As an auditor for the CPA firm of Hinkson and Calvert, you encounter the following situations in auditing different clients.

- LR Corporation is a closely held corporation whose stock is not publicly traded. On December 5, the corporation acquired land by using 5,000 shares of sites $20 par value common stock. The owner's asking price for the land was $120,000, and the fair value of the land was $110,000.

- Vera Corporation is a publicly held corporation whose common stock is traded on the securities markets. On June 1, it acquired land by issuing 20,000 shares of its $10 par value stock. at the time of the exchange, the land was advertised for sale at $250,000. the stock was selling at $11 per share.

Instruction

Prepare the journal entries for each of the situations above

Read more: Problem-11: Corporations: Organization and Capital Stock Transactions

On January 1, 2021, the stockholders equity section of Newlin Corporation shows common stock ($5 par value) $1,500,000; paid-in capital in excess of par $1,000,000; and retained earnings $1,200,000. During the year, the following treasury stock transactions occurred.

| Mar. 1 | Purchased 50,000 shares for cash at $15 per share |

| July 1 | Sold 10,000 treasury shares for cash at $17 per share |

| Sept. 1 | Sold 8,000 treasury shares for cash at $14 per share. |

Instructions

- Journalize the treasury stock transactions.

- Restate the entry for September 1, assuming the treasury shares were sold at $12 per share

Read more: Problem-12: Corporations: Organization and Capital Stock Transactions

Rinehart Corporation purchased from its stockholders 5,000 shares of its own previously issued stock for $255,000. It later resold 2,000 shares for $54 per share, then 2,000 more shares for $49 per share, and finally 1,000 shares for $43 per share.

Instructions

Prepare journal entries for the purchase of the treasury stock and the three sales of treasury stock.

Read more: Problem-13: Corporations: Organization and Capital Stock Transactions

Tran Corporation is authorized to issue both preferred and common stock. The par value of the preferred is $50. During the first year of operations, the company had the following events and transactions pertaining to its preferred stock.

| Feb. 1 | Issued 20,000 shares for cash at $53 per share |

| July 1 | Issued 12,000 shares for cash at $57 per share. |

Instruction

- Journalize the transactions

- Post to the stockholders' equity accounts.

- Indicate the financial statement presentation of the related accounts

Read more: Problem-14: Corporations: Organization and Capital Stock Transactions

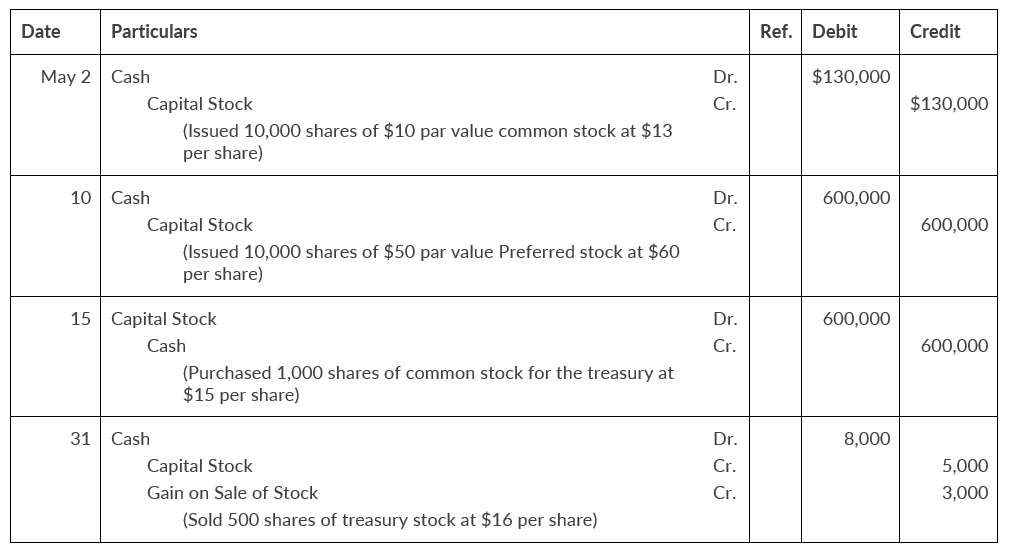

Gillian corporation recently hired a new accountant with extensive experience in accounting for partnerships. Because of the pressure of the new job, the accountant was unable to review his textbooks on the topic of corporation accounting. During the first month, the accountant made the following entries for the corporation's Capital stock.

