Forney Company maintains a petty cash fund for small expenditures. The following transactions occurred over a 2-month period.

| July 1 | Established petty cash fund by writing a check on Scranton Bank for $200. |

| 15 | Replenished the petty cash fund by writing a check for $196.00. On this date the fund consisted of $4.00 in cash and the following petty cash receipts; freight-out $92.00, postage expense $42.40, entertainment expense $46.60, and miscellaneous expense $11.20. |

| 31 | Replenished the petty cash fund by writing a check for $192.00. At this date the fund consisted of $8.00 in cash and the following petty cash receipts: freight-out $82.10, charitable contributions expense $45.00, postage expense $25.50, and miscellaneous expense $39.40.. |

| Aug. 15 | Replenished the petty cash fund by writing a check for $187.00. On this date, the fund consisted of $13,00 in cash and the following petty cash receipts: freight-out $77.60, entertainment expense $43,00, postage expense $33,00, and miscellaneous expense $37.00. |

| 16 | Increased the amount of the petty cash fund to $300 by writing a check for $100. |

| 31 | Replenished the petty cash fund by writing a check for $284.00. On this date, the fund consisted of $16 in cash and the following petty cash receipts: postage expense $140.00, travel expense $95.60, and freight-out $47.10. |

Instructions

- Journalize the petty cash transactions.

- Post to the Petty Cash account.

- What internal control features exist in a petty cash fund?

Solution

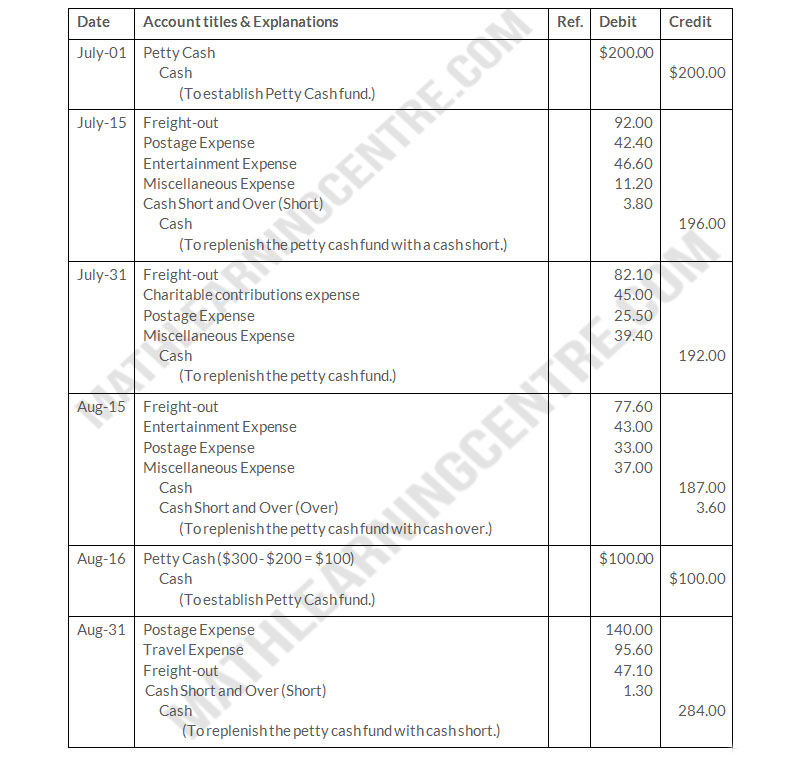

a.

Forney Company

Journal

Journal

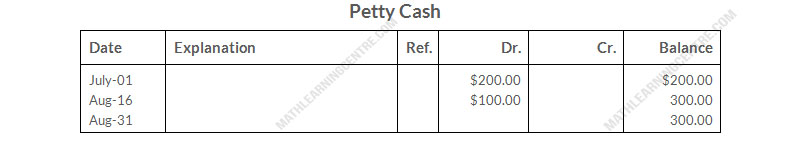

b.

Forney Company

c.

Try Yourself