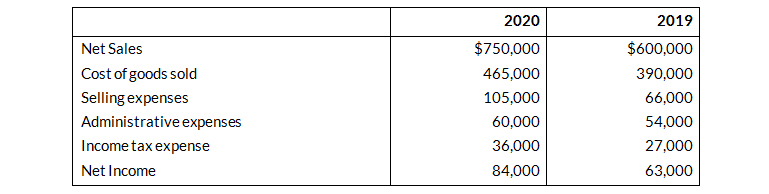

Operating data for Navarro Corporation are presented below.

Instructions

Prepare a schedule showing a vertical analysis for 2020 and 2019

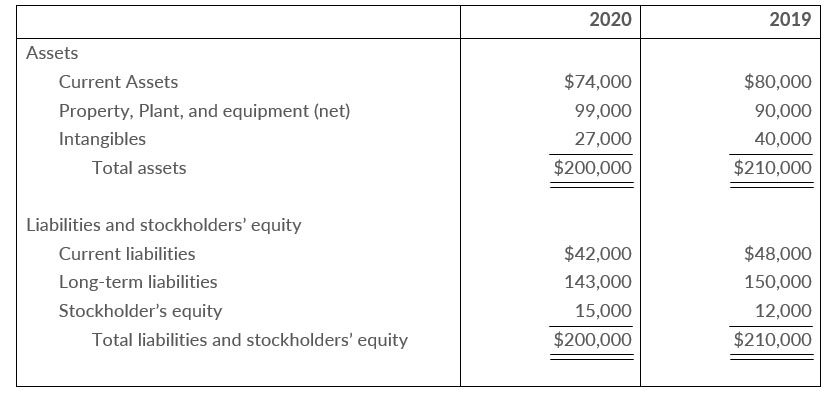

The Comparative condensed balance sheets of Gurley Corporation are presented below.

Comparative Condensed Balance Sheets

December 31

Instructions

- Prepare a horizontal analysis of the balance sheet data for Gurley Corporation using 2019 as a base

- Prepare a vertical analysis of the balance sheet data for Gurley Corporation in columnar form for 2020

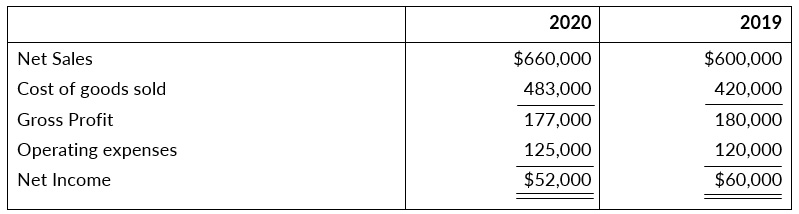

The Comparative condensed income statements of Emley Corporation are shown below.

Comparative Condensed Balance Sheets

For the Years Ended December 31

Instructions

- Prepare a horizontal analysis of the income statement data for Emley Corporation using 2019 as a base

- Prepare a vertical analysis of the income statement data for Emley Corporation in columnar form for both years

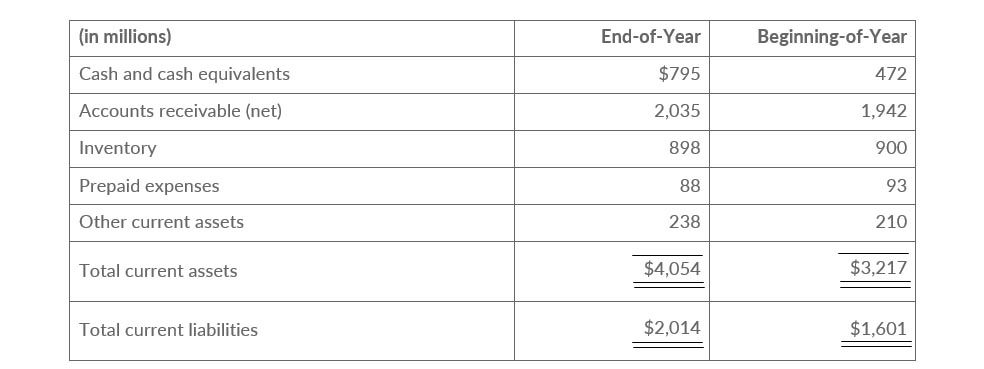

Suppose Nordstrom, Inc, which operates department stores in numerous states, has the following selected financial statement data for a recent year.

Balance Sheets (partial)

For the year, net sales were $8,258 and cost of goods sold was $5,328 (in millions).

