Presented below are two independent transactions. Both transactions have commercial substance.

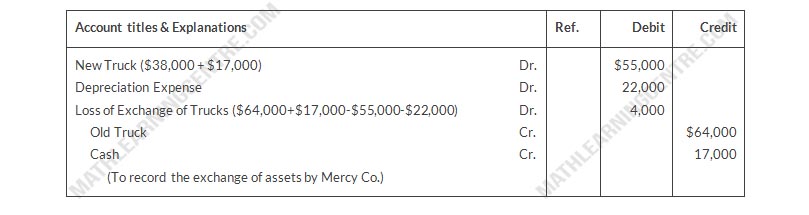

- Mercy Co. exchanged old trucks (cost $64,000 less $22,000 accumulated depreciation) plus cash of $17,000 for new trucks. The old trucks had a fair value of $38,000.

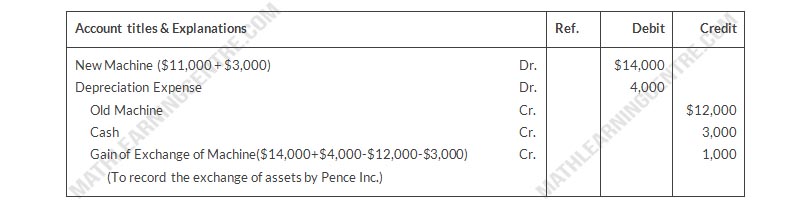

- Pence Inc. trandes its used machine (cost $12,000 less $4,000 accumulated depreciation) for a new machine. In addition to exchanging the old machine (which had a fair value of $11,000),, Pence also paid cash of $3,000

Instructions

- Prepare the entry to record the exchange of assets by Mercy Co.

- Prepare the entry to record the exchange of assets by Pence Inc.

Solution

a.

Mercy Co.

Journal Entry

Journal Entry

b.

Pence Inc.

Journal Entry

Journal Entry