Instruction

On the basis of the explanation for each entry, prepare the entry that should have been made for the capital stock transactions.

Read more: Problem-15: Corporations: Organization and Capital Stock Transactions

The following stockholders equity accounts, arranged alphabetically, are in the ledger of Eudaley Corporation at December 31, 2020.

| Common Stock ($5 stated Value) | $1,500,000 |

| Paid-in Capital in Excess of Par-Preferred Stock | 280,000 |

| Paid-in Capital in Excess of Par-Common Stock | 900,000 |

| Preferred Stock (8%, 100 par) | $500,000 |

| Retained Earnings | 1,234,000 |

| Treasury Stock (10,000 common shares) | 120,000 |

Instruction

Prepare the stockholders' equity section of the balance sheet at December 31, 2020.

Read more: Problem-16: Corporations: Organization and Capital Stock Transactions

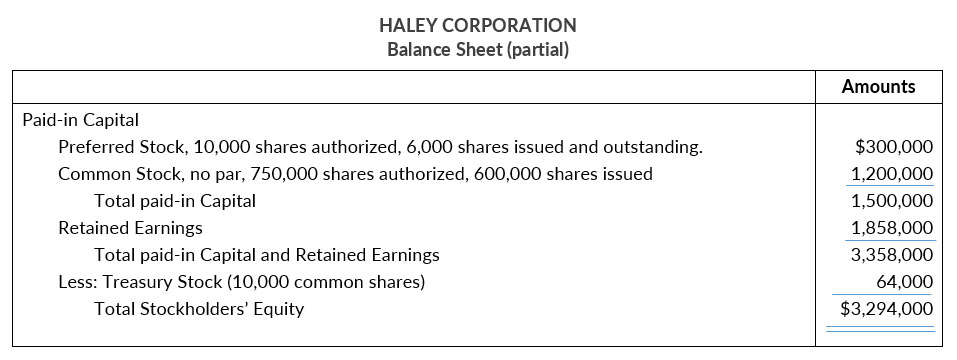

The stockholders equity section of Haley Corporation at December 31 is as follows.

Instructions

From a review of the stockholders' equity section, as chief accountant, write a memo to the president of the company answering the following questions.

- How many shares of common stock are outstanding?

- Assuming there is a stated value, what is the stated value of the common stock?

- What is the par value of the preferred stock?

Read more: Problem-17: Corporations: Organization and Capital Stock Transactions

The stockholders equity section of Aluminum Company of America (Alcoa) showed the following ( in alphabetical order): additional paid-in capital $6,101, common stock $925, preferred stock $56, retained earnings $7,428, and treasury stock 2,828. All dollar data are in millions.

The preferred stock has 557,740 shares authorized, with a par value of $100. At December 31 of the current year, 557,649 shares of preferred are issued and 546,024 shares are outstanding. There are 1.8 billion shares of $1 par value common stock authorized, of which 924.6 million are issued and 844.8 million are outstanding ant December 31.

Instructions

Prepare the stockholders' equity section of the current year, including disclosure of all relevant data.

Read more: Problem-18: Corporations: Organization and Capital Stock Transactions

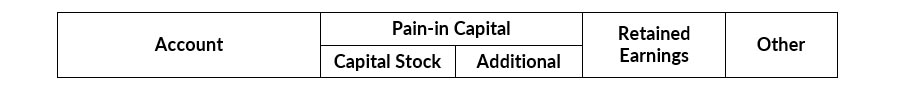

The ledger of Rolling Hills Corporation contains the following accounts: Common Stock, Preferred Stock, Treasury stock, Paid-in Capital in Excess of Par-Preferred Stock, Paid-in Capital in Excess of Stated Value-Common Stock, Paid-in Capital from Treasury Stock, and Retained Earnings.

Instruction

Classify each account using the following table headings.

Read more: Problem-19: Corporations: Organization and Capital Stock Transactions