The stockholders equity accounts of Kerp Company at January 1, 2020, are as follows

| Preferred Stock, 6%, $50 par | $600,000 |

| Common Stock, 6%, $5 par | 800,000 |

| Paid-in Capital in Excess par-Preferred Stock | 200,000 |

| Paid-in Capital in Excess par-Common Stock | 300,000 |

| Retained Earnings | 800,000 |

There were no dividends in arrears on preferred stock. During 2020, the company had the following transactions and events.

| July 1 | Declared a $0.60 cash dividend per share on common stock. |

| Aug. 1 | Discovered $25,000 understatement of depreciation expense in 2019. (Ignore income taxes.) |

| Sept. 1 | Paid the cash dividend declared on July 1. |

| Dec. 1 | Declared a 15% stock dividend on common stock when the market price of the stock was $18 per share. |

| 15 | Declared a 6% cash dividend on preferred stock payable January 15, 2020. |

| Dec. 1 | Determined that net income for the year was $355,000. |

| 31 | Recognized a $200,000 restriction of retained earnings for plant expansion. |

Instruction

- Journalize the transactions and the closing entry for net income and dividends.

- Enter the beginning balances, and post the entries to the stockholders' equity accounts.

- Prepare a retained earnings statement for the year.

- Prepare the stockholders' equity section at December 31, 2020.

Solution

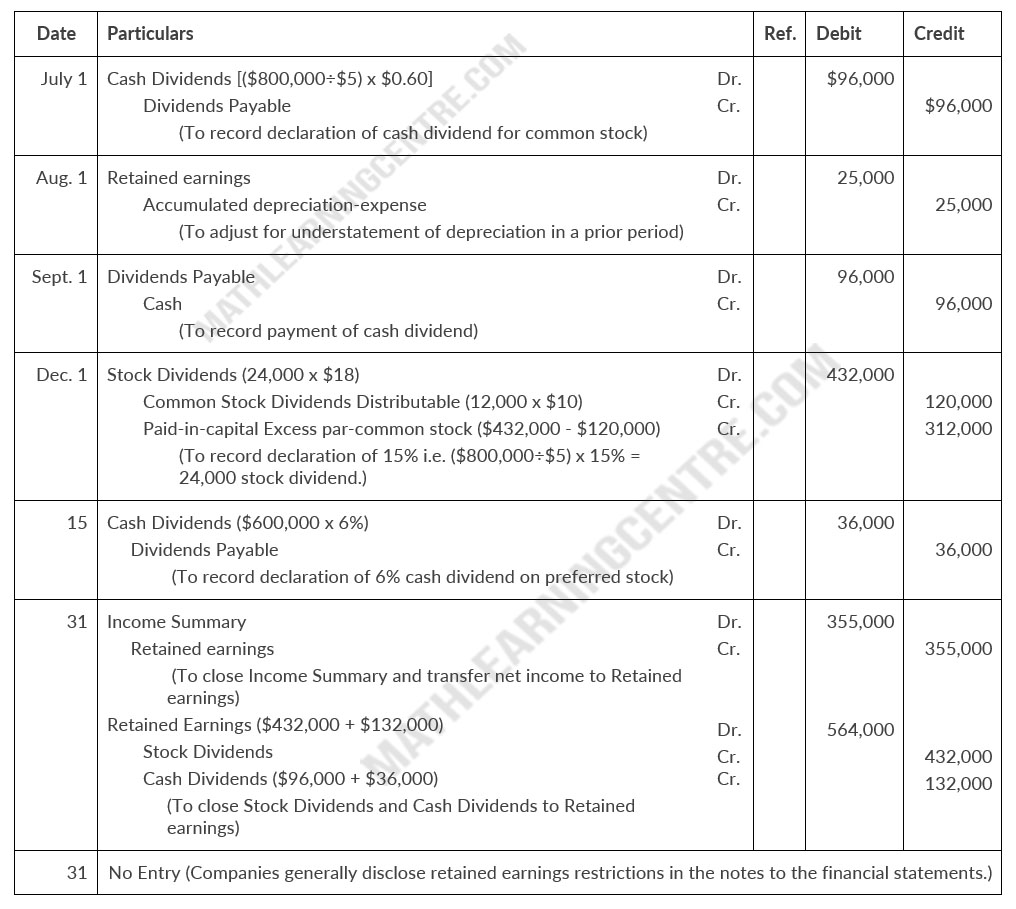

a.

