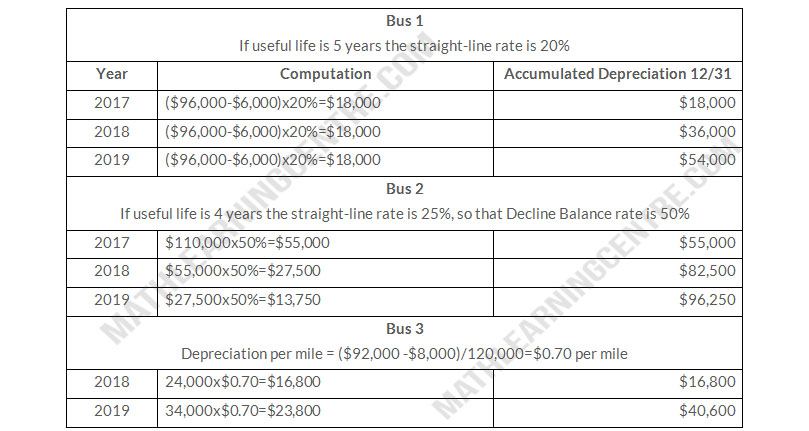

| Bus | Acquired | Cost | Salvage Value | Useful Life in Years | Depreciation Method |

| 1. | 1/1/16 | $96,000 | $6,000 | 5 | Straight-line |

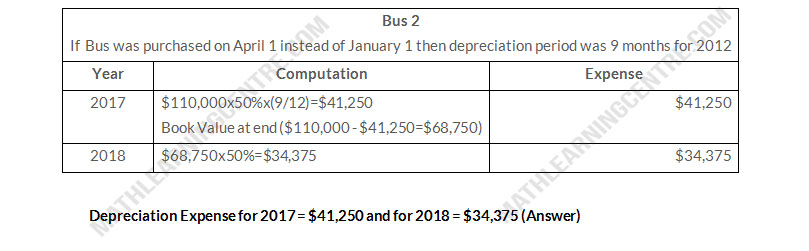

| 2. | 1/1/16 | 110,000 | 10,000 | 4 | Declining balance |

| 3. | 1/1/17 | 92,000 | 8,000 | 5 | units-of-activity |

For the declining-balance method, the company uses the double-declining rate. For the units-of-activity method, total miles are expected to be 120,000. Actualy miles of use in the first 3 years were 2018, 24,000, 2019, 34,000, and 2020, 30,000

Instructions

- Compute the amount of accumulated depreciation on each bus at December 31, 2019

- If Bus 2 was purchased on April 1 instead of January 1,. What is the depreciation expense for this bus in (1) 2017 and (2) 2018?

Solution