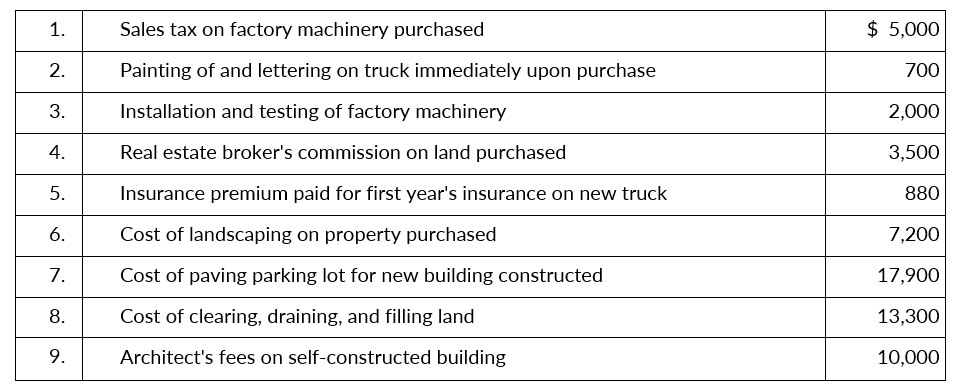

Benedict Company incurred the following costs.

Instructions

Indicate to which account Benedict would debit each of the costs.

Read more: Problem-11: Plant Assets, Natural Resources and intangible Assets

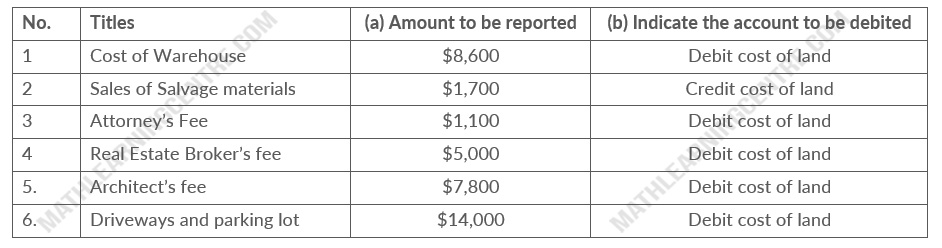

On March 1, 2019, Westmorian Company acquired real estate on which it planned to construct a small office buildings. The company paid $75,000 in cash. An old warehouse on the property was razed at a cost of $8,6000; the salvaged materials were sold for $1,700. Additional expenditures before construction began included $1,100 attorney's fee for work concerning the land purchase, $5,000 real estate broker's fee, $7,800 architect's fee, and $14,000 to put in driveways and a parking lot.

Instructions

- Determining the amount to be reported as the cost of the land.

- For each cost not used in part (a), indicate the account to be debited.

Solution

Tom Parkey has prepared the following list of statements about depreciation.

- Depreciation is a process of asset valuation, not cost allocation.

- Depreciation provides for the proper matching of expenses with revenues.

- The book value of a plant asset should approximate its fair value.

- Depreciation applies to three classes of plant assets: land, buildings, and equipment.

- Depreciation does not apply to a building because its usefulness and revenue-producing ability generally remain intact over time.

- The revenue-producing ability of a depreciable asset will decline due to wear and tear and to obsolescence.

- Recognizing depreciation on an asset results in an accumulation of cash for replacement of the asset.

- The balance in accumulated depreciation represents the total cost that has been charged to expense.

- Depreciation expense and accumulated depreciation are reported on the income statement.

- Four factors affect the computation of depreciation: cost, useful life, salvage value, and residual value.

Instructions

Read more: Problem-13: Plant Assets, Natural Resources and intangible Assets

Yello Bus lines uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2019, at a cost of $148,000. Over its 4-year useful life, the bus in expected to be driven 100,000 miles. Salvage value is expected to be $8,000.

Instructions

- Compute the depreciable cost per unit

- Prepare a depreciation schedule assuming actual mileage was 2019: 26,000; 2020: 32,000; 2021: 25,000; and 2022: 17,000.

