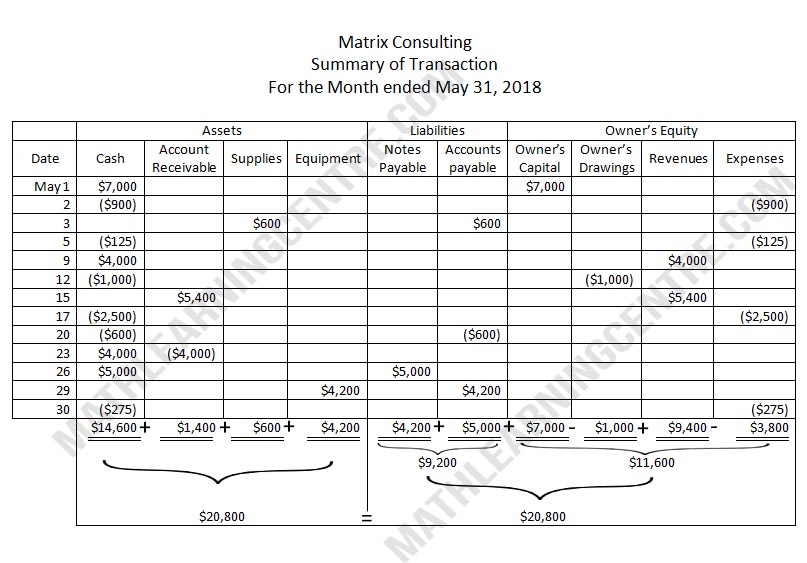

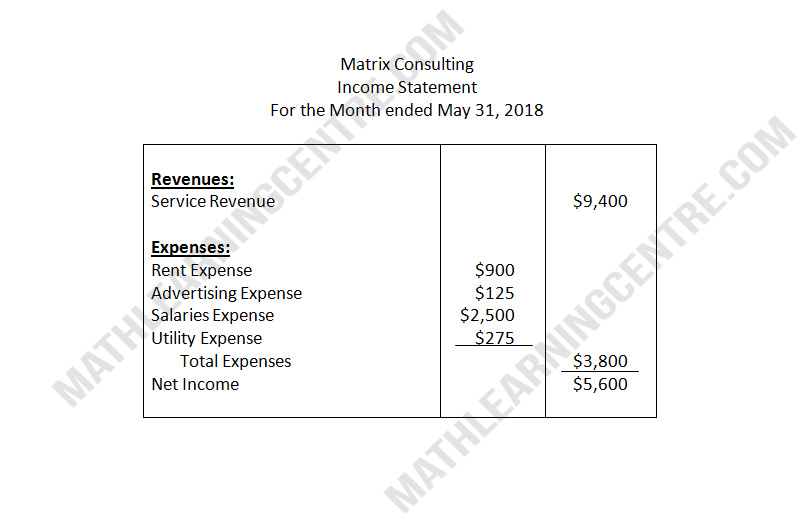

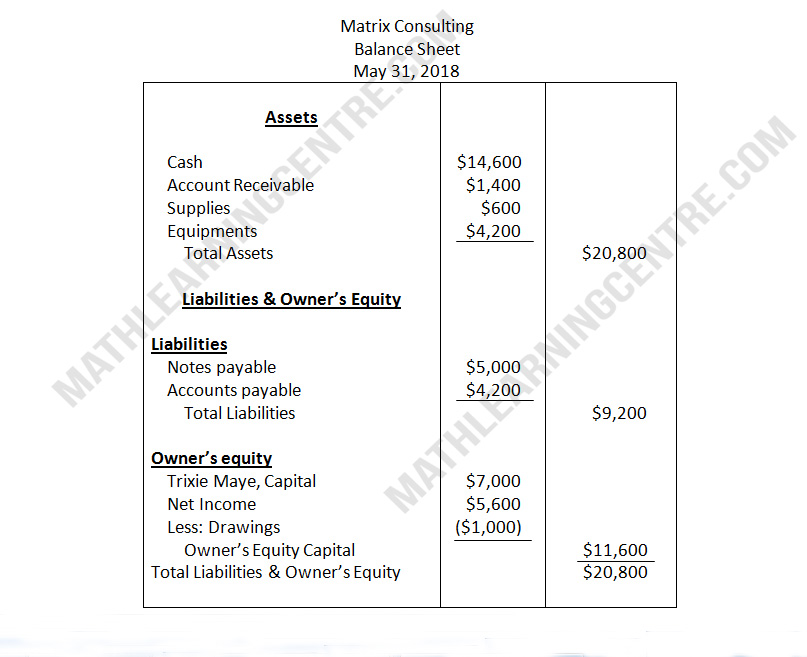

Trixie Maye started her own consulting firm, Matrix Consulting, on May 1, 2018. The following transactions occurred during the month of May

- Trixie invested $7,000 cash in the business.

- Paid $900 for office rent for the month

- Purchased $600 for office rent for the month

- Paid $125 to advertise in the County News.

- Received $4,000 cash for services performed.

- Withdrew $1,000 cash for personal use

- Performed $5,400 of services on account.

- Paid $2,500 for employee salaries.

- Paid for the supplies purchased on account on May 3.

- Received a cash payment of $4,000 for services performed on account on May 15.

- Borrowed $5,000 from the bank on a note payable.

- Purchased equipment for $4,200 on account.

- Paid $275 for utilities