Instructions

- Compute the four liquidity ratios at the end of the year.

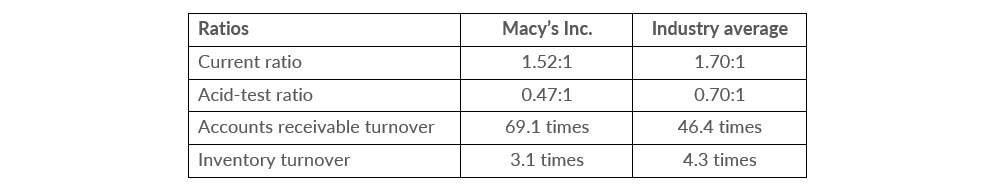

- Compare Nordstrom's liquidity with (1) Mac's Inc., and (2) the industry averages for department stores as below information

Keener Incorporation had the following transactions occur involving current assets and current liabilities during February 2020.

| Feb. 3 | Accounts receivable of $15,000 are collected. |

| 7 | Equipment is purchased for $28,000 cash. |

| 11 | Paid $3,000 for a 3-year insurance policty |

| 14 | Accounts payable of $12,000 are paid |

| 18 | Cash dividends of $5,000 are declined. |

Additional information:

- as February 1, 2020, current assets were $110,000, and current liabilities were 450,000

- As of February 1, 2020, current assets included $15,000 of inventory and $2,000 of prepaid expenses.

Instructions

- Compute the current ratio as of the beginning of the month and after each transaction.

- Compute the acid-test ratio as of the beginning of the month and after each transaction.

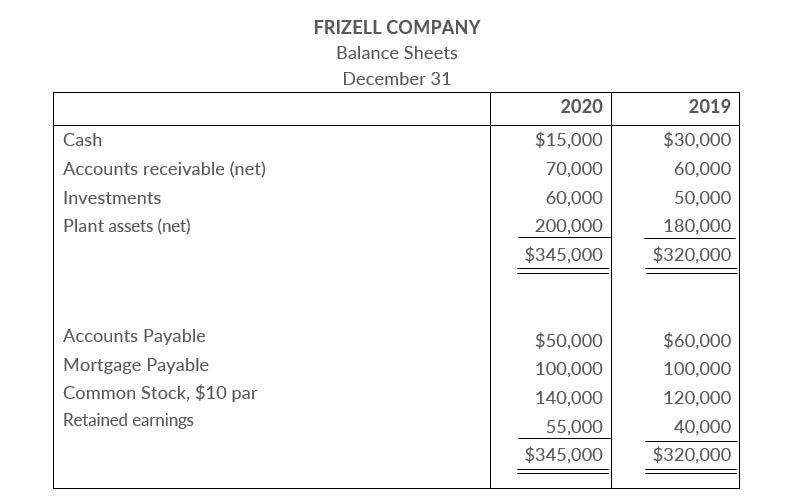

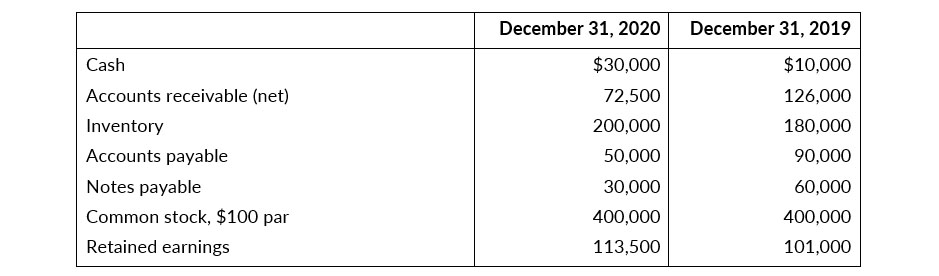

Frizell Company has the following comparative balance sheet data.

Additional information for 2020:

- Net income was $25,000

- Sales on account were $410,000. Sales returns and allowances were $20,000

- Cost of goods sold was $198,000

Instructions

Compute the following ratios at December 31, 2020.

- Current Ratio

- Acid-test Ratio

- Accounts receivable turnover.

