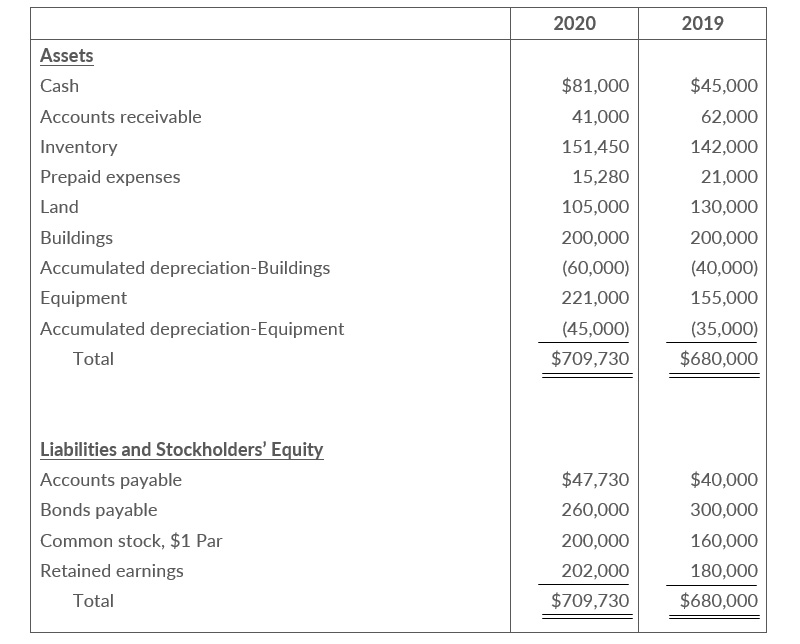

The comparative balance sheets for Rothlisberger Company as of December 31 are presented below.

Comparative Balance Sheets

December 31

- Operating expenses include depreciation expense of $42,000 and charges from prepaid expenses of $5,720

- Land was sold for cash at book value

- Cash dividends of $20,000 were paid.

- Net income of 2020 was $42,000

- Eqipment was purchased for $88,000 cash. In addition , equipment costing $22,000 with a book value of $10,000 was sold for $6,000 cash.

- Bonds wer converted at face value by issuing 40,000 shares of $1 par value common stock

Instructions

Prepare a statement of ash flows for the year ended December 31, 2020, using the indirect method.

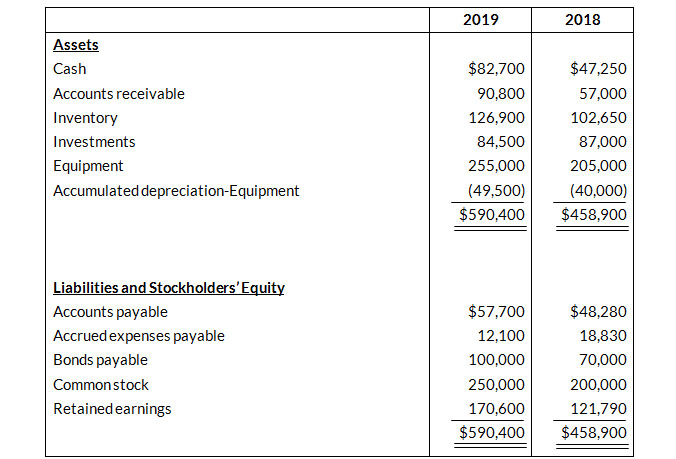

Condensed financial data of Oakley Company appear below.

Comparative Balance Sheets

December 31

Income Statement

For the Year Ended December 31, 2019

- Equipment costing $97,000 was purchased for cash during the year.

- Investments were sold at cost.

- Equipment costing $47,000 was sold for $15,550, resulting in gain of $8,750.

- A cash dividend of $83,400 was declared and paid during the year.

Instructions

Cushenberry Corporation had the following transactions.

- Sold land (cost $12,000) for $15,000

- Issued common stock at par for $20,000

- Recorded depreciation on buildings for $17,000.

- Paid salaries of $9,000.

- Issued 1,000 shares of $1 par value common stock for equipment worth $8,000

- Sold equipment (cost $10,000, accumulated depreciation $7,000) for $1,200

Instructions

For each transaction above, (a) prepare the journal entry, and (b) indicate how it would affect the statement of cash flows using the indirect method.

Gutierrez Company reported net income of $225,000 for 2020. Gutierrez also reported depreciation expense of $45,000 and a loss of $5,000 on the disposal of equipment. The comparative balance sheet shows a decrease in accounts receivable of $15,000 for the year, a $17,000 increase in accounts payable, and a $4,0000 decrease in prepaid expenses.

