Gallardo Co. is involved in a lawsuit as a result of an accident that took place September 5, 2020. The lawsuit was filed on November 1, 2020, and claims damages of $1,000,000.

Instructions

- At December 31, 2020, Gallardo's attorneys feel it is remote that Gallardo will lose the lawsuit. How should the company account for the effects of the lawsuit?

- Assume instead that at December 31, 2020, Gallardo's attorneys feel it is proable that Gallardo will lose the lawsuit and be required to pay $1,000,000. How should the company account for this lawsuit?

- Assume instead that at December 31, 2020, Gallardo's attorneys feel it is reasonable possible that Gallardo could lost the lawsuit and be required to pay $1,000,000. How should the company account for this lawsuit?

Read more: Problem-11: Current Liabilities and Payroll Accounting

Younger Online Company has the following liability accounts after posting adjusting entries: Accounts Payable $73,000, Unearned Ticket Revenue $24,000, Warranty Liability $18,000, Interest Payable $8,000, Mortgage Payable $120,000, Notes Payable $80,000, and Sales Taxes Payable $10,000. Assume the company's operating cycle is less than 1 year ticket revenue will be recognized within 1 year; warranty costs are expected to be incurred within 1 year, and the notes mature in 3 years.

Instructions

- Prepare the current liabilities section of the balance sheet, assuming $30,000 of the mortgage is payable next year.

- Comment on Younger Online Company's liquidity6, assuming total current assets are $300,000.

Read more: Problem-12: Current Liabilities and Payroll Accounting

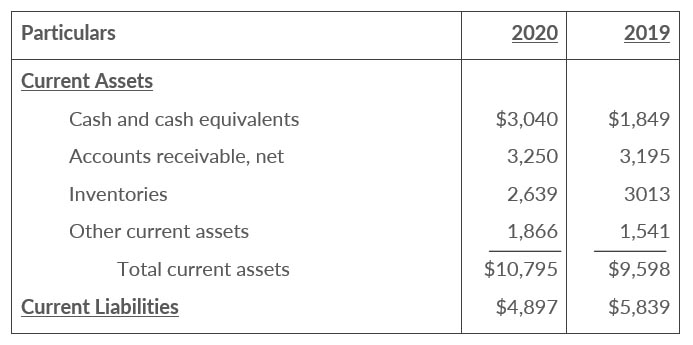

Suppose the following financial data were reported by $3M Company for 2019 and 2020

Balance Sheets (partial)

Instructions

- Calculate the current ratio and working capital for 3M for 2019 and 2020.

- Suppose that at the end of 2020, 3M management used 200 million cash to pay off $200 million of accounts payable. How would its current ratio and working capital have changed?

Read more: Problem-13: Current Liabilities and Payroll Accounting

Maria Garza's regular hourly wage rate is $16, and she receives a wage of 1 1/2 times the regular hourly rate for work in excess of 40 hours. During a March weekly pay period, Maria worked 42 hours. Her gross earnings prior to the current week were $6,000. Maria is married and claims three withholding allowances. Her only voluntary deduction is for group hospitalization insurance at $25 per week

Instructions

- Compute the following amounts for Maria's wages for the current week.

- Gross earnings.

- FICA taxes. (Assume a 7.65% rate on maximum of $117,000.)

- Federal income taxes withheld. (Use the withholding table)

- State income taxes withheld. (Assume a 2.0% rate.)

- Net Pay

- Record Maria's Pay.

Read more: Problem-14: Current Liabilities and Payroll Accounting

Employee earnings records for Slaymaker Company reveals the following gross earnings for four employees through the pay period of December 15.

| J. Seligman | $93,500 | L. Marshall | $115,100 |

| R. Eby | $113,600 | T. Olson | $120,000 |

For the pay period ending December 31, each employee's gross earnings is 4,500. The FICA tax rate is 7.65% on gross earnings of $117,000.

