| Purchases | Payments | Returns | |

| Hale Company | $6,750 | $6,000 | $-0- |

| Janish Company | 5,250 | 1,875 | $2,250 |

| Valdez Company | 6,375 | 6,750 | $-0- |

Instructions

- What is the January 1 balance in the Valdez Company subsidiary account?

- What is the January 31 balance in the control account?

- Compute the balances in the subsidiary accounts at the end of the month.

- Which January transaction would not be recorded in a special Journal?

| Sept. 2 | Sold merchandise on account to H. Drew, invoice no. 101, $620, terms n/30. The cost of the merchandise sold was $420. |

| 10 | Purchased merchandise on account from A. Pagan $650, terms 2/10, n3/0. |

| 12 | Purchased office equipment on account from R. Cairo $6,500. |

| 21 | Sold merchandise on account to G. Holliday, invoice no. 102 for $800, terms 2/10, n/30. The cost of the merchandise sold was $480. |

| 25 | Purchased merchandise on account from D. Downs $860, terms n/30. |

| 27 | Sold merchandise to S. Miller for $700 cash. The cost of the merchandise sold was $400. |

Instructions

- Prepare a sales journal and a single-column purchases journal. (Use page 1 for each journal)

- Record the transaction(s) for September that should be journalized in the sales journal and the purchases journal.

| May 1 | R. Santiago invested $40,000 cash in the business. |

| 2 | Sold merchandise to Lawrie Co. for $6,300 cash. The cost of the merchandise sold was $4,200. |

| 3 | Purchased merchandise for $7,700 from J. Moskos using check no. 101. |

| 14 | Paid salary to H. Rivera $700 by issuing check no. 102. |

| 16 | Sold merchandise on account to K. Stanton for $900, terms n/30. The cost of the merchandise sold was $630. |

| 22 | A check of $9,000 is received from M. Mangini in full for invoice 101; no discount given. |

Instructions

- Prepare a multiple-column cash receipts journal and a multiple-column cash payments journal. (Use page 1 for each journal.)

- Record the transaction(s) for May that should be journalized in the cash receipts journal and cash payments journal.

- Made a refund to a customer as an allowance for damaged goods

- Received collection from customer within the 3% discount period.

- Purchased merchandise for cash.

- Paid a creditor within the 3% discount period.

- received collection from customer after the 3% discount period had expried

- Paid freight on merchandise purchased.

- Paid cash for office equipment.

- Received cash refund from supplier for merchandise returned

- Withdrew cash for personal use for owner.

- Made cash sales.

Instructions

Indicate (a) the journal, and (b) the columns in the journal that should be used in recording each transaction.

| Mar. 2 | Purchased equipment costing $7,400 from Bole company on account. |

| 5 | Received credit of $410 from Carwell Company for merchandise damaged in shipment to Hasselback.. |

| 7 | Issued credit of $400 to Dempsey Company for merchandise the customer returned. The returned merchandise had a cost of $260. |

Hasselback Company uses a one-column purchases journal, a sales journal, the columnar cash journals used in the text, and a general journal.

Instructions

Journalize the transactions in the general journal.

- Payment of creditors on account.

- Return of merchandise sold for credit.

- Collection on account from customers.

- Sale of land for cash.

- Sale of merchandise on account.

- Sale of merchandise for cash.

- Received credit for merchandise purchased on credit.

- Sales discount taken on goods sold.

- Payment of employee wages.

- Income summary closed to owner's capital.

- Depreciation on building.

- Purchase of office supplies for cash.

- Purchase of merchandise on account.

Instructions

For each transaction, indicate whether it would normally be recorded in a cash receipts journal, cash payments journal, sales journal, single-column purchases journal, or general journal.

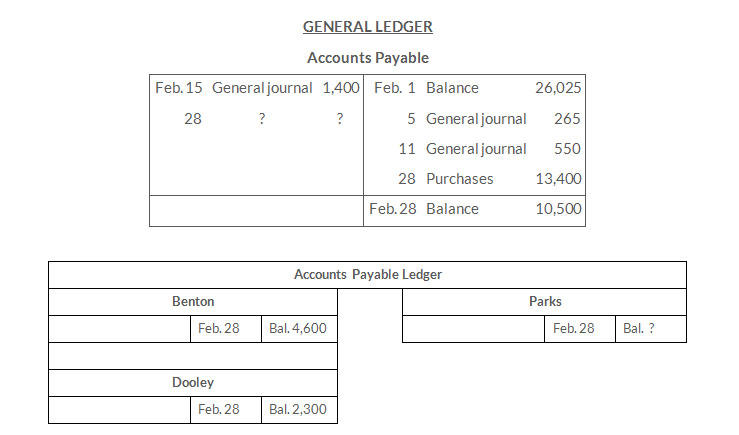

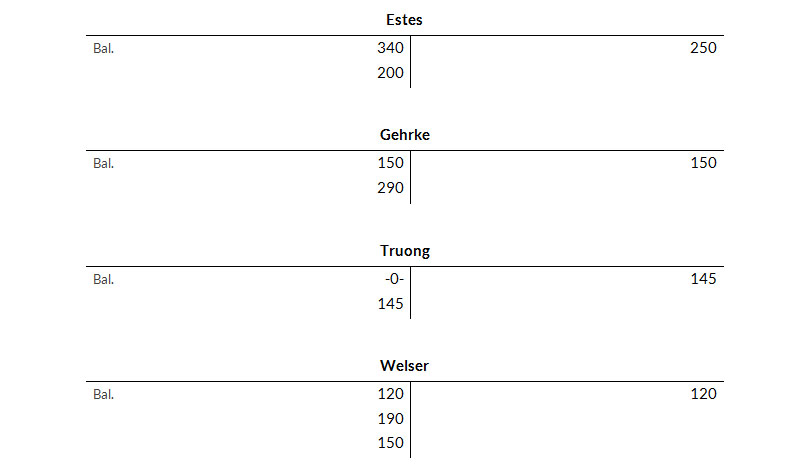

Instructions

- Indicate the missing posting reference and amount in the control account, and the missing ending balance in the subsidiary ledger.

