During 2019, Roblez Corporation had the following transactions and events

- Declared a cash dividend.

- Issued par value common stock for cash at par value.

- Completed a 2-for-1 stock split in which $10 par value stock was changed to $5 par value stock.

- Declared a small stock dividend when the market price was higher than par value.

- Made a prior period adjustment for overstatement of net income.

- Issued the shares of common stock required by the stock dividend declaration in item no. 4 above.

- Paid the cash dividend in item no. 1 above

- Issued par value common stock for cash above par value.

Instructions

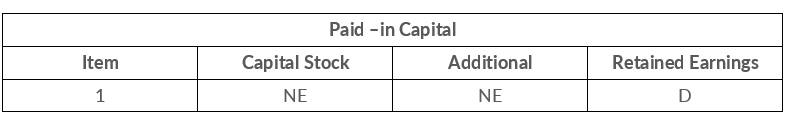

Indicate the effect(s) of each of the foregoing items on the subdivisions of stockholders' equity. Present your answer in tabular form with the following columns. Use (1) for increase, (D) for decrease, and (NE) for no effect. Item no. 1 is given as an example.

Read more: Problem-11: Corporations: Dividends, Retained Earnings, and Income Reporting

Before preparing financial statements for the current year, the chief accountant for Toso Company discovered the following errors in the accounts.

- The declaration and payment of $50,000 cash dividend was recorded as a debit to interest Expense $50,000 and a credit to Cash $50,000.

- A 10% stock dividend (1,000 shares) was declared on the $10 par value stock when the market price per share was $18. The only entry made was Stock Dividends (Dr.) $10,000 and Dividend Payable (Cr.) $10,000. The shares have not been issued.

- A 4-for-1 stock split involving the issue of 400,000 shares of $5 par value common stock for 100,000 shares of $20 par value common stock was recorded as a debit to Retained Earnings $2,000,000 and a credit to common stock $2,000,000.

Instructions

Prepare the correcting entries at December 31.

Read more: Problem-12: Corporations: Dividends, Retained Earnings, and Income Reporting

On January 1, 2020, Eddy Corporation had retained earnings of $650,000. During the year, Eddy had the following selected transactions.

- Declared cash dividends $120,000.

- Corrected overstatement of 2019 net income because of inventory error $40,000.

- Earned net income $350,000.

- Declared stock dividends $90,000.

Instructions

Prepare a retained earnings statement for the year.

Read more: Problem-13: Corporations: Dividends, Retained Earnings, and Income Reporting

Newland Company reported retained earnings at December 31, 2019, of $310,000. Newland had 200,000 shares of common stock outstanding at the beginning of 2020. The following transactions occurred during 2020.

- An error was discovered, In 2018, depreciation expense was recorded at $70,000, but the correct amount was $50,000.

- A cash dividend of $0.50 per share was declared and paid.

- A 5% stock dividend was declared and distributed when he market price per share was $15 per share

- Net income was $285,000.

Instructions

Prepare a retained earnings statement for the year.

Read more: Problem-14: Corporations: Dividends, Retained Earnings, and Income Reporting

Dirk Company reported the following balances at December 31, 2020; common stock $500,000, paid-in-capital in excess of par value-common stock $100,00, and retained earnings $250,000. During 2021, the following transactions affected stockholders equity.

- Issued preferred stock with a par value of $125,000 for $200,000

- Purchased treasury stock (common) for $40,000

- Earned net income of $180,000.

- Declared and paid ash dividends of $56,000

Instructions

Prepare the stockholders' equity section of Dirk Company's December 31, 2021, balance sheet.

Read more: Problem-15: Corporations: Dividends, Retained Earnings, and Income Reporting

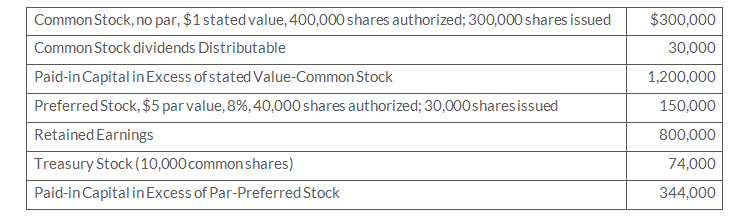

The following accounts appear in the ledger of Horner Inc. after the books are closed at December 31.

Instructions

Prepare the stockholders' equity section at December 31, assuming retained earnings is restricted for plant expansion in the amount of $100,000.

Read more: Problem-16: Corporations: Dividends, Retained Earnings, and income Reporting

The following information is available for Norman Corporation for the year ended December 31, 2020; sales revenue $700,000, other revenues and gains $92,000, operating expenses $110,000, cost of goods sold $465,000, other expenses and losses $32,000, and preferred stock dividends $30,000. The company's tax rate was 30%, and it had 50,000 shares outstanding during the entire year.

Instruction

- Prepare a corporate income statement.

- Calculate earnings per share

Read more: Problem-17: Corporations: Dividends, Retained Earnings, and Income Reporting

In 2020, Pennington Corporation had net sales of $600,000 and cost of goods sold of $360,000, Operating expenses were $153,000, and interest expense was $7,500. The corporation's tax rate is 30%. The corporation declared preferred dividends of $15,000 in 2020, and its average common stockholders equity during the year was $200,000.

Instruction

- Prepare an income statement for Pennington Corporation.

- Compute Pennington Corporation's return on common stockholders' equity 2020.

Read more: Problem-18: Corporations: Dividends, Retained Earnings, and Income Reporting

Ringold Corporation has outstanding at December 31, 2019, 50,000 shares of $20 par value, cumulative, 6% preferred stock and 200,000 shares of $5 par value common stock. All shares were outstanding the entire year. During 2019, Rnggold earned total revenues of $2,000,000 and incurred total expenses (except income taxes) of $1,300,000. Ringgold's income tax rate is 30%.

Instruction

Read more: Problem-19: Corporations: Dividends, Retained Earnings, and Income Reporting

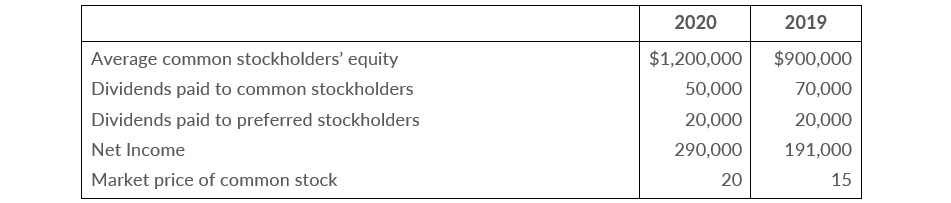

The financial information is available for Plummer Corporation.

The weighted-average number of shares of common stock outstanding was 80,000 for 2019 and 100,000 for 2020.

Instruction

Calculate earnings per share and return on common stockholders' equity for 2020 and 2019.

Read more: Problem-20: Corporations: Dividends, Retained Earnings, and Income Reporting