Instructions

Prepare the operating activities section for the statement of cash flows for 2020. Use the indirect method..

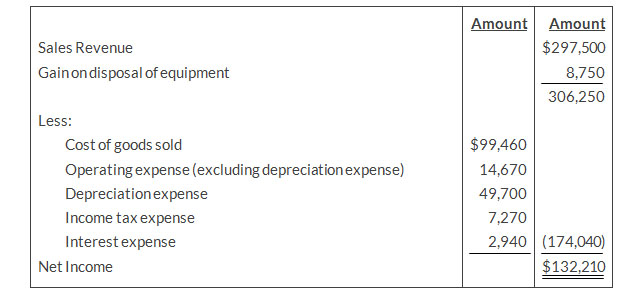

The current sections of Scoggin Inc.'s balance sheets at December 31, 2019 and 2020 are presented here. Scoggin's net income for 2019 was $153,000. Depreciation expense was $24,000.

Instructions

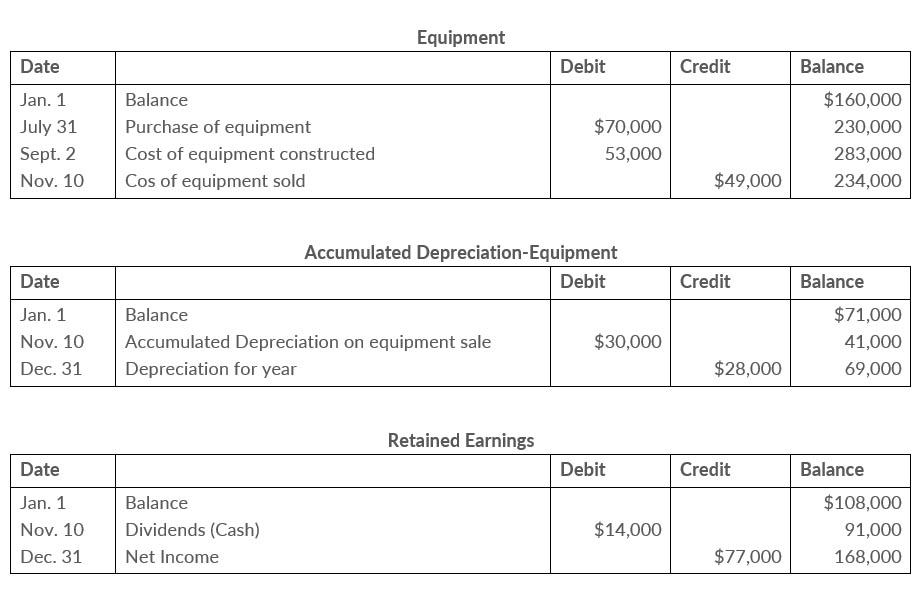

The three accounts shown below appear in the general ledger of Herrick Corp. during 2020.

Instructions

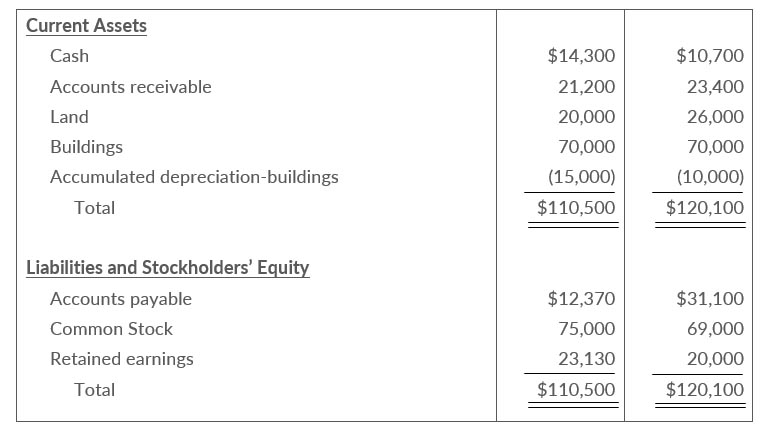

Rojas Corporation's comparative balance sheets are presented below.

Comparative Balance Sheets

December 31

- Net income was $22,630. Dividends declared and paid were $19,500.

- No noncash investing and financing activities occurred during 2020.

- The land was sold for cash of $4,900.

