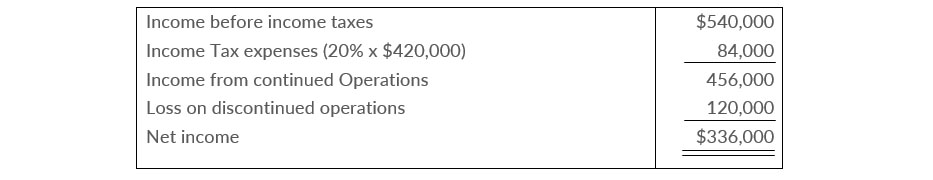

For its fiscal year ending October 31, 2020, Haas Corporation reports the following partial data shown below.

The loss on discontinued operations comprised a $50,000 loss from operations and a $70,000 loss from disposal. The income tax rate is 20% on all items.

Instructions

- Prepare a correct statement of comprehensive income beginning with income before income taxes.

- Explain in memo form why the income statement data are misleading.

Trayer Corporation has income from continuing operations of $290,000 for the year ended December 31, 2020. It also has the following items (before considering income taxes).

- An unrealized loss of $80,000 on available-for-sale securities.

- A gain of $30,000 on the discontinuance of a division (Comprising a $10,000 loss from operations and a $40,000 gain on disposal).

- A correction of an error in last year's financial statements that resulted in a $20,000 understatement of 2019 net income

Assume all items are subject to income taxes at a 20% tax rate.

Instructions

Prepare a statement of comprehensive income, beginning with income from continuing operations.