- Indicate the amounts in the control account that were dual-posted (i.e., posted to the control account and the subsidiary accounts).

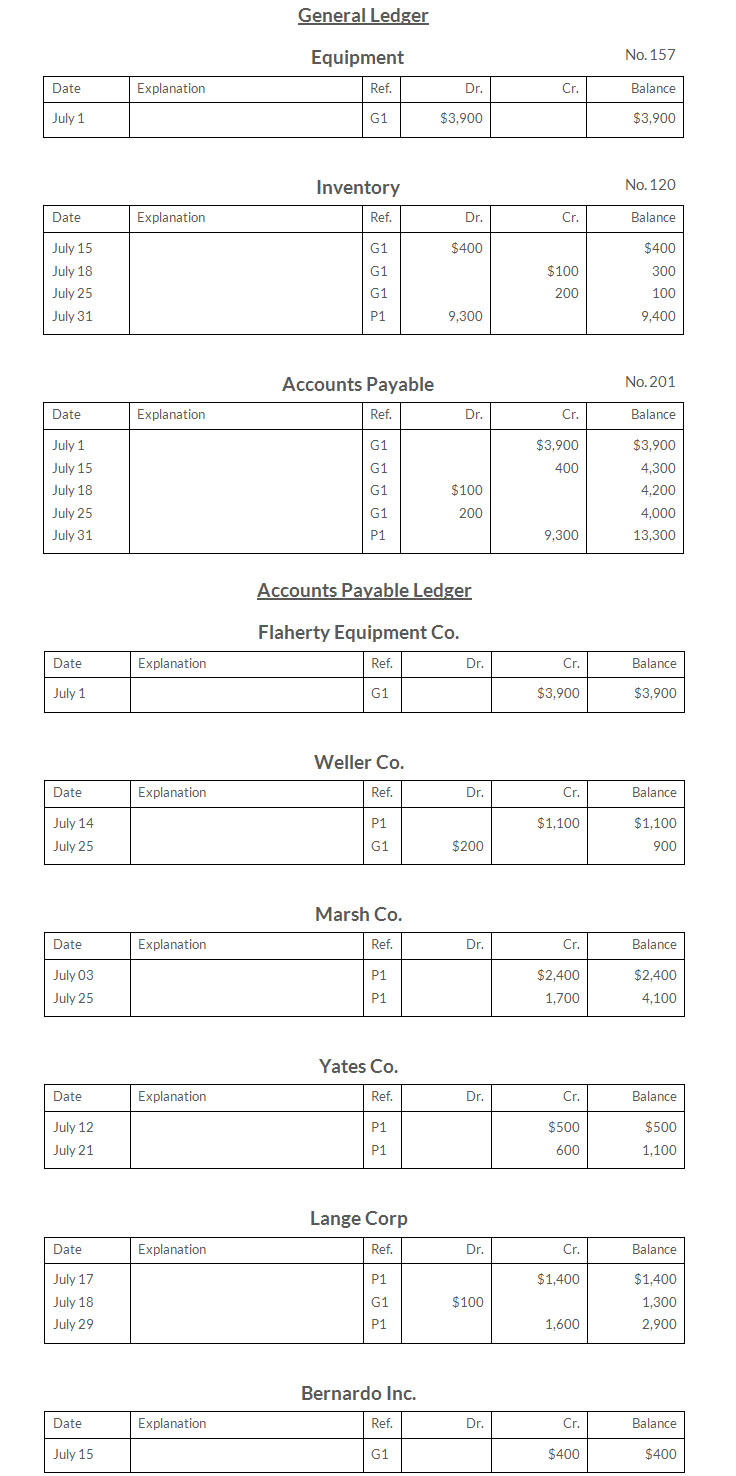

Instructions

- The single-column purchases journal for July

- The general journal entries for July.

Instructions

| Accounts Payable | $14,000 |

| Accounts Receivable | 22,000 |

| Cash | 17,000 |

| Inventory | 13,500 |

Hulse's sales journal for January shows a total of $110,000 in the selling-price column, and its one-column purchases journal for January shows a total of $77,000.

The column totals in Hulse's cash receipts journal are Cash Dr. $61,000, Sales Discounts Dr. $1,100, Accounts Receivable Cr. $45,000, Sales Revenue Cr. $6,000, and Other Accounts Cr. $11,100.

The column totals in Hulse's cash payments journal for January are Cash Cr. $55,000, Inventory Cr. $1,000, Accounts Payable Dr. $46,000, and Other Accounts Dr. $10,000. Hulse's total cost of goods sold for January is $63,600.

Accounts Payable, Accounts Receivable, Cash, Inventory, and Sales Revenue are not involved in the Other Accounts column in either the cash receipts or cash payments journal, and are not involved in any general journal entries.

Instructions

Compute the January 31 balance for Hulse in the following accounts.

- Accounts Payable.

- Accounts Receivable.

- Cash.

- Inventory.

- Sales Revenue.