Read more: Problem-14: Plant Assets, Natural Resources and intangible Assets

Rottino Company purchased a new machine on October 1, 2019, at a cost of $150,000. The company estimated that the machine will have a salvage value of $12,000. The machine is expected to be used for 10,000 working hours during its 5-year indicated.

Instructions

Compute the depreciation expense under the following methods for the year indicated

- Straight-line for 2019

- Units-of-activity for 2019, assuming machine usage was 1,700 hours.

- Delining-blance using double the straight-line rate for 2019 and 2020

Read more: Problem-15: Plant Assets, Natural Resources and intangible Assets

Linton Company purchased a delivery truck for $34,000 on January 1, 2019. The truck has an expected salvage value of $2,000, and s expected to be driven 100,000 miles over its estimated useful life of 8 years. Actual miles driven were 15,000 in 2019 and 12,000 in 2020.

Instructions

- Compute depreciation expense for 2019 and 2020 using

- the straight-line method,

- the units-of-activity method, and

- the double-decline-balance method.

- Assume that Linton uses the straight-line method.

- Prepare the journal entry to record 2019 depreciation.

- Show how the truck would be reported in the December 31, 2019, blance sheet.

Read more: Problem-16: Plant Assets, Natural Resources and intangible Assets

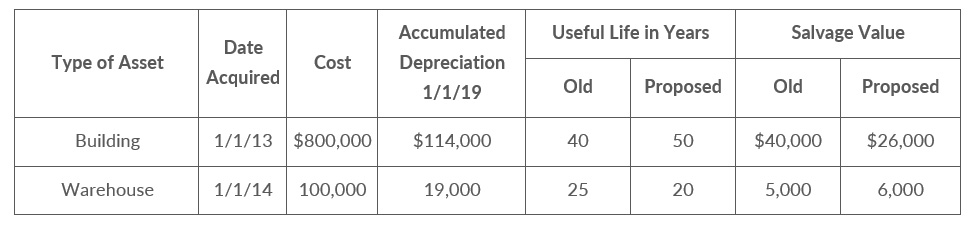

Terry Wade, the new controller of Hellickson Company, has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of 2019. His findings as as follows

Instructions

- Compute the revised annual depreciation on each asset in 2019. (Show computations

- Prepare the entry (or entries) to record depreciation on the building in 2019.

Read more: Problem-17: Plant Assets, Natural Resources and intangible Assets

Presented below are selected transactions at Ridge Company for 2019.

| Jan. 1 | Retired a piece of machinery that was purchased on January 1, 2009. The machine cost $62,000 on that date. It had a useful life of 10 years with no salvage value. |

| June 30 | Sold a computer that was purchased on January 1, 2016. The computer cost $45,000. It had a useful life of 5 years with no salvage value. The computer was sold for $14,000. |

| Dec. 31 | Discarded a delivery truck that was purchased on January 1, 2015. The truck cost $33,000. It was depreciated based on a 6-year useful life with a $3,000 salvage value. |

Instructions

Journalize all entries required on the above dates, including entries to update depreciation, where applicable, on assets disposed of. Ridge Company uses straight-line depreciation. (Assume depreciation is up to date as of December 31, 2018.)

Read more: Problem-18: Plant Assets, Natural Resources and intangible Assets

Pryce Company owns equipment that cost $65,000 when purchased on January 1, 2016. It ha been depreciated using the straight-line method based on estimated salvage value of $5,000 and an estimated useful life of 5 years.

Instructions

Prepare Pryce Company's journal entries to record the sale of the equipment in these four independent situations.

- Sold for $31,000 on January 1, 2019.

- Sold for $31,000 on May 1, 2019.

- Sold for $11,000 on January 1, 2019.

- Sold for $11,000 on October 1, 2019.

Read more: Problem-19: Plant Assets, Natural Resources and intangible Assets

On July 1, 2019, Friedman Inc. invested $720,000 In a mine estimated to have 900,000 tons of ore of uniform grade. During the last 6 months of 2019, 100,000 tons of are ore were mined.

Instructions

- Prepare the journal entry to record depletion.

- Assume that the 100,000 tons of ore were mined, but only 80,000 units were sold. How are the costs applicable to the 20,000 unsold units reported?

Read more: Problem-20: Plant Assets, Natural Resources and intangible Assets