Kerp Company

Journal Entries

Journal Entries

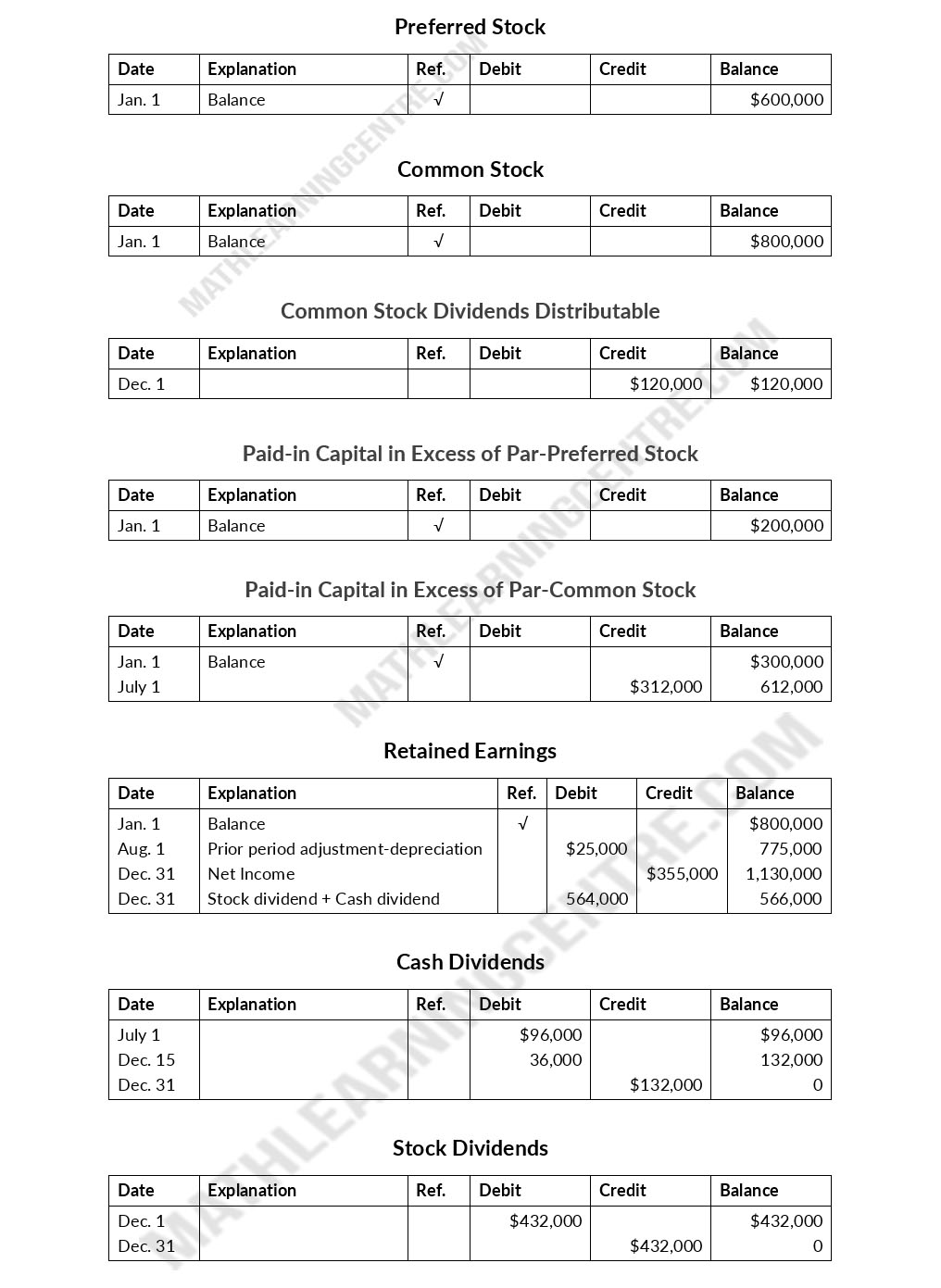

b.

c.

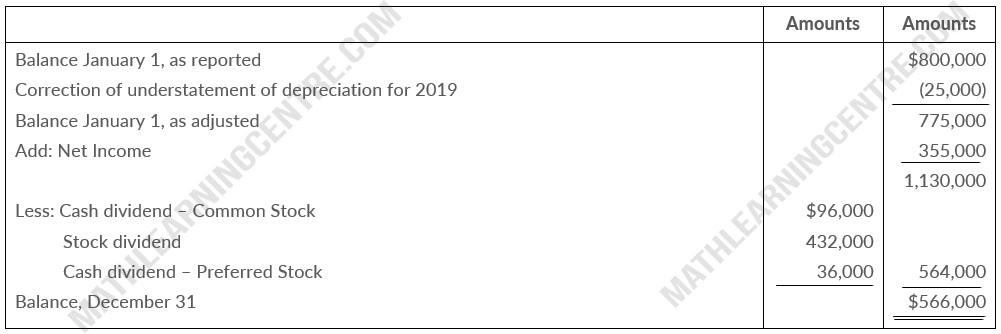

Kerp Company

Retained Earnings Statement

For the Year Ended December 31, 2020

Retained Earnings Statement

For the Year Ended December 31, 2020

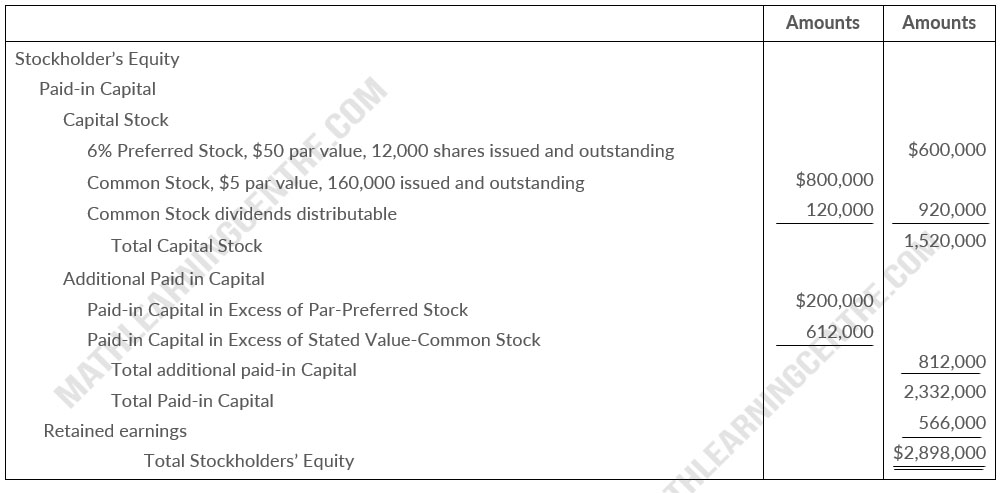

d.

Kerp Company

Balance Sheet (Partial)

December 31, 2020

Balance Sheet (Partial)

December 31, 2020