Information related to Mingenback Company for 2019 is summarized below.

| Total credit sales | $2,500,000 |

| Accounts receivable at December 31 | 875,000 |

| Bad debts written off | 33,000 |

Instructions

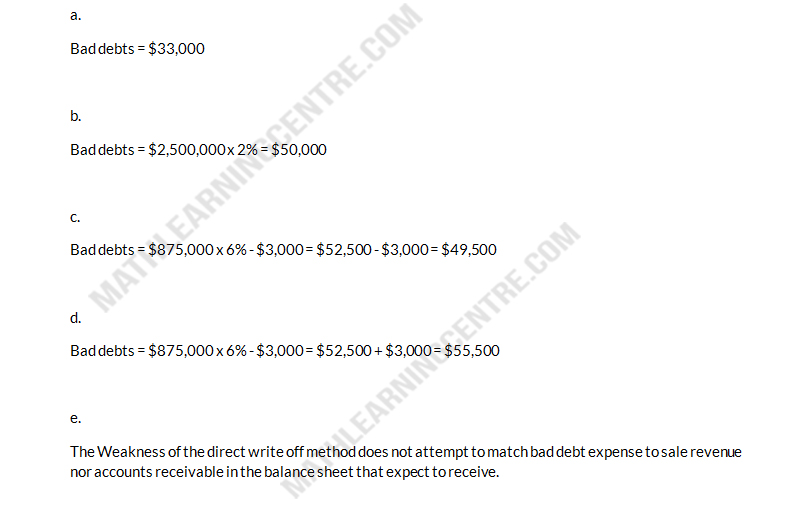

- What amount of bad debt expense will Mingenback Company report if it uses the direct write-off method of accounting for bad debts?

- Assume that Mingenback Company estimates its bad debt expense to be 2% of credit sales. What amount of bad debt expense will Mingenback record if it has an Allowance of Doubtful Accounts credit balance of $4,000?

- Assume that Mingenback Company estimates its bad debt expense based on 6% of has an Allowance for Doubtful Accounts credit balance of $3,000?

- Assume the same facts as in (c), except that there is a $3,000 debit balance in Allowance for Doubtful Accounts. What amount of bad debt expense will Mingenback record?

- What is the weakness of the direct write-off method of reporting bad debt expense?

Solution