Linton Company purchased a delivery truck for $34,000 on January 1, 2019. The truck has an expected salvage value of $2,000, and s expected to be driven 100,000 miles over its estimated useful life of 8 years. Actual miles driven were 15,000 in 2019 and 12,000 in 2020.

Instructions

- Compute depreciation expense for 2019 and 2020 using

- the straight-line method,

- the units-of-activity method, and

- the double-decline-balance method.

- Assume that Linton uses the straight-line method.

- Prepare the journal entry to record 2019 depreciation.

- Show how the truck would be reported in the December 31, 2019, blance sheet.

Solution

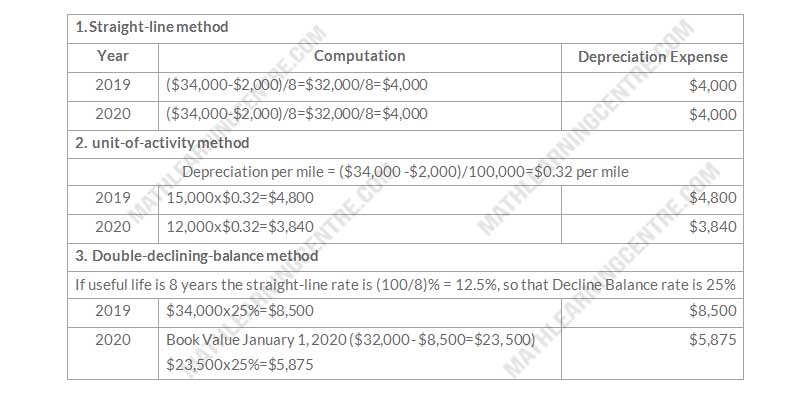

a.

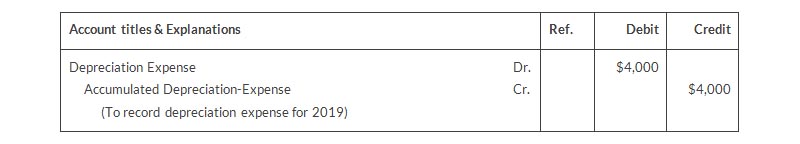

b. 1.

Linton Company

Journal Entry for 2019

(Straight-line method)

Journal Entry for 2019

(Straight-line method)

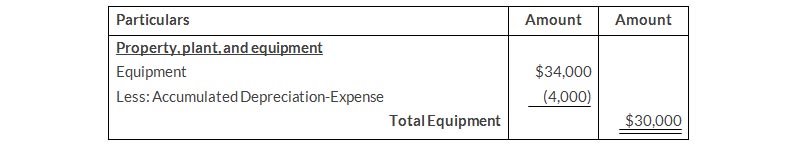

b. 2.

Linton Company

Balance Sheet (partial)

For the Year Ended December 31, 2019

Balance Sheet (partial)

For the Year Ended December 31, 2019