| Depreciation | $1,400 per month |

| Advertising | $200 per month |

| Insurance | $2,000 per month |

| Weed and feed materials | $12 per lawn |

| Direct Labor | $10 per lawn |

| Fuel | $2 per lawn |

All That Blooms charges $60 per treatment for the average single-family lawn

Instructions

Determine the company's break-even point in (a) number of lawns serviced per month and (b) dollars

| Salaries | $5,900 per month |

| Utilities | $1,100 per month |

| Depreciation | $1,000 per month |

| Maintenance | $100 per month |

| Maid service | $14 per room |

| Other costs | $28 per room |

Instructions

Determine the inn's break-even point in (a) number of rented rooms per month and (b) dollars

Instructions

- Determine the contribution margin in dollars, per unit, and as a ratio.

- Using the contribution margin technique, compute the break-even point in dollars and in units.

Instructions

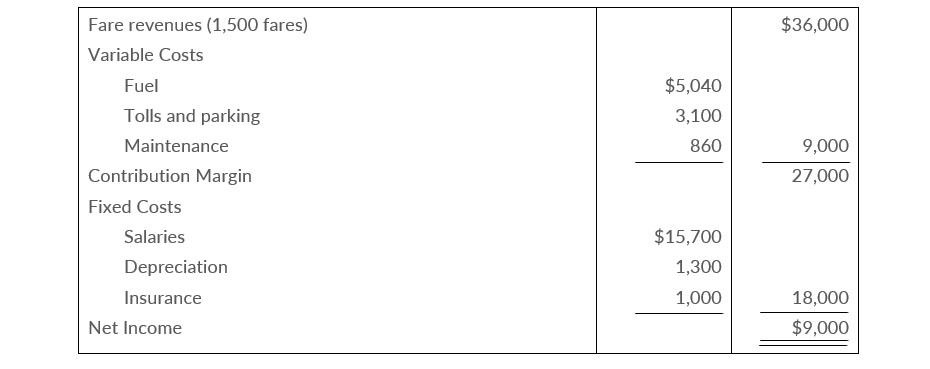

- Calculate the break-even point in (1) dollars and (2) number of fares.

- Without calculation, determine the contribution margin at the break-even point

Instructions

- Compute the varitable costs per unit and the contribution margin ratio for 2020

- Compute the increase in fixed costs for 2021

Instructions

- Compute the number of units sold in 2019.

- Compute the number of units that would have to be sold in 2020 to reach the stock holders' desired profit level.

- Assume that Naylor Company sells the same number of units in 2020 as it did in 2019. What would the selling price have to be in order to reach the stockholders' desired profit level?

- Increase selling price by 10% with no change in total variable costs or units sold.

- Reduce variable costs to 55% of sales

Instructions

Instructions

- Prepare a CVP graph, assuming maximum sales of $3,200,000. (Note: Use $400,000 increments for sales and costs and 100,000 increments for nits.)

- Compute the break-even pount in (1) units and (2) dollars.

- Assuming actual sales are $2 million, compute the margin of safety in (1) dollars and (2) as a ratio

Carey Company had sales in 2020 of $1,560,000 on 60,000 units. Variable costs totaled $900,000, and fixed costs totaled $500,000.

A new raw material is available that will decrease the variable cost per unit by 20% (or $3). However, to process the new raw material, fixed operating costs will increase by $100,000, Managements feels that one-half of the decline in the variable costs per unit should be passed on to customers in the form of a sales price reduction. The marketing department expects that this sale price reduction will result in a 5% increase in the number of units sold.

Instructions

- assuming the changes have not been made, and

- assuming that changes are made as described.