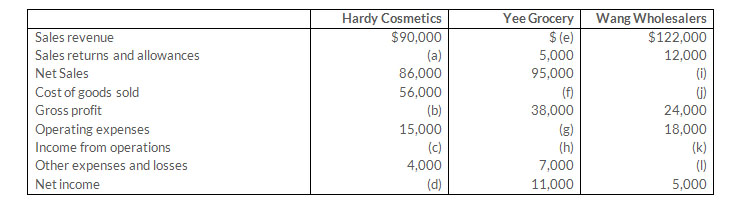

Instructions

Read more: Problem-21: Accounting for Merchandising Operations

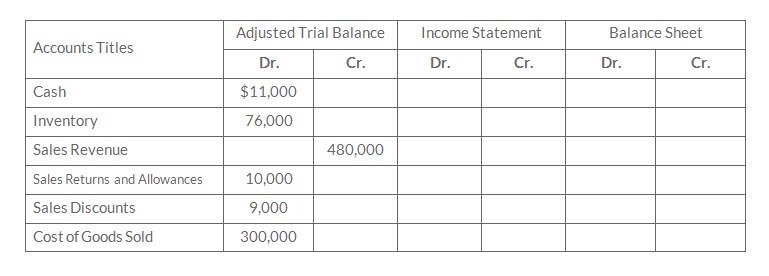

Instructions

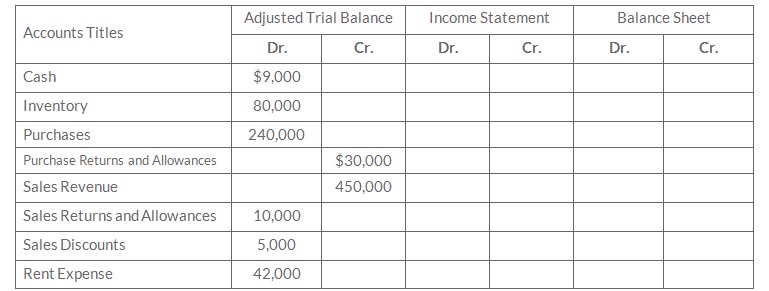

Complete the worksheet by extending amounts reported in the adjusted trial balance to the appropriate columns in the worksheet. Do not total individual columns

Read more: Problem-22: Accounting for Merchandising Operations

Worksheet

For the Month Ended June 30, 2019

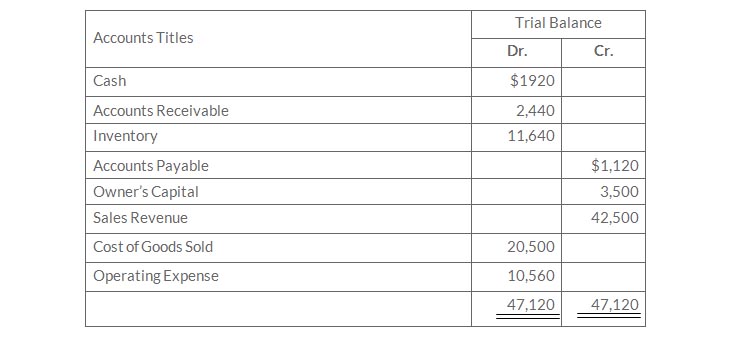

Operating expenses incurred on account, but not yet recorded, total $1,500

Instructions

Enter the trial balance on a worksheet and compete the worksheet.

Read more: Problem-23: Accounting for Merchandising Operations

Instructions

Prepare a cost of goods sold section for the year ending August 31 (periodic inventory).

Read more: Problem-24: Accounting for Merchandising Operations

| Freight-in | $4,000 |

| Purchases | 509,000 |

| Purchase discounts | 6,000 |

| Purchase returns and allowances | 2,000 |

| Sales Revenue | 840,000 |

| Sales discounts | 5,000 |

| Sales returns and allowances | 10,000 |

At December 31, 2019, Brooke Hanson determines that its ending inventory is $60,000.

Instructions

- Compute Brooke Hanson's 2019 gross profit.

- Compute Brooke Hanson's 2019 operating expenses if net income is $130,000 and there are no non operating activities.

Read more: Problem-25: Accounting for Merchandising Operations

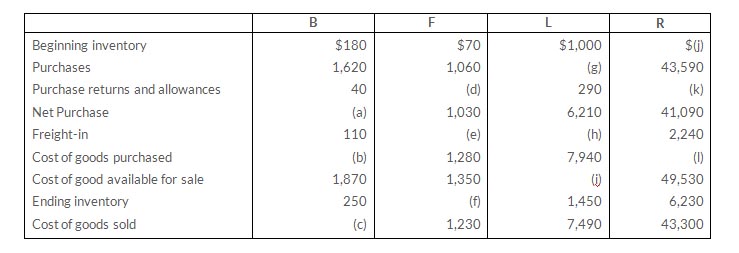

Instructions

Fill in the lettered blanks to complete the cost of goods sold sections.

Read more: Problem-26: Accounting for Merchandising Operations

- On April 5, purchased merchandise from Dion Company for $25,000, terms 2/10 net/30, FOB shipping point.

- On April 6, paid freight costs of $900 on merchandise purchased from Dion company

- On April 7, purchased equipment on account for $30,000.

- On April 8, returned some of April 5 merchandise, which cost $2,800 to Dion Company

- On April 15, paid the amount due to Dion Company in full.

Instructions

- Prepare the journal entries to record these transactions on the books of Nandi Co. using a periodic inventory system.

- Assume that Nandi Co. paid the balance due to Dion Company on May 4 instead of April 15. Prepare the journal entry to record this payment.

Read more: Problem-27: Accounting for Merchandising Operations

- On April 5, purchased merchandise from Jose Company for $21,000, terms 2/10 net/30, FOB shipping point.

- On April 6, paid freight costs of $800 on merchandise purchased from Jose company

- On April 7, purchased equipment on account from Winker Mfg. Co. for $26,000.

- On April 8, returned merchandise, which cost $4,000 to Jose Company

- On April 15, paid the amount due to Jose Company in full.

Instructions

- Prepare the journal entries to record these transactions on the books of Chung Co. using a periodic inventory system.

- Assume that Chung Co. paid the balance due to Jose Company on May 4 instead of April 15. Prepare the journal entry to record this payment.

Read more: Problem-28: Accounting for Merchandising Operations

Instructions

Complete the worksheet by extending amounts reported in the adjustment trial balance to the appropriate columns in the worksheet. The company uses the periodic inventory system.

Read more: Problem-29: Accounting for Merchandising Operations