Instructions

Compute the FICA withholdings that should be made for each employee for the December 31 pay period.

Read more: Problem-15: Current Liabilities and Payroll Accounting

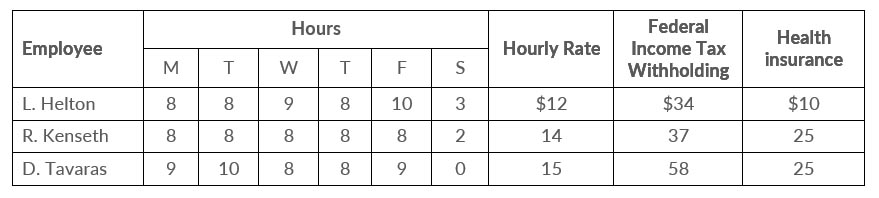

Ramirez Company has the following data for the weekly payroll ending January 31.

Employees are paid 1 1/2 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes are 7.65% on the first $117,000 of gross earnings. Ramirez company is subject to 5.4% state unemployment taxes and 0.8% federal unemployment taxes on the first $7,000 of gross earnings.

Instructions

- Prepare the payroll register for the weekly payroll.

- Prepare the journal entries to record the payroll and Reamirez's payroll tax expense.

Read more: Problem-16: Current Liabilities and Payroll Accounting

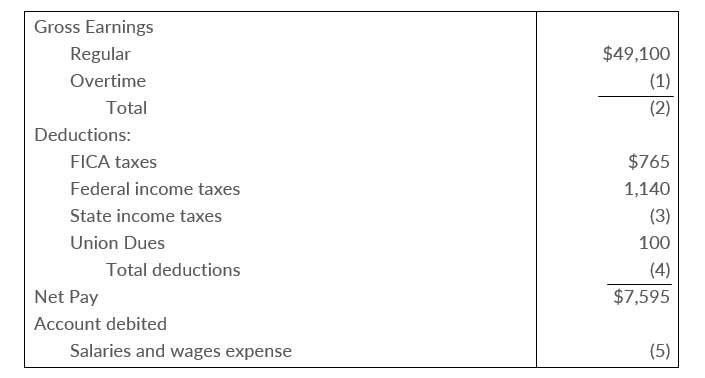

Selected data from a February payroll register for Sutton Company are presented below. Some amounts are intentionally omitted.

FICA taxes are 7.65%, State income taxes are 4% of gross earnings.

Instructions

- Fill in the missing amounts.

- Journalize the February payroll and the payment of the payroll.

Read more: Problem-17: Current Liabilities and Payroll Accounting

According to a payroll register summary of Frederickson Company, the amount of employees, gross pay in December was $850,000, of which $80,000 was not subject to Social Security taxes of 6.2% and $750,000 was not subject to state and federal unemployment taxes.

Instructions

- Determine the employer's payroll tax expense for the month, using the following rates: FICA 7.65%, state unemployment 5.4%, and federal unemployment 0.8%

- Prepare the journal entry to record December payroll tax expense.

Read more: Problem-18: Current Liabilities and Payroll Accounting

Mayberry Company has two fringe benefit plans for its employees.

- It grants employees 2 days' vacation for each month worked. Ten employees worked the entire month of March at an average daily wage of $140 per employee.

- In its pension plan, the company recognizes 10% of gross earnings as a pension expense. Gross earnings in March were $40,000. No contribution has been made to the pension fund.

Instructions

Read more: Problem-19: Current Liabilities and Payroll Accounting

Podsednik Corporation has 20 employees who each earn $140 a day. The following information is available.

- At December 31, Podsednik recorded vacation benefits. Each employee earned 5 vacation days during the year.

- At December 31, Podsednik recorded pension expense of $100,000, and made a contribution of $70,000 to the pension plan.

- In January, 18 employees used on vacation day each

Instructions

Prepare Podsednik's journal entries to record these transactions

Read more: Problem-20: Current Liabilities and Payroll Accounting