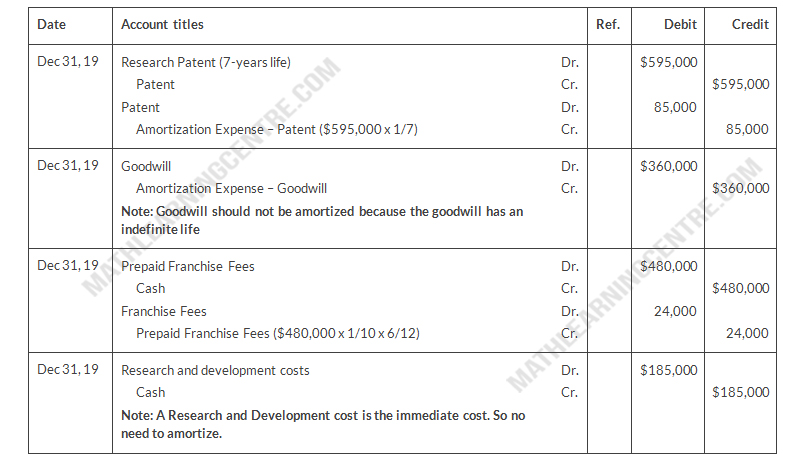

Gill Company, organized in 2019, has the following transactions related to intangible assets.

| 1/2/19 | Purchased patent (7-year life) | $595,000 |

| 4/1/19 | Goodwill purchased (indefinite life) | 360,000 |

| 7/1/19 | 10-year franchise; expiration date 7/1/2029 | 480,000 |

| 9/1/19 | Research and development costs | 185,000 |

Instructions

Prepare the necessary entries to record these intangibles. All costs incurred were for cash. Make the adjusting entries as of December 31, 2019, recording any necessary amortization and reflecting all balances accurately as of that date.

Solution