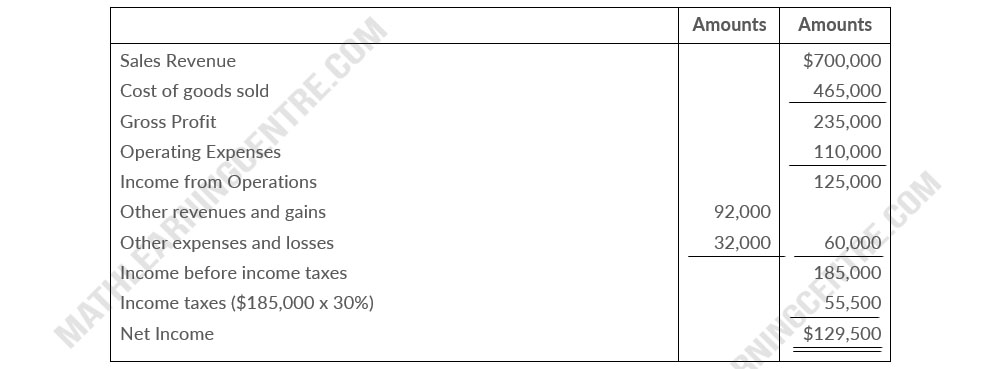

The following information is available for Norman Corporation for the year ended December 31, 2020; sales revenue $700,000, other revenues and gains $92,000, operating expenses $110,000, cost of goods sold $465,000, other expenses and losses $32,000, and preferred stock dividends $30,000. The company's tax rate was 30%, and it had 50,000 shares outstanding during the entire year.

Instruction

- Prepare a corporate income statement.

- Calculate earnings per share

Solution

a.

Norman Corporation

Income Statement

For the Year Ended December 31, 2020

Income Statement

For the Year Ended December 31, 2020

b.

Earnings per share = [($129,500 - $30,000)/50,000] = $1.99