Instructions

- If Costello uses the direct write-off method to account for uncollectible accounts, journalize the adjusting entry at December 31, assuming Costello determines that L. Dole's $1,400 balance is uncollectible.

- If Allowance for doubtful Accounts has a credit balance of $2,100 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be (1) 1% of net sales, and (2) 10% of acconts receivable

- If Allowance for Doubtful Accounts has a debit balance of $200 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be (1) 0.75% of net sales and (2) 6% of accounts receivable.

Instructions

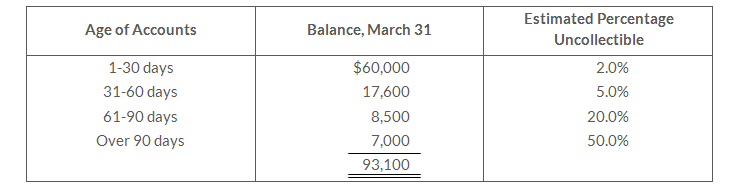

- Determine the total estimated uncollectibles

- Prepare the adjusting entry at March 31 to record bad debt expense.

Instructions

Prepare journal entries to record the 2020 transactions of Finzelberg Company.

Instructions

Prepare the journal entries on December 31, 2019, May 11, 2020, and June 12, 2020.

- On March 3, Kitselman Appliances sells $650,000 of its receivables to Ervay Factors Inc. Ervay Factors assesses a finance charge of 3% of the amount of receivables sold. Prepare the entry on Kitselman Appliances books to record the sale of the receivables.

- On May 10, Fillmore Company sold merchandise for $3,000 and accepted the custoemr's America Bank MasterCard. America Bank charges a 4% service charge for credit card sales. Prepare the entry on Fillmore Company's books to record the sale of merchandise.

- On April 2, Jennifer Eiston uses her JCPenney Company credit card to purchase merchandise from a JCPenney store for $1,500. On May 1, Elston is is billed for the $1,500 amount due. Eiston pays $500 on the balance due on May 3. Eiston received a bill dated June 1 for the amount due, including interest at 1.0% per month on the unpaid balance as of May3. Prepare the entries on JCPenney Co.'s books related to the transactions that occurred on April 2, May 3, and June 1.

- on July 4, Spangler's Restaurant accepts a Visa card for a $200 dinner bill. Visa charges a 2% service fee. Prepare the entry on Spangler's books related to this transactions.

| Jan. 15 | Made Colaw credit card sales totaling $18,000. (There were no balance prior to January 15.) |

| 20 | Made Visa credit card sales (service charge fee 2%) totaling $4,500. |

| Feb. 10 | Collected $10,000 on Colaw credit card sales |

| 15 | Added finance charges of 1.5% to Colaw credit card account balances. |

Instructions

Journalize the transactions for Colaw Stores

| Nov. 1 | Loaned $30,000 cash to Manny Lopez on a 12 month, 10% note. |

| Dec. 11 | Sold goods to Ralph Kremer, Inc., receiving a $6,750, 90-day, 8% note |

| 16 | Received a $4,000, 180 day, 9% note in exchange for Joe Fernetti's outstanding accounts receivable. |

| 31 | Accrued interest revenue on all notes receivable. |

Instructions

- Journalize the transactions for Elburn Supply Co.

- Record the collection of the Lopez note at its maturity in 2020.

2020

| May 1 | Received a $9,000, 12-month 10% note in exchange for Mark Chamber's outstanding accounts receivable. |

| Dec. 31 | Accrued interest on the Chamber note. |

| Dec. 31 | Closed the interest revenue account. |

2021

| May 1 | Received principal plus interest on the Chamber note.(no interest has been accrued in 2021 |

| Apr. 1, 2019 | Accepted Goodwin Company's 12-month, 12% note in settlement of a $30,000 account receivable. |

| July 1, 2019 | Loaned $25,000 cash to Thomas Slocombe on a 9-month, 10% note. |

| Dec. 31, 2019 | Accrued interest on all notes receivable. |

| Apr. 1, 2020 | Received principal plus interest on the Goodwin note. |

| Apr. 1, 2020 | thomas Slocombe dishonored its note; Vandiver expects it will eventually collect. |

Instructions

Prepare journal entries to record the transactions. Vandiver prepares adjusting entries once a year on December 31.