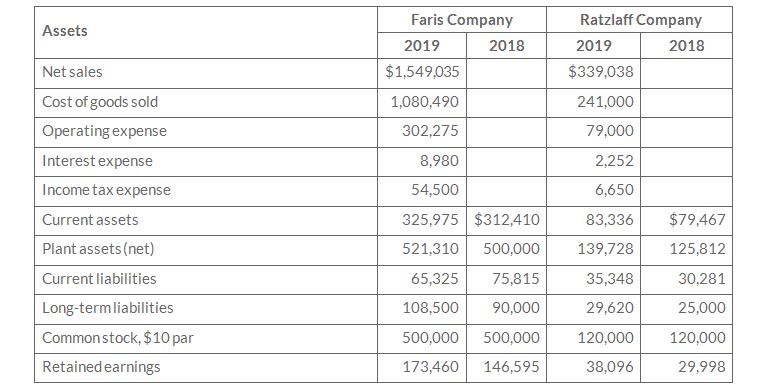

Comparative statement data for Farris Company and Raizlaff Company, two competitors, appear below. All balance sheet data are as of December 31, 2019, and December 31, 2018

Instructions

- Prepare a vertical analysis of the 2019 income statement data for Farris company and Ratzlaff Company in columnar form

- Comment on the relative profitablity of the companies by return on assets and the return on common stockholder's equity for both companies

Solution

a.

Kurzen Inc.

Condensed Income Statement

For the year ended December 31, 2019

Condensed Income Statement

For the year ended December 31, 2019

b.

Faris Company’s return on assets of 12.39% is higher than the Ratzlaff Company’s return on assets of 4.73%. Also Faris Company’s return on common stockholders’ equity of 15.57% is higher than the Ratzlaff Company’s return on common stockholders’ equity of 6.88%. So that Faris Company appears to be more profitable. It has higher relative gross profit, income from operations, income before taxes and Net income.