The following expenditures relating to plant assets were made by Prather Company during the first 2 months of 2019.

- Paid $5,000 of accrued taxes at time plant site was acquired.

- Paid $200 insurance to cover possible accident loss on new factory machinery while the machinery was in transit.

- Paid $850 sales taxes on new delivery truck.

- Paid $17,500 for parking lots and driveways on new plant site.

- Paid $250 to have company name and advertising slogan painted on new delivery truck.

- Paid $8,000 for installation of new factory machinery.

- Paid $900 for one-year accident insurance policy on new delivery truck.

- Paid $75 motor vehicle license fee on the new truck.

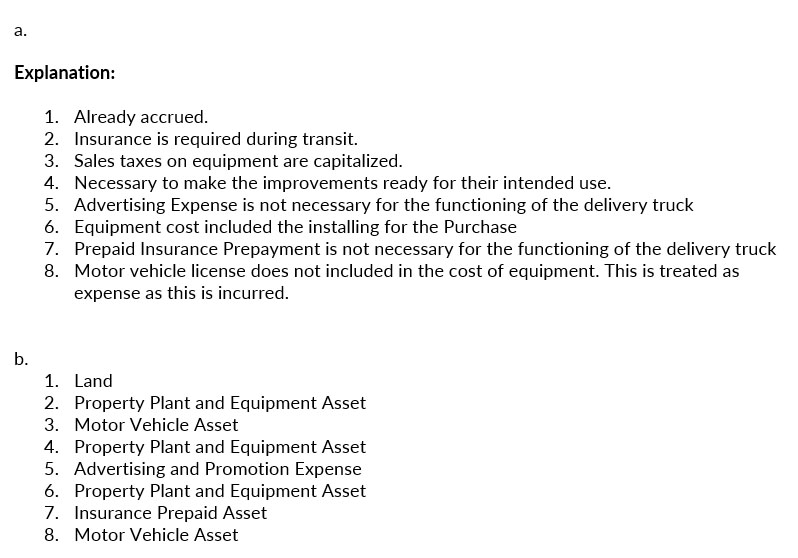

Instructions

- Explain the application of the historical cost principle in determining the acquisition cost of plant assets.

- List the numbers of the foregoing transactions, and opposite each indicate the account title to which each expenditure should be debited.

Solution