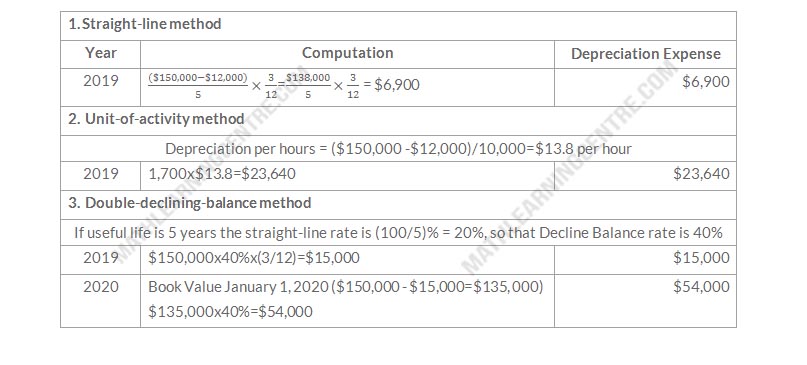

Rottino Company purchased a new machine on October 1, 2019, at a cost of $150,000. The company estimated that the machine will have a salvage value of $12,000. The machine is expected to be used for 10,000 working hours during its 5-year indicated.

Instructions

Compute the depreciation expense under the following methods for the year indicated

- Straight-line for 2019

- Units-of-activity for 2019, assuming machine usage was 1,700 hours.

- Delining-blance using double the straight-line rate for 2019 and 2020

Solution