Instructions

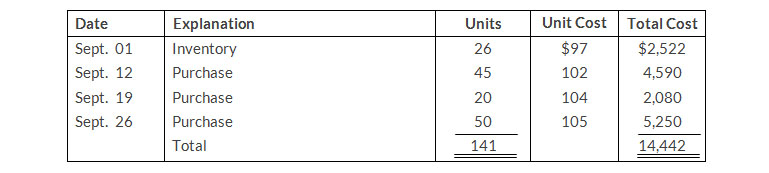

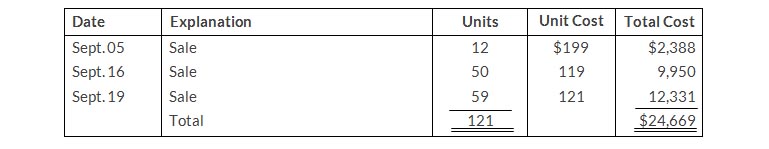

- Compute ending inventory at September 30 using FIFO, LIFO and moving-average cost.

- Compare ending inventory using a perpetual inventory system to ending inventory using a periodic inventory system.

- Which inventory cost flow method (FIFO, LIFO) gives the same ending inventory value under both periodic and perpetual? Which method give different ending inventory values?

Solution

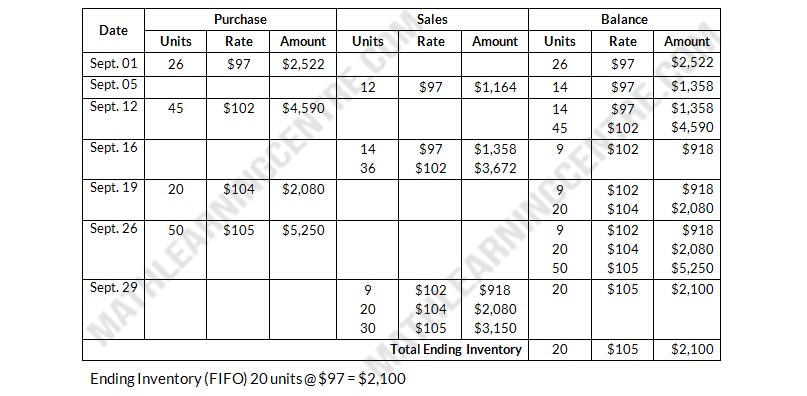

Perpetual Inventory System

FIFO Method

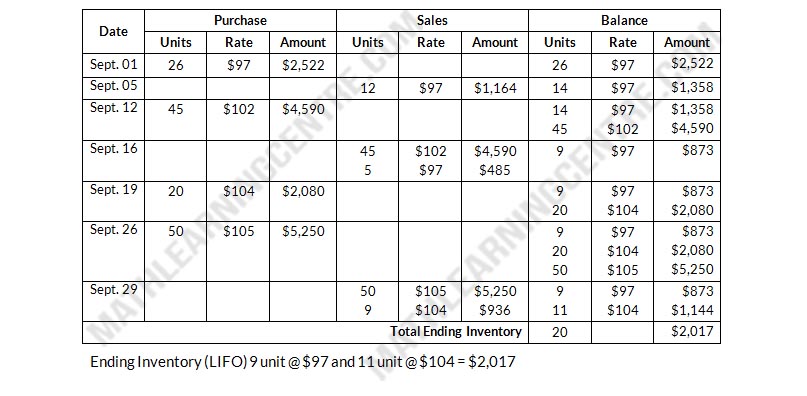

Perpetual Inventory System

LIFO Method

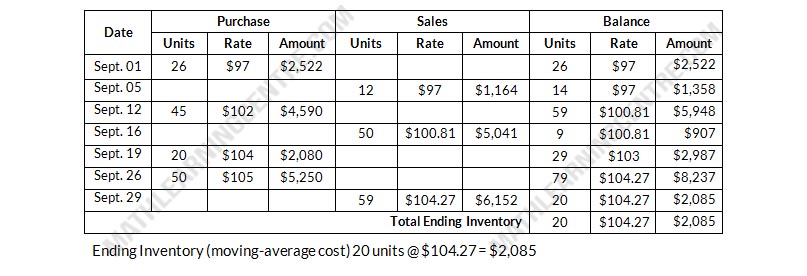

Perpetual Inventory System

Average Method

Units remaining in ending inventory = 141- 121 = 20

Ending inventory (FIFO Method) = 20 x $105 = $2,100

Ending inventory (LIFO Method) = 20 x $97 = $1,940

Ending inventory is same for both perpetual and periodic methods

FIFO Methods gives the same ending inventory value for both perpetual and periodic methods. LIFO Methods gives the different ending inventory value for both perpetual and periodic methods.