On January 1, 2021, Lock Corporation issued $1,800,000 face value, 5%, 10-year bonds at $1,667,518. This price resulted in an effective-interest rate of 6% on the bonds. Lock uses the effective-interest method to amortize bond premium or discount. The bonds pay annual interest January 1.

Instructions

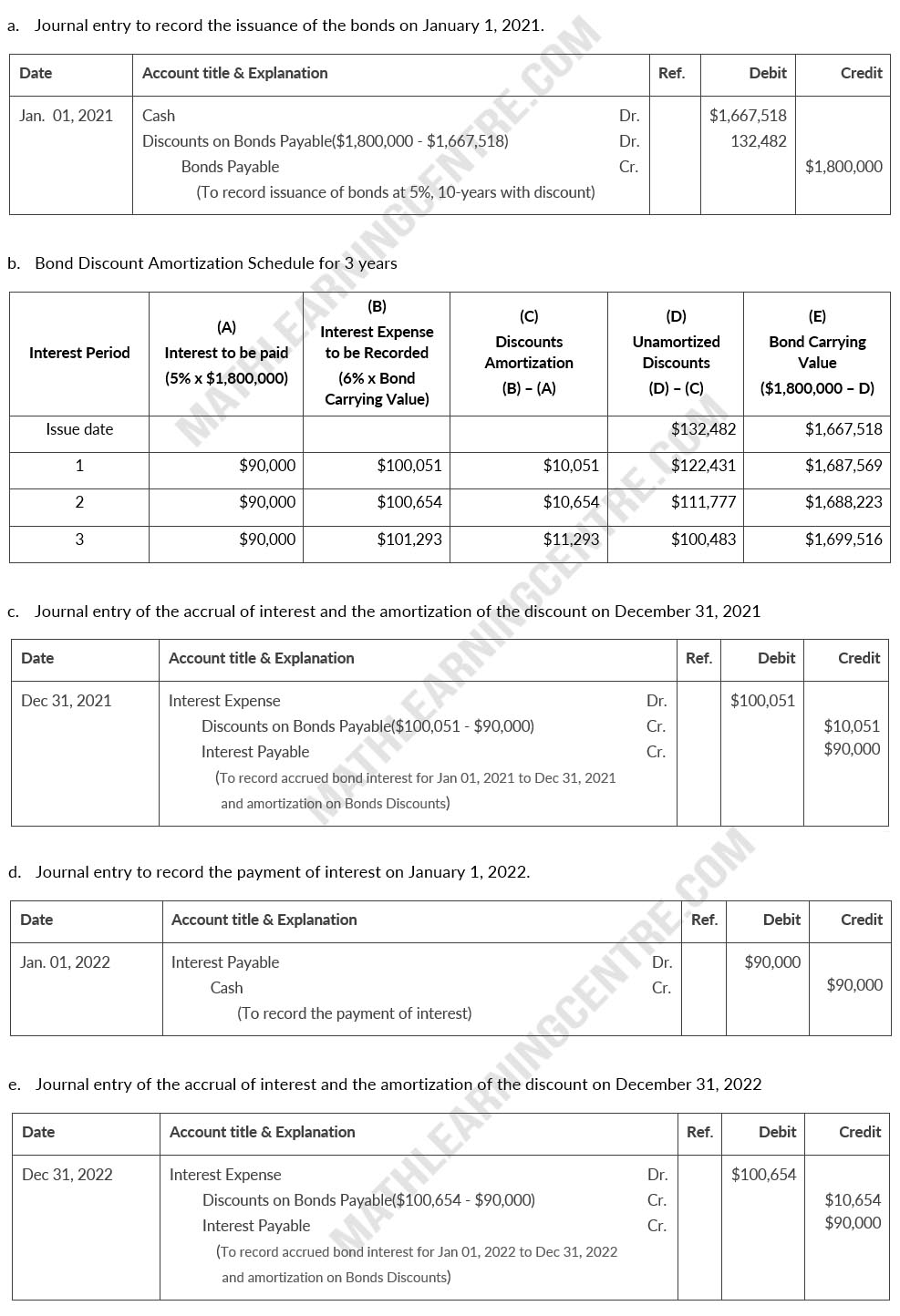

- Prepare the journal entry to record the issuance of the bonds on January 1, 2021.

- Prepare an amortization table through December 31, 2023 (three interest periods) for this bond issue.

- Prepare the journal entry to record the accrual of interest and the amortization of the discount on December 31, 2021.

- Prepare the journal entry to record the payment of interest on January 1, 2022.

- Prepare the journal entry to record the accrual of interest and the amortization of the discount December 31, 2022..

Solution