Selected accounts from the chart of accounts of Mercer Company are shown below

The cost of all merchandise sold was 60% of the sales price. During January, Mercer completed the following transactions.

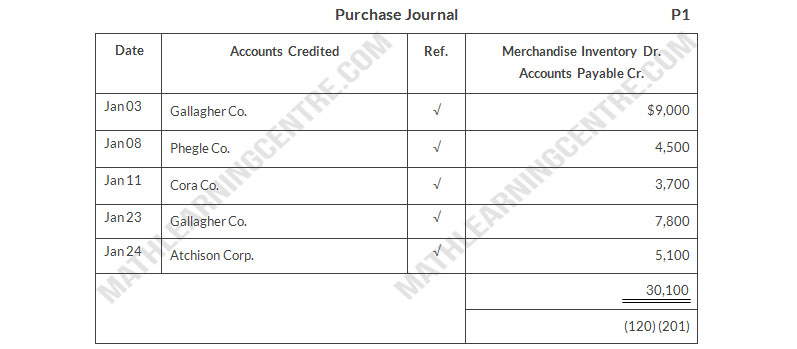

| Jan. 3 | Purchased merchandise on account to from Gallagher Co. $9,000. |

| 4 | Purchased supplies for cash $80. |

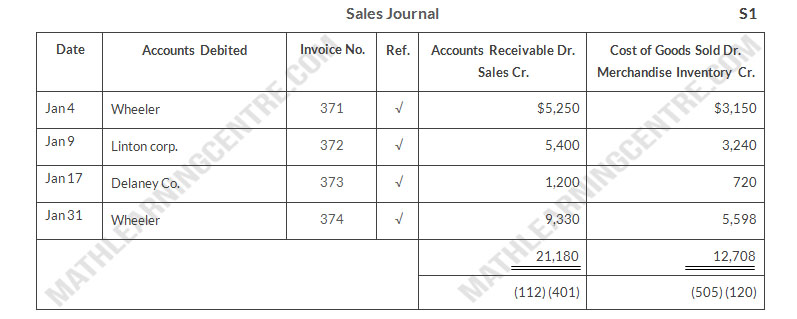

| 4 | Sold merchandise on account to Wheeler $5,250, invoice no. 371, terms 1/10, n/30 |

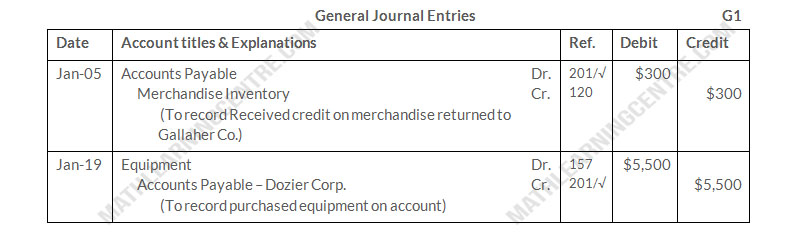

| 5 | Returned $300 worth of damaged goods purchased on account from Gallagher Co. on January 3. |

