On January 1, 2019, Evers Company purchased the following two machines for use in its production process.

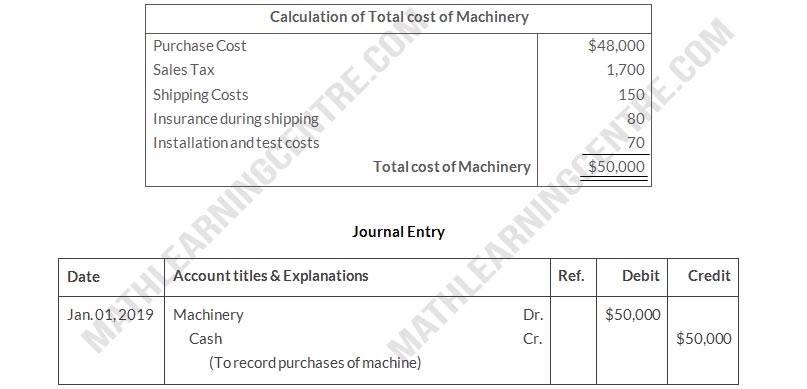

| Machine A: | The cash price of this machine was $48,000. Related expenditures included: sales tax $1,700, shipping costs $150, insurance during shipping $80, installation and testing costs $70, and $100 of oil and lubricants to be used with the machinery during its first year of operations. Evers estimates that the useful life of the machine is 5 years with a $5,000 salvage value remaining at the end of that time period. Assume that the straight-line method of depreciation is used. |

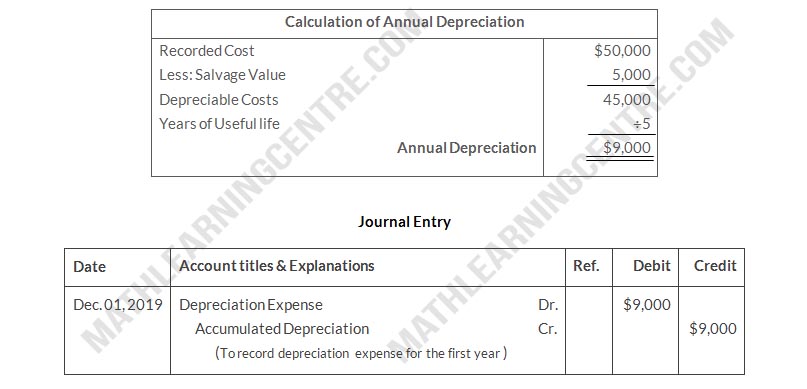

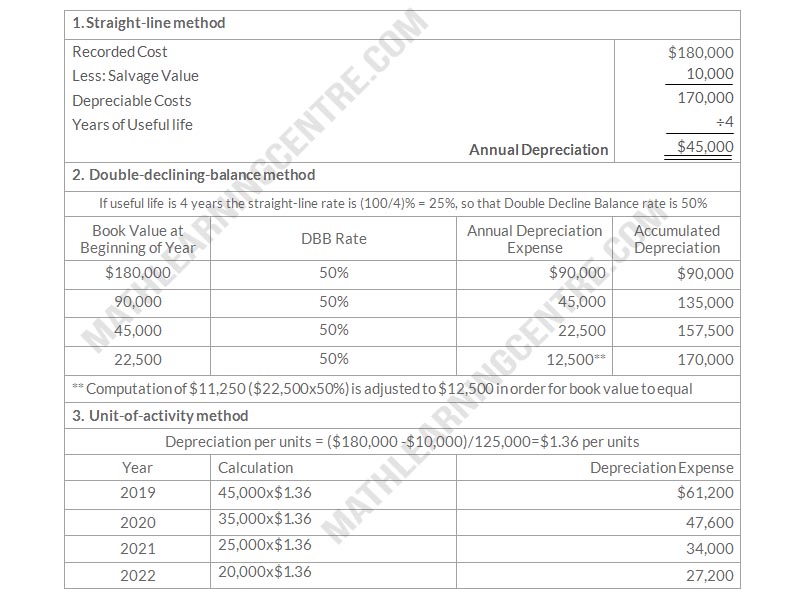

| Machine B: | The recorded cost of this machine was $180,000. Evers estimates that the useful life of the machine is 4 years with a $10,000 salvage value remaining at the end of that time period |

Instructions

- Prepare the following for Machine A

- The journal entry to record its purchase on January 1, 2019

- The journal entry to record annual depreciation at December 31, 2019.

- Calculate the amount of depreciation expense that Evers should record for Machine B each year of its useful life under the following assumptions.

- Evers uses the straight-line method of depreciation.

- Evers uses the declining-balance method. The rate used is twice the straight-line rate.

- Evers uses the units-of-activity method and estimates that the useful life of the machine is 125,000 units. Actual usage is as follows: 2019, 45,000 units: 2020, 35,000 units: 2021, 25,000 units: 2022, 20,000 units.

- Which method used to calculate depreciation on Machine B reports the highest amount of depreciation expense year 1 (2019)? The highest amount in year 4 (2022)? The highest total amount over the 4-year period?

Solution

a.

For Machine A

1.

2.

b.

For Machine B

c.

--Highest depreciation in Year 1 (2019) = Declining balance $ 90000

--Highest amount in Year 4 (2022) = Straight Line

--Highest total amount over 4 year period = No matter which of the three methods is used. Total depreciation of each methods are same at 4 years period.

--Highest amount in Year 4 (2022) = Straight Line

--Highest total amount over 4 year period = No matter which of the three methods is used. Total depreciation of each methods are same at 4 years period.