The bank portion of the bank reconciliation for Langer Company at November 30, 2019, was as follows

Langer Company

Bank Reconciliation

November 31, 2019

Bank Reconciliation

November 31, 2019

The adjusted cash balance per bank agreed with the cash balance per books at November 30.

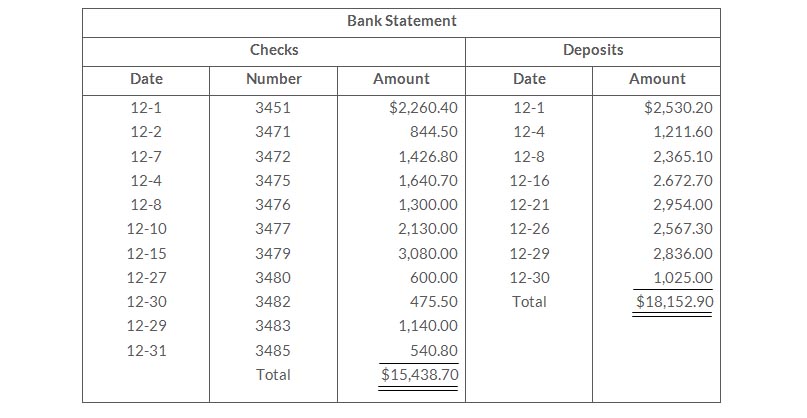

The December bank statement showed the following checks and deposits.

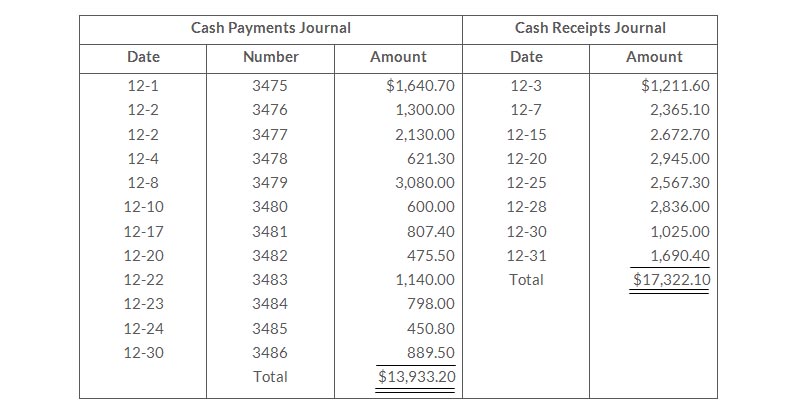

The cash records per books December showed the following.

The bank statement contained two memoranda.

- A credit of $5,145 for the collection of a $5,000 note for Langer Company plus interest of $160 and less a collection fee of $15. Langer Company has not accrued any interest on the note.

- A debit of $572.80 for an NSF check written by L. Rees, a customer At December 31,the check had not been redeposited in the bank.

At December 31, the cash balance per book was $12,485.20, and the cash balance per the bank statement was $20,154.30. The bank did not make any errors, but two errors were made by Langer Company.

Instructions

- Using the four steps in the reconciliation, prepare a bank reconciliation at December 31.

- Prepare the adjusting entries based on the reconciliation.

Solution

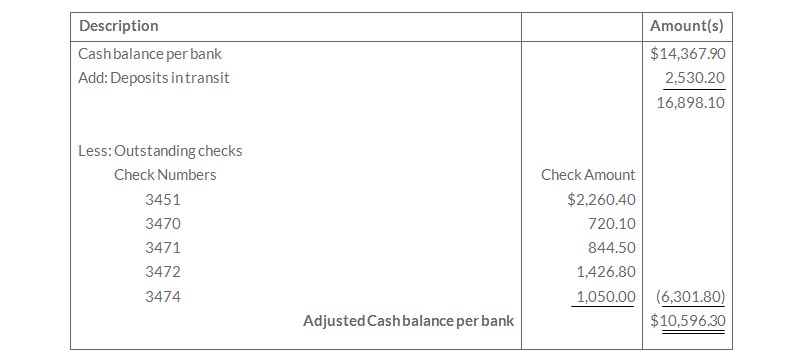

a.

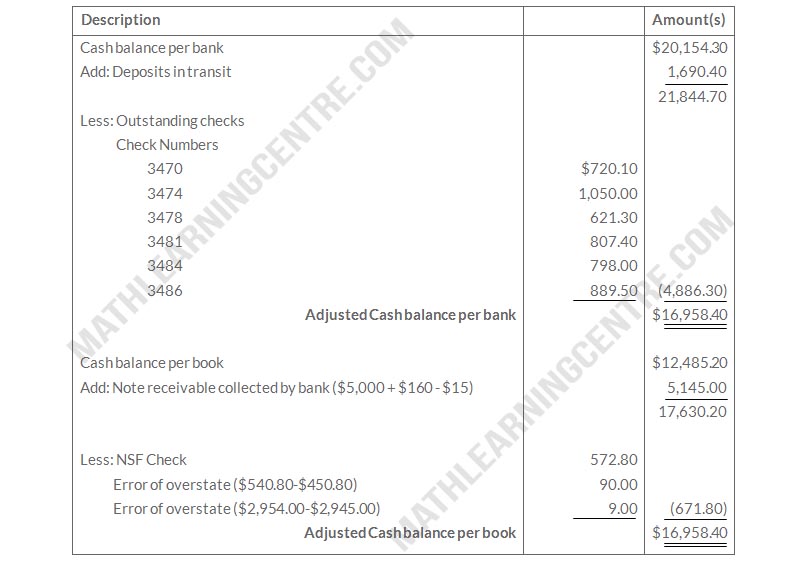

Langer Company

Bank Reconciliation Statement

December 31, 2019

Bank Reconciliation Statement

December 31, 2019

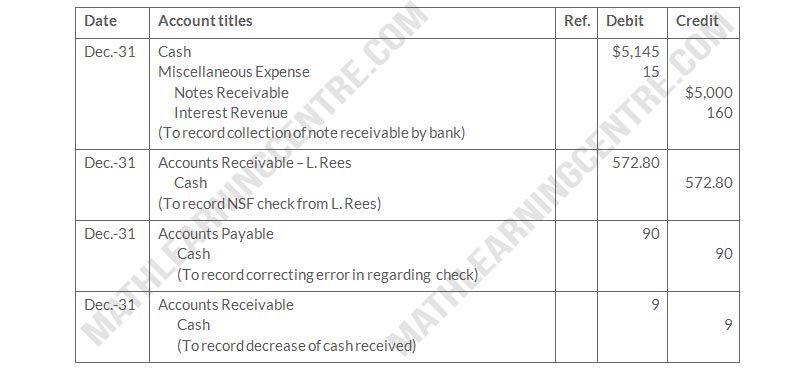

b.

Langer Company

Adjusting Entries

Adjusting Entries