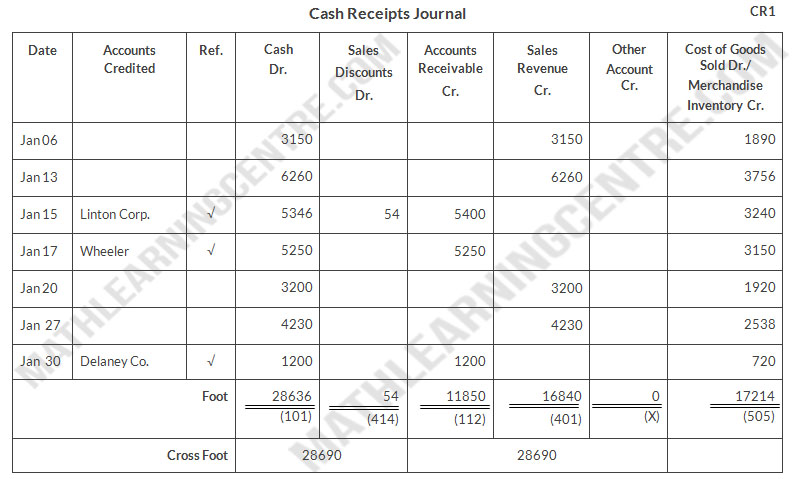

| 6 | Made cash sales for the week totaling $3,150. |

| 8 | Purchased merchandise on account from Phegle Co. $4,500. |

| 9 | Sold merchandise on account to Linton Corp. $5,400, Invoice no. 372, terms 1/10, n/30. |

| 11 | Purchased merchandise on account from Cora Co. $3,700. |

| 13 | Paid in full Gallagher Co. on account less a 2% discount. |

| 13 | Made cash sales for the week totaling $6,260. |

| 15 | Received payment from Linton Corp. for invoice no. 372. |

| 15 | Paid semi-monthly salaries of $14,300 to employees. |

| 17 | Received payment from Wheeler for invoice no. 371. |

| 17 | Sold merchandise on account to Delaney Co. $1,200, invoice no. 373, terms 1/10, n/30. |

| 19 | Purchased equipment on account from Dozier Corp. $5,500. |

| 20 | Cash Sales for the week totaled $3,200. |

| 20 | Paid in full Phegley Co. on account less a 2% discount. |

| 23 | Purchased merchandise on account from Gallagher Co. $7,800. |

| 24 | Purchased merchandise on account from Atchison Corp. $5,100. |

| 27 | Made cash sales for the week totaling $4,230. |

| 30 | Received payment from Delaney Co. for invoice no. 373. |

| 31 | Paid semi-monthly salaries of $13,200 to employees. |

| 31 | Sold merchandise on account to wheeler $9,330, invoice no. 374, terms 1/10, n/30 |

Mercer Company uses the following journals

- Sales journal.

- Single-column purchases journal.

- Cash receipts journal with columns for cash Dr., Sales Discounts Dr., Accounts Receivable Cr., Sales Revenue Cr., Other Accounts Cr., Cost of Goods Sold Dr., and Inventory Cr.

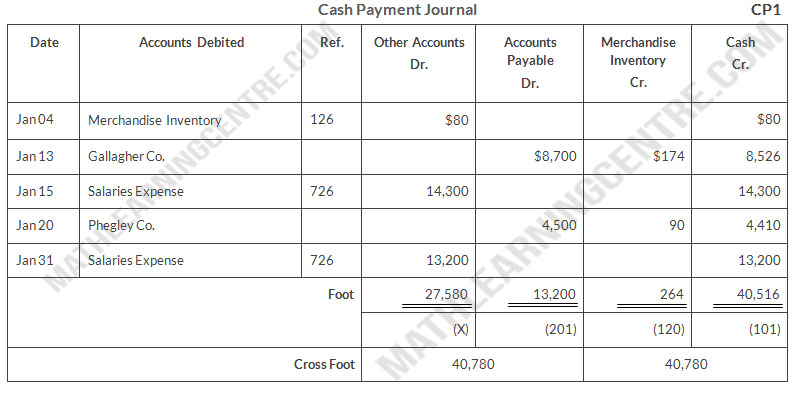

- Cash payments journal with columns for Other Accounts Cr., Accounts Payable Dr., Inventory Cr., and Cash Cr.

- General journal.

Instructions

Using the selected accounts provided:

- Record the January transactions in the appropriate journal noted

- Foot and cross-foot all special journals.

- Show how postings would be made by placing ledger account numbers and check-marks as needed in the journals. (Actual posting to ledger accounts is not required.)

Solution

a.

Mercer Company

b.

Mercer Company

c.

Mercer Company

d.

Mercer Company

e.

Mercer Company