Instructions

- Prepare a statement of cash flows for 2020 using the indirect method

- Compute free cash flow

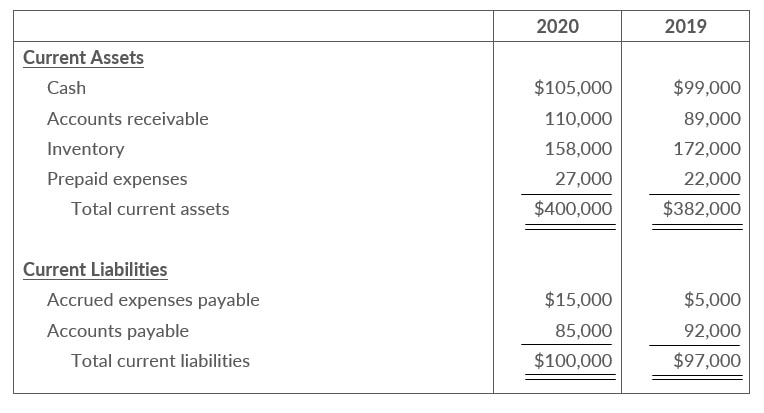

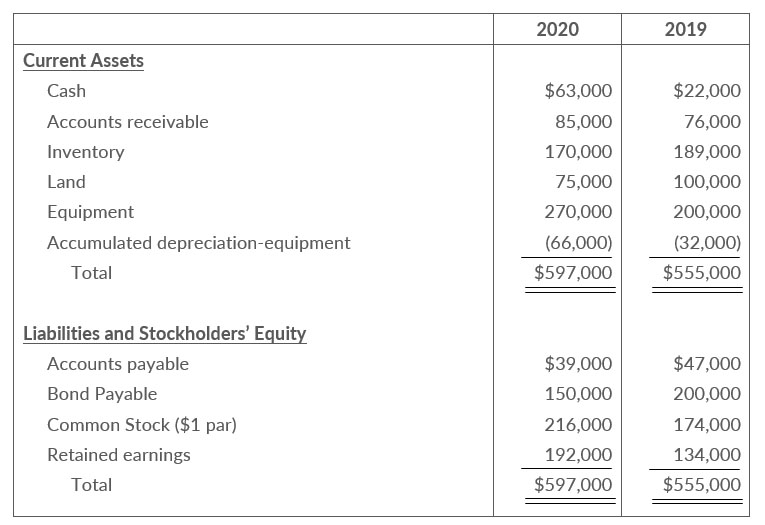

Here are comparative balance sheets for Velo Company.

Comparative Balance Sheets

December 31

- Net income for 2020 was $93,000

- Cash dividends of $35,000 were declared and paid.

- Bonds payable amounting to $50,000 were redeemed for cash $50,000

- common stock was issued for $42,000 cash.

- No equipment was sold during 2020, but land was sold at cost

Instructions

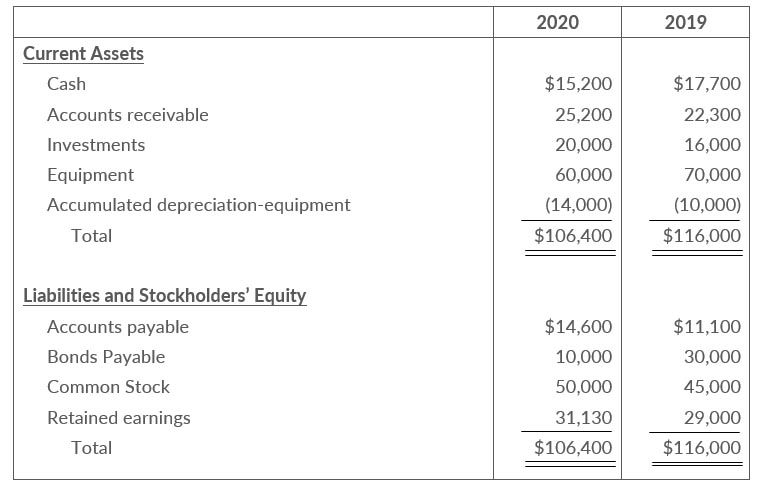

Rodriquez Corporation's comparative balance sheets are presented below.

Comparative Balance Sheets

December 31

- Net income was $18,300. Dividends declared and paid were $16,400.

- Equipment which cost $10,000 and had accumulated depreciation of $1,200 was sold for $3,300.

- No noncash investing and financing activities occurred during 2020.

Instructions

- Prepare a statement of cash flows for 2020 using the indirect method

- Compute free cash flow

Macgregor Company completed its first year of operations on December 31, 2020. Its initial income statement showed that Macgregor had revenues of $192,000 and operating expenses of $78,000. Accounts receivable and accounts payable at year-end were $60,000 and $23,000, respectively. Assume that accounts payable related to operating expenses. Ignore income taxes.