| Accounts Receivable | $24,500 | Service Revenue | $92,500 |

| Interest Expense | 7,700 | Interest Payable | 2,200 |

Analysis shows that adjusting entries were made to (1) accrue $5,000 of service revenue and (2) accrue $2,200 interest expense.

Instructions

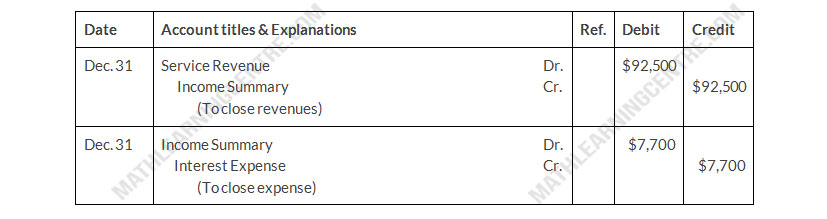

- Prepare the closing entries for the temporary accounts shows above at December 31.

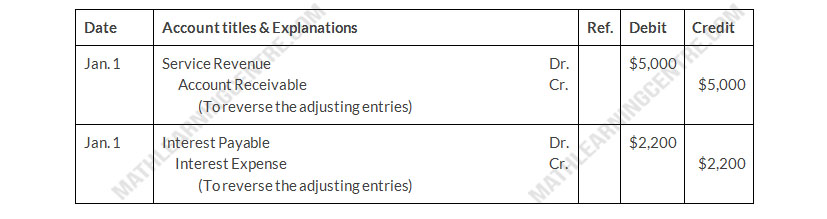

- Prepare the reversing entries on January 1.

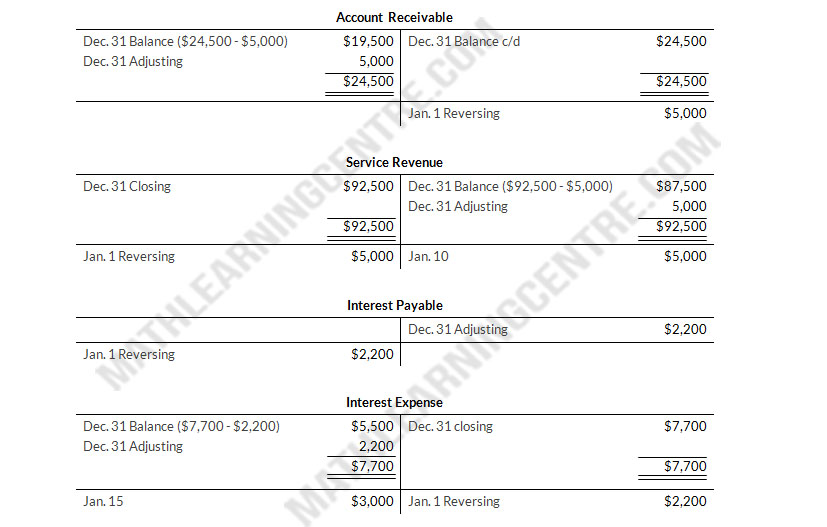

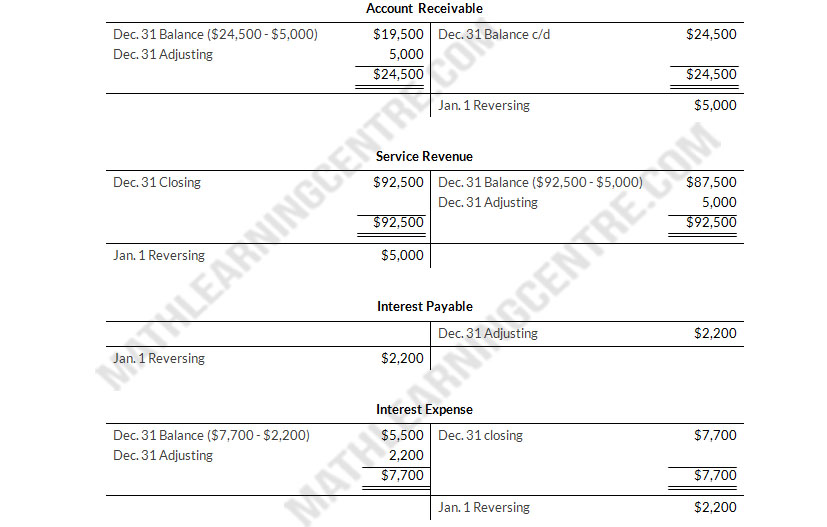

- Post the entries in (a) and (b). Underline and balance the accounts. (Use T-Accounts)

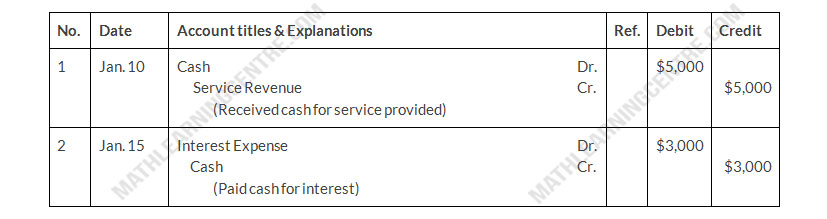

- Prepare the entries to record (1) the collection of the accrued revenue on January 10 and (2) the payment of all interest due ($3,000) on January 15.

- Post the entries in (d) to the temporary accounts.

Solution

Closing Journal Entries

Reversing Journal Entries

T-accounts

Journal Entries

T-accounts