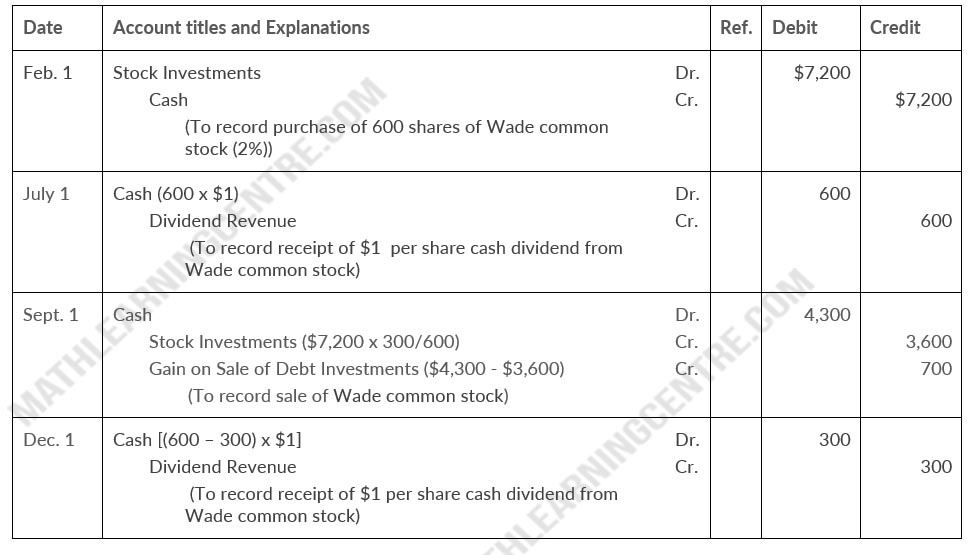

Hulse Company had the following transactions pertaining to stock investments.

| Feb. 1 | Purchased 600 shares of Wade common stock (2%) for $7,200 cash |

| July 1 | Received a cash dividend of $1 per share on Wade common stock. |

| Sept. 1 | Sold 300 shares of Wade common stock for $4,300 cash. |

| Dec. 1 | Received a cash dividend of $1 per share on Wade common stock. |

Instructions

- Journalize the transactions.

- Explain how dividend revenue and the gain (loss) on sale should be reported in the income statement

Solution

Journal Entries