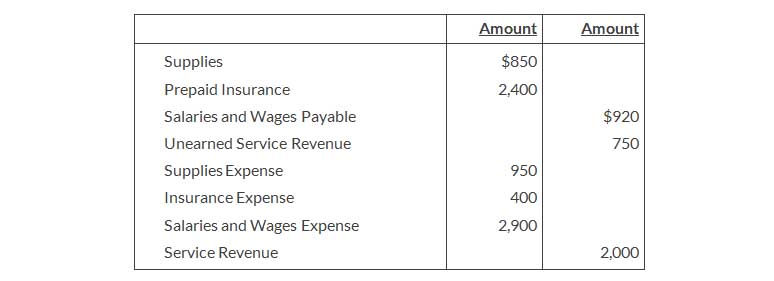

- Insurance expired during July of $400 was omitted.

- Supplies expense includes $250 of supplies that are still on hand at July 31.

- Depreciation on equipment of $150 was omitted.

- Accrued but unpaid salaries and wages at July 31 of $300 were not included.

- Services performed but unrecorded totaled $650.

Instructions

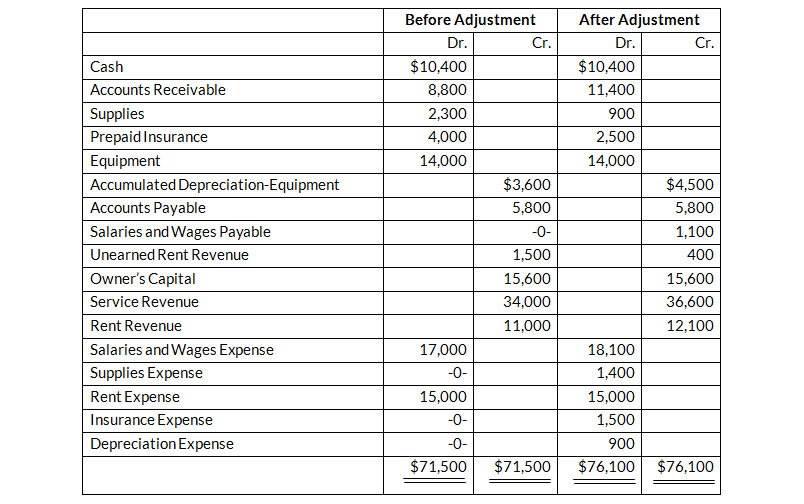

Adjusted Trial Balance

January 31, 2019

Instructions

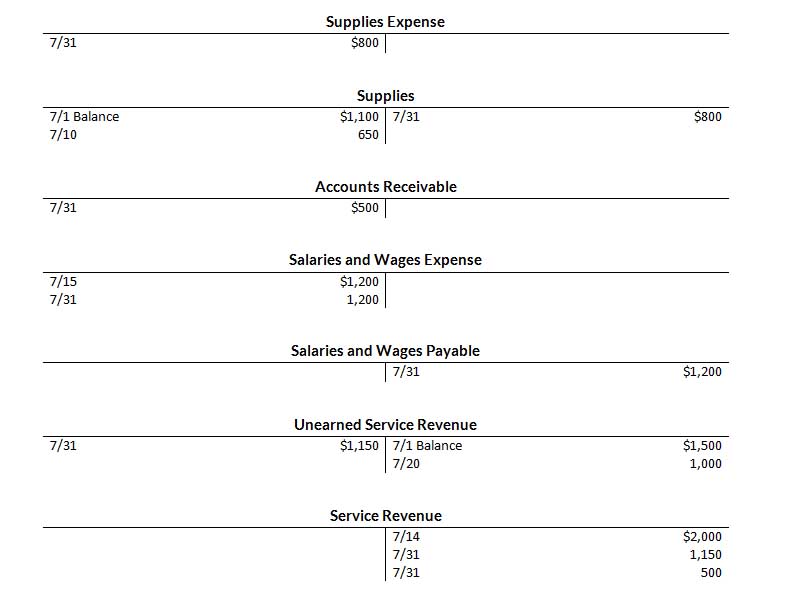

- If the amount in Supplies Expense is the January 31 adjusting entry, and $1,000 of supplies was purchased in January, what was the balance in Supplies on January 1?

- If the amount in Insurance Expense is the January 31 adjusting entry, and the original insurance premium was for one year, what was the total premium and when was the policy purchased?

- If $3,800 of salaries was paid in January, what was the balance in Salaries and Wages Payable at December 31, 2018.

Instructions

Trial Balance

August 31, 2020

Instructions

| Jan. 02 | Paid $1,920 for fire protection for the year. |

| 10 | Paid $1,700 for supplies. |

| 15 | Received $6,100 for services to be performed in the future. |

On January 31, it is determined that $2,100 of the services were performed and that there are $650 of supplies on hand.

Instructions

- Journalize and post the January transactions. (Use T-accounts.)

- Journalize and post the adjusting entries at January 31.

- Determine the ending balance in each of the accounts.