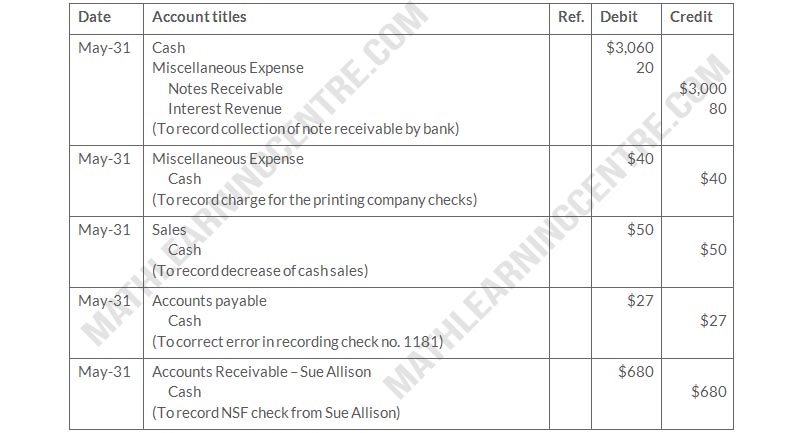

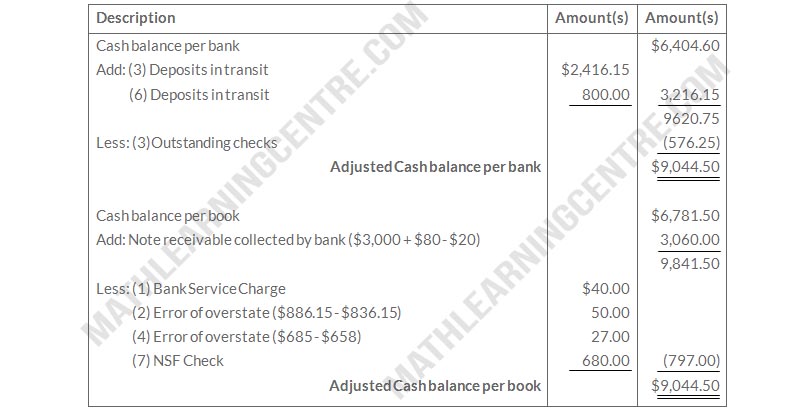

- The statement included a debit memo of $40 for the printing of additional company checks.

- Cash sales of $836.15 on May 12 were deposited in the bank. the cash receipts journal entry and the deposit slip were incorrectly made for $886.15. The bank credited Reber Company for the correct amount.

- Outstanding checks at May 31 totaled $576.25. Deposits in transit were $2,416.15.

- On may 18, the company issued check No. 1181 for $685 to Lynda Carsen on account. The check, which cleared the bank in May, was incorrectly journalized and posted by Reber company for $658.

- A $3,000 note receivable was collected by the bank for Reber Company on May 31 plus $80 interest. The bank charged a collection fee of $20. no interest has been accrued on the note.

- Included with the cancelled checks was a check issued by Stiner Comapny to Ted Cress for $800 that was incorrectly charged to Reber Company by the bank.

- On May 31, the bank statement showed an NSF charge of $680 for a check issued by Sue Allison, a customer, to Reber Company on account.

Instructions

- Prepare the bank reconciliation at May 31, 2019.

- Pprepare the necessary adjusting entries for Reber Company at May 31, 2019.

Solution

bank reconciliation Statement

May 31, 2019

Adjusting Entries