- Inventory turnover

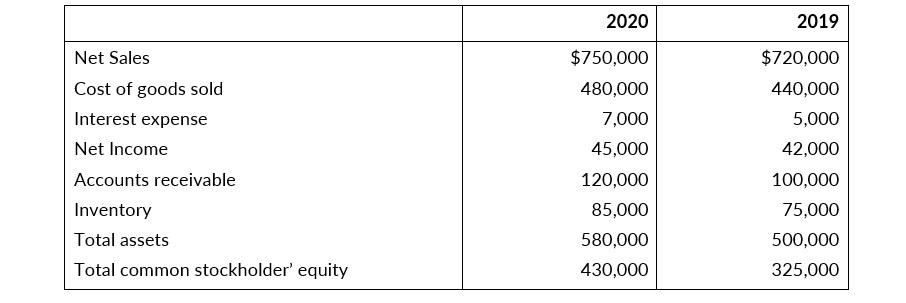

Selected Comparative statements data for Queen products company are presented below. All balance sheet data as of December 31.

Instructions

Compute the following ratios for 2020.

- Profit margin

- Asset turnover.

- Return on assets.

- Return on common stockholders' equity

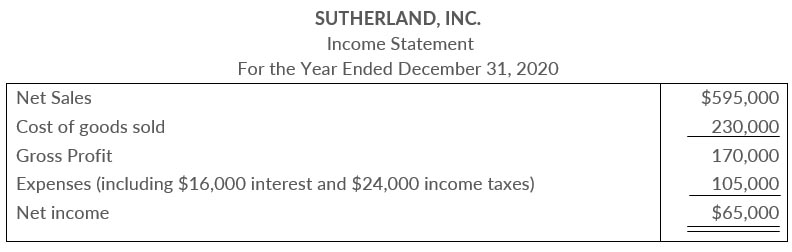

The income statement for Sutherland, Inc. appears below.

Additional information:

- The weighted-average common shares outstanding in 2020 were 30,000 shares.

- The market price of Sutherland, Inc. stock was $13 in 2020.

- Cash dividends of $26,000 were paid, $5,000 of which were to preferred stockholders.

Instructions

Compute the following ratios at December 31, 2020.

- Earning per share

- Price-earnings ratio.

- Payout ratio.

- Times interest earned.

Lingenfelter Corporation experienced a fire on December 31, 2020, in which its financial records were partially destroyed. It has been able to salvage some of the rerecords and has ascertained the following balances.

Additional information:

- The inventory turnover is 4.5 times.

- The return on common stockholders' equity is 16%. The company had no additional paid-in-capital.

- The accounts receivable turnover is 8.8 times

- The return on assets is 12.5%

- Total assets at December 31, 2019, were $655,000

Instructions

Compute the following for Lingenfelter Corporaton.

- Cos of goods sold for 2020.

- Net sales (credit) for 2020.

- Net income for 2020.

- Total assets at December 31, 2020.

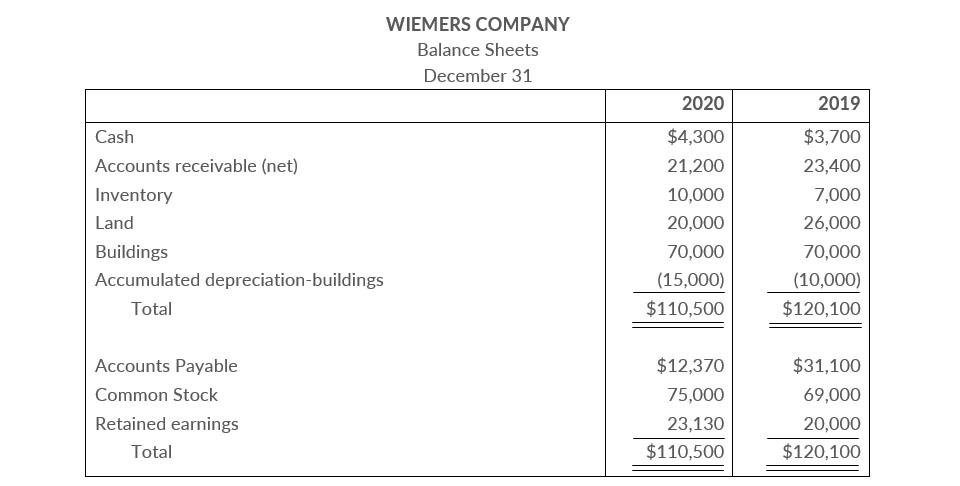

Wiemers Corporation's comparative balance sheets are presented below.

Wiemers's 2020 income statement included net sales of $100,000, cost of goods sold of $60,000, and net income of $15,000.

Instructions

Compute the following ratios at 2020.

- Current ratio.

- Acid-test Ratio

- Accounts Receivables turnover.

- Inventory turnover.

- Profit margin.

- Asset turnover.

- Return on assets.

- Return on common stockholders' equity.

- Debt to total assets.