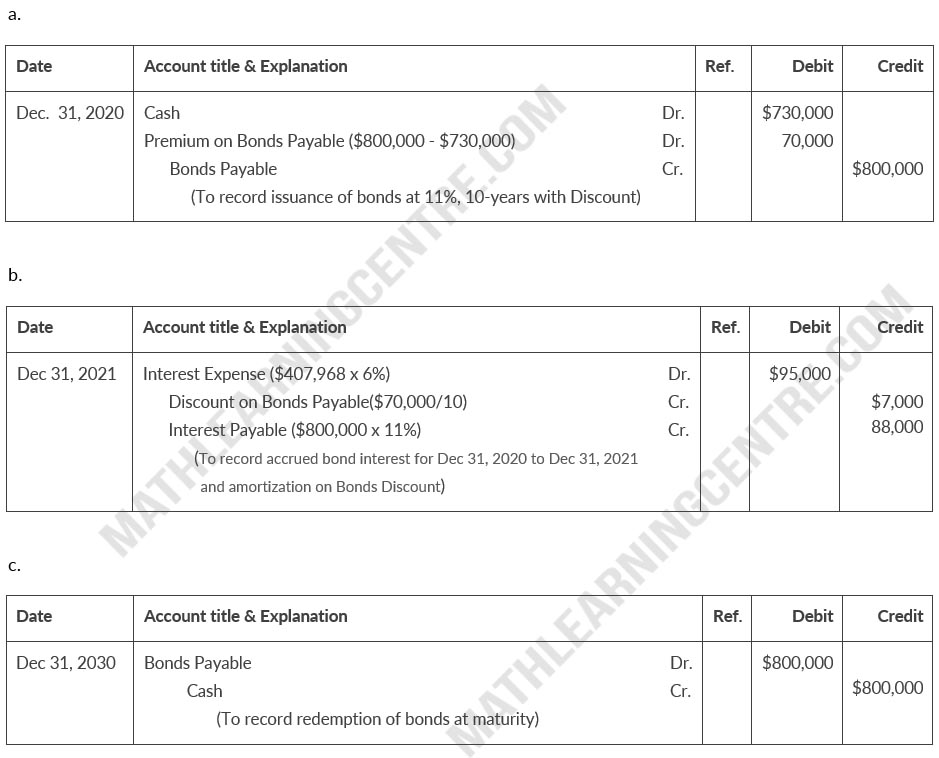

Gridley Company issued $800,000, 11%, 10-year bonds on December 31, 2020, for $730,000. Interest is payable annually on December 31. Gridley Company uses the straight-line method to amortize bond premium or discount.

Instructions

Prepare the journal entries to record the following.

- The issuance of the bonds

- The payment of interest and the discount amortization on December 31, 2021.

- The redemption of the bonds at maturity, assuming interest for the last interest period has been paid and recorded.

Solution

Journal Entries