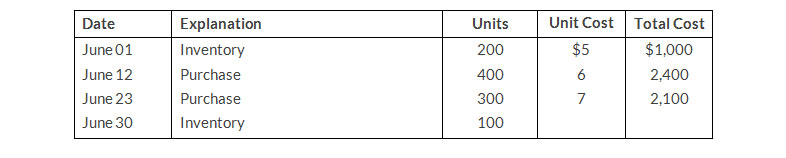

Moath company reports the following for the month of June.

Instructions

- Calculate the cost of the ending inventory and the cost of goods sold for each cost flow assumption, using a perpetual inventory system. Assume a sale of 440 unts occurred on June 5 for a selling price of $8 and a sale of 360 units on June 27 for $9.

- How do the results differ under (1) FIFO and (2) LIFO.

- Why the average unit cost not $6 [($5+$6+$7)/3]?

Solution

a.

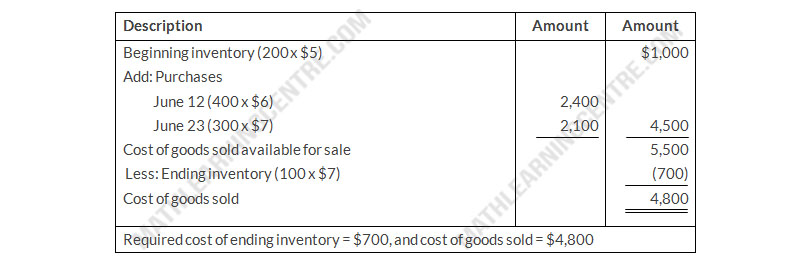

Moath Company

FIFO Method

FIFO Method

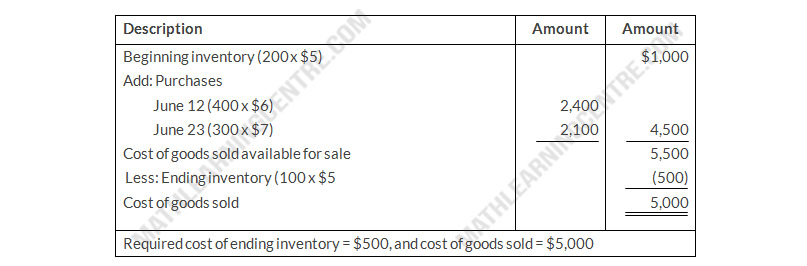

Moath Company

LIFO Method

LIFO Method

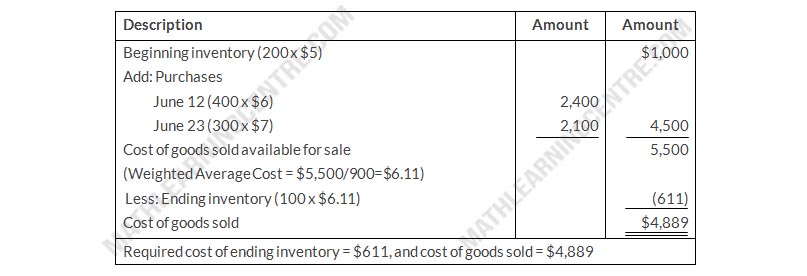

Moath Company

Average-cost Method

Average-cost Method

b.

Cost of ending inventory is lower than FIFO ($700>$500) but higher than LIFO. On the other hands cost of goods sold is lower than LIFO ($5,000>$4,800) but higher than FIFO

c.

The Weighted average cost method uses the weighted average cost, not a sample average unit of cost. The sample average cost ($5+$6+$7)/3 = $6 which is not used here