On January 1, Guillen Corporation, had 95,000 shares of no-par common stock issued and outstanding. The stock has a stated value of $5 per share. During the year, the following occurred.

| Apr. 1 | Issued 25,000 additional shares of common stock for $17 per share. |

| June 15 | Declared a cash dividend of $1 per share to stockholders of record on June 30. |

| July 10 | Paid the $1 cash dividend. |

| Dec. 1 | Issued 2,000 additional shares of common stock for $19 per share. |

| 15 | Declared a cash dividend on outstanding shares of $1.20 per share to stockholders of record on December 31. |

Instruction

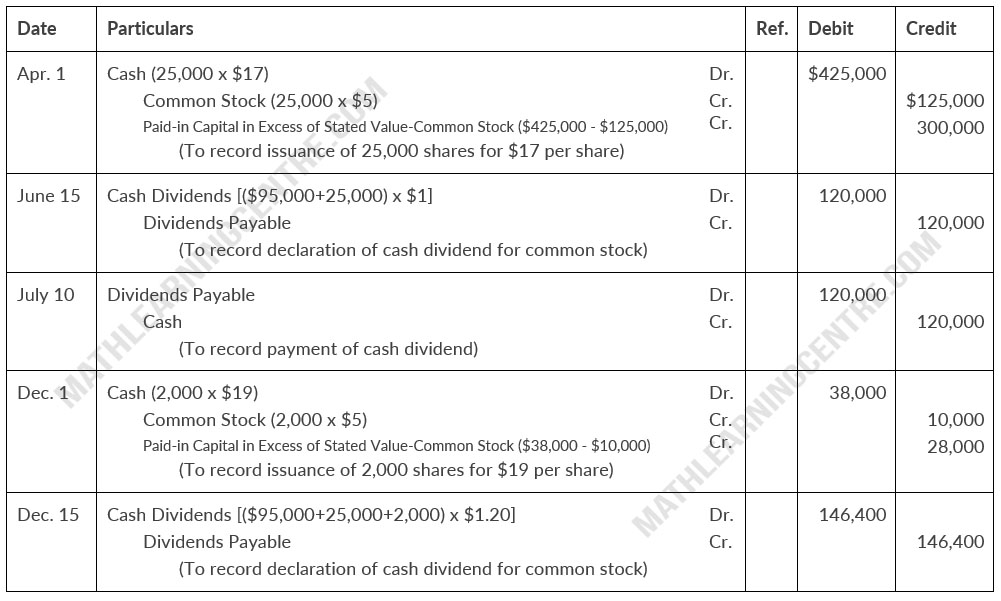

- Prepare the entries to record these transactions

- How are dividends and dividends payable reported in the financial statements prepared at December 31?

Solution

a.

Guillen Corporation

Journal Entries

Journal Entries

b.

In the retained earnings statement, dividends of $120,000 + $146,400 = $266,400 will be deducted. In the balance sheet, dividends of $146,400 